Bank of Napa Reports Strong Growth

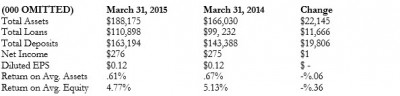

NAPA, CA / ACCESSWIRE / April 23, 2015 / Bank of Napa, N.A. (OTCQB: BNNP) announced its financial results for the period ending March 31, 2015, where the Bank earned $276,000, representing a slight increase over the net income of $275,000 posted for the first quarter of 2014.

Total deposits at March 31, 2015 were $163.2 million, representing an increase from March 31, 2014 of $19.8 million and 13.8%. Loan totals at March 31, 2015 increased to $110.9 million, up by $11.7 million, or 11.8%, from March 31, 2014. Bank of Napa’s total assets reached $188.2 million at March 31, 2015, representing a $22.1 million or 13.3% increase over the balance at March 31, 2014.

President and Chief Executive Officer Tom LeMasters stated, “Considering the investment costs incurred in the quarter associated with opening our second full service office in Downtown Napa, we are pleased that we were able to produce net income in an amount that was above the prior year. Additionally, the customer response and growth of the Downtown Office has affirmed our decision to invest in a new branch.”

At March 31, 2015, the Bank had equity capital of $23.8 million, and all capital ratios were in excess of the regulatory definition for “well capitalized” distinction.

Bank of Napa, N.A.offers a complete range of loan and deposit products, and services to businesses and consumers in the Napa Valley. It operates two full service offices: at the corner of Redwood Road and Solano Avenue at 2007 Redwood Road, Suite 101; and at Second and Seminary Streets at 1715 Second Street, in Napa CA. Bank of Napa is a member of the FDIC. Its common stock is traded on the Over the Counter Bulletin Board under the symbol BNNP and the Bank can be found on the web at www.thebankofnapa.com.

Contact Information:

Tom LeMasters

President & CEO

707-257-7777

Information contained herein may contain certain forward-looking statements that are based on management’s current expectations regarding economic, legislative, and regulatory issues that may impact the Bank’s earnings in future periods. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include the words “believe,” “expect,” “intend,” “estimate,” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may.” Factors that could cause future results to vary materially from current management expectations include, but are not limited to, general economic conditions, changes in interest rates, deposit flows, real estate values, and competition; changes in accounting principles, policies or guidelines; changes in legislation or regulation; and other economic, competitive, governmental, regulatory and technological factors affecting the Bank’s operations, pricing, products and services. The Bank undertakes no obligation to release publicly the result of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date of this press release or to reflect the occurrence of unanticipated events.

SOURCE: Bank of Napa, N.A.

ReleaseID: 427911