Blockchain In Energy Market 2019 Trends, Size, Share, Growth insight, Competitive Analysis, Emerging Technologies, Regional, And Global Forecast To 2023

Blockchain in Energy Market is segmented by Technology Type, By Platform, By Implementation, By End-Use, By Region – Forecast Till 2023.

Pune, India – March 29, 2019 /MarketersMedia/ —

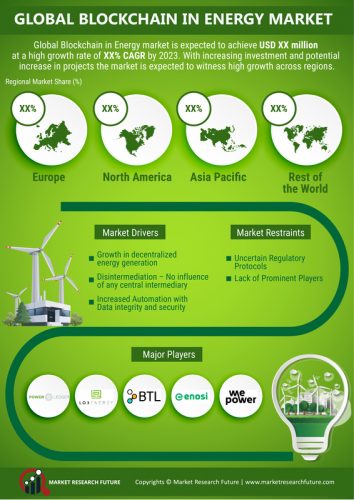

Blockchain in Energy Market to rise at 74.35% growth rate and reach USD 5.03 billion during 2019 and 2023 due to Blockchain can make a significant impact on factors such as operational costs, capital expenditure, risk management, and security. Increased automation with data integrity and security is expected to support the growth of the global blockchain in energy market over the next couple of years. In addition, shifting focus towards enabling real-time transactions and creating more dynamic business models in expected to create market opportunities in near future, according to Global Blockchain in Energy Market 2019 Industry Report published by “Market Research Future”.

Get Free Sample “Blockchain in Energy Market Research Report – Global Forecast to 2023” at: https://www.marketresearchfuture.com/sample_request/5814

Market Synopsis:

The key players in the global Blockchain in Energy market include:

Power Ledger Pty Ltd, WePower UAB, LO3 Energy, Inc, Grid +, BTL Group Ltd., The Sun Exchange (Pty) Ltd, Conjoule GmbH, Enosi Foundation and Electron (Chaddenwych Services Limited).

The gradually growing demand for blockchain as a technology is expected to disrupt the core of the several industries where it may be implemented. The beginning of the concept of blockchain in energy originated as a niche product on the market peripheries but has captured the attention of several industry experts and leaders in recent times. The use of blockchain technology in the energy sector allows energy companies the chance to make substantial cost-saving and process efficiencies which is a significant advantage that is expected to be derived from the implementation of blockchain in energy. However, the preliminary potential of blockchain technology in the energy industry proves its potential to be that of a robust technology in its imminent energy industry applications.

Presently, there is no standardization or regulatory framework which applies to blockchain technology which may prove challenging for the growth of the market. The U.S Federal Trade Commission has created a Blockchain Working Group to work toward this and navigate uncharted territory through resource sharing and hosting experts from around the globe. Since blockchain technology is still in its initial stages of growth and implementation, the development of new business models that utilize blockchain is expected to promote the novel opportunities during the review period.

Market Segments Analysis:

The blockchain in energy market is segmented on the basis of end-use industries, technology type, platform type, implementation type, and application type. By technology type, the market is segmented into closed blockchain, open blockchain, hybrid blockchain and consortium blockchain. Closed Blockchain is accredited for a significant market share of 77.71% in 2017 and is projected to develop at the highest CAGR of 76.88% during the forecast period.

The platform type basis of segmentation of the market comprises of hyperledger, ethereum, tendermint, and interbit. Ethereum is responsible for the leading market share of 76.89% in 2017, with a market value of USD 138.6 and is likely to develop at the highest CAGR of 78.56% during the forecast period. The market segmentation of the market on the basis of implementation type comprises of development platforms, service & solution, and industry specific. The end use industries-based segmentation of the market includes power & utilities, renewable energy, and oil & gas. The applications-based segmentation of the computer vision market consists of grid management, energy trading, control & security, payment schemes, supply chain and logistics.

Regional Analysis:

Europe accounts for the largest regional segment in the global blockchain in energy market due to the regions forward-thinking the approach to the adoption of blockchain platforms in the energy sector. The European Commission has recently launched the EU Blockchain Observatory & Forum with the aim of understanding the key developments in the blockchain technology and to promote European players to develop and invest in blockchain activities. Investments in this technology are encouraged by the fact that blockchain platforms offer substantial reductions in operating costs, transparency and security. Countries such as the U.K, France, Germany, Spain, Norway, and the Netherlands are a part of 22 European nations which have formed a blockchain partnership in an effort to freely exchange information which will assist in advancing applications of the technology.

North America possesses the second most significant segment in the global market and closely follows Europe. There is a rapid growth in blockchain based energy projects as the adoption of renewable energy grows in order to meet the burgeoning demand for power in the region. Use of blockchain platforms in the region is expected to reduce costs and solve data management complications. The use of blockchain technology for data management, development of new business models and to keep a better track of clean energy generated is expected to drive growth in the region during the forecast period.

TABLE OF CONTENTS:

1 EXECUTIVE SUMMARY

2 SCOPE OF THE REPORT

2.1 MARKET DEFINITION

2.2 SCOPE OF THE STUDY

2.2.1 RESEARCH OBJECTIVES

2.2.2 ASSUMPTIONS & LIMITATIONS

2.3 MARKETS STRUCTURE

3 MARKET RESEARCH METHODOLOGY

3.1 RESEARCH PROCESS

3.2 SECONDARY RESEARCH

3.3 PRIMARY RESEARCH

3.4 FORECAST MODEL

4 MARKET LANDSCAPE

4.1 FIVE FORCES ANALYSIS

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF BUYERS

4.1.3 BARGAINING POWER OF SUPPLIERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 SEGMENT RIVALRY

4.2 VALUE CHAIN/SUPPLY CHAIN OF GLOBAL BLOCKCHAIN IN ENERGY MARKET

5 INDUSTRY OVERVIEW OF GLOBAL BLOCKCHAIN IN ENERGY MARKET

5.1 INTRODUCTIO

5.2 GROWTH DRIVERS

5.3 IMPACT ANALYSIS

5.4 MARKET CHALLENGES

Continued…

LIST OF TABLES:

TABLE 1 GLOBAL BLOCKCHAIN IN ENERGY MARKET: BY REGION, 2017-2023

TABLE 2 NORTH AMERICA BLOCKCHAIN IN ENERGY MARKET: BY COUNTRY, 2017-2023

TABLE 3 EUROPE BLOCKCHAIN IN ENERGY MARKET: BY COUNTRY, 2017-2023

TABLE 4 ASIA PACIFIC BLOCKCHAIN IN ENERGY MARKET: BY COUNTRY, 2017-2023

TABLE 5 MIDDLE EAST & AFRICA BLOCKCHAIN IN ENERGY MARKET: BY COUNTRY, 2017-2023

TABLE 6 LATIN AMERICA BLOCKCHAIN IN ENERGY MARKET: BY COUNTRY, 2017-2023

Continued…

LIST OF FIGURES:

FIGURE 1 GLOBAL BLOCKCHAIN IN ENERGY MARKET SEGMENTATIONFIGURE 2 FORECAST METHODOLOGY

FIGURE 3 FIVE FORCES ANALYSIS OF GLOBAL BLOCKCHAIN IN ENERGY MARKET

FIGURE 4 VALUE CHAIN OF GLOBAL BLOCKCHAIN IN ENERGY MARKET

FIGURE 5 SHARE OF GLOBAL BLOCKCHAIN IN ENERGY MARKET IN 2017, BY COUNTRY (IN %)

FIGURE 6 GLOBAL BLOCKCHAIN IN ENERGY MARKET, 2017-2023,

Continued…

Browse More Details On Report At: https://www.marketresearchfuture.com/reports/blockchain-in-energy-market-5814

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

Contact Info:

Name: abhishek sawant

Email: Send Email

Organization: Market Research Future

Address: Market Research Future Office No. 528,, Amanora Chambers Magarpatta Road, Pune, India.,

Phone: +1 646 845 9312

Website: https://www.marketresearchfuture.com/reports/blockchain-in-energy-market-5814

Source: MarketersMedia

Release ID: 496912