Commercial Business Insurance Broker in Wake Forest and Raleigh Opens Doors

Sotarius gets its name from the root word “Soteria” who was the Greek goddess of safety and deliverance from harm. At Sotarius, we use our expertise and experience in the world of commercial risk to keep our clients safe from harm’s way.

Raleigh, United States – April 14, 2018 /PressCable/ —

John Brooks, Principal of Sotarius, a new commercial business insurance agency and brokerage firm, recently announced the grand opening of the new commercial insurance agency in Wake Forest and Raleigh, NC and serving businesses throughout North Carolina and especially the Triangle region including businesses located in Chapel Hill, Durham, Research Triangle, Cary, Holly Springs, Garner, Knightdale and more.

Sotarius is a commercial business insurance broker that provides commercial insurance for small businesses with specialization in risk management strategies, general liability insurance for small businesses, professional liability insurance, workers compensation insurance (workers’ comp), errors and omission policies (E&O) and general business insurance lines (GL) for commercial, industrial and tech industries.

Business general liability insurance or commercial liability coverage is something most businesses simply must have, so it is critical that business owners understand what it covers and what it doesn’t cover.

What is Commercial Insurance?

As the name “commercial” implies, commercial insurance is put in place to protect businesses, which can include business owners and their employees. Every business is different so there is no one-size-fits-all insurance policy for company owners or decision-makers. Very simply, commercial insurance includes one or more types of commercial business insurance coverage designed to protect businesses, their owners and their employees. Many commercial or business insurance policy premiums include basic coverage such as property, general liability, crime and commercial auto insurance, as well as other optional insurance, such as business interruption insurance, equipment breakdown insurance, malpractice, D&O or otherwise known as directors’ and officers’ insurance and workers compensation.

What are the different types of Commercial Business Insurance?

General liability insurance

Professional liability insurance

Property insurance

Workers’ compensation insurance

Errors and Omissions insurance

Directors’ and Officers’ Liability Insurance

Vehicle insurance

Business interruption insurance

Malpractice insurance

What Does Business Insurance Cost?

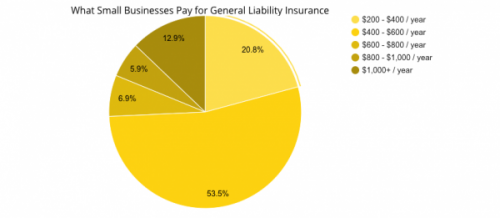

Insureon.com conducted a commercial business insurance study and found that, “On average, the annual cost of General Liability Insurance, regardless of policy limits, was just $741 (less than $62 per month), with a median price of $428 (about $36 per month). Most small-businesses owners (54 percent) paid between $400 and $600 for their policies. Another 21 percent paid less than $400.”

One component that has the biggest impact on the cost of a commercial General Liability Insurance policy is the actual industry of the business buying the coverage. Of course this completely makes sense: brick-and-mortar retailers get a lot more foot traffic than home-based accountants, and commercial cleaners have a greater chance of damaging client property than a digital marketing company. Customer injuries and client property damage are both covered by a General Liability policy.

By looking at the chart you will be able to see how a specific industry directly affects what you can expect to pay for a General Liability policy with an aggregate limit of $2 million and a per-occurrence limit of $1 million which is a very typical structure of a commercial GL policy.

Why Choose Sotarius for Your Next Commercial Insurance Policy

“Experience and Service are the two distinguishing characteristics that set us apart,” says John Brooks, principal at Sotarius. “Experience in the markets makes us unique; and, also a deep understanding of the legal implications that many clients simply don’t see or understand the liability and risk they face until they sit down with us and allow us to share case studies and real-world scenarios that hit home. Service is what keeps problems at bay and at Sotarius we extend that type of service so our clients can rest easy knowing they are properly covered and readily prepared.”

Sotarius gets its name from the root word “Soteria” who was the Greek goddess of safety and deliverance from harm. At Sotarius, we take great pride in using our expertise and experience in the world of commercial risk to keep our clients safe from harm’s way so that they can conduct and grow their business unimpeded by the pitfalls that business owners incur as a daily part of running and operating a business.

To learn more about Sotarius or principal, John Brooks, please visit the website at http://www.sotarius.com

Contact Info:

Name: John Brooks

Organization: Sotarius

Address: 8320 Falls of Neuse Rd # 105-B, Raleigh, NC 27615, United States

Phone: +1-919-629-9699

For more information, please visit http://sotarius.com

Source: PressCable

Release ID: 330968