Digital Banking Market Trends 2021, Growth Analysis and Forecasts 2026

Digital Banking Market is anticipated to witness healthy growth during 2021 to 2027 driven by a steady shift towards online banking platforms.

Delaware, United States – July 22, 2021 /MarketersMedia/ —

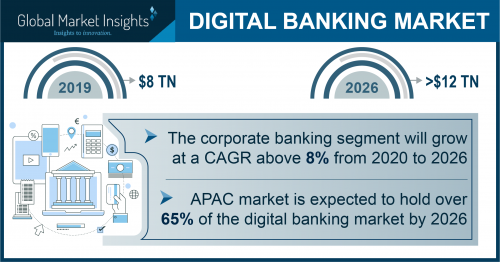

Digital Banking Market will generate lucrative growth opportunities through 2026 on account of a steady shift towards online banking platforms. With the availability of high-speed internet and smartphones, accessing mobile banking services have become easier for customers. Increasing need to enhance user experience and lower the OPEX & CAPEX associated with banking transactions could massively boost the adoption of digital banking systems. Global Market Insights, Inc., estimates that the digital banking market demand might surpass USD 12 trillion by the year 2026.

The global banking & financial industry is flourishing, with huge amounts of transactions being done on a daily basis. Back in 2019, overall digital payment transactions were valued over USD 740 trillion, and were predicted to be more than 750 billion in terms of volume. Digitalization of financial offerings and digital transformation in the BFSI sector could considerably advocate industry outlook.

Mentioned below are some of the ongoing trends advancing the digital banking market size:

Rapid advancements in the corporate banking sector –

Corporate banking is regarded as an extremely profitable unit of banks which supports a lot of large-scale enterprises. Surging need for a platform with reduced complexities and simplifies banking processes could stimulate the adoption of digital banking solutions across corporate banks. Estimates suggest that the segment could record a CAGR of more than 8% within the predicted timeframe.

These services allow corporate banks to decrease complications in handling cash payments and transactions across different partner banks. Additionally, it offers enhanced liquidity management capabilities as well as optimum convenience and control in major banking processes.

To access a sample copy or view this report in detail along with the table of contents, please click the link below:

https://www.gminsights.com/request-sample/detail/2651

Lucrative opportunities across Asia Pacific –

Rapid digitization across the banking sector coupled with increasing developments in financial technologies could accelerate the Asia Pacific digital banking market share. Forecasters claim that the region could control almost 65% of the global market share by the end of 2026. Banking institutes across Singapore and India are embracing digital banking technologies with open arms. Citing an instance, Singapore’s biggest mobile operator, Singtel along with its partner Grab is considered to be a strong contender for a digital banking license in Singapore.

Businesses operating in APAC are constantly focusing on launching and developing advanced digital banking solutions. For example, earlier in August 2020, Sub-K IMPACT Solutions introduced a new digital finance platform dubbed Sub-K Sarthi. The platform offered affordable and accessible financial services to users. This feature is ideal for SMEs and underserved customers.

Adoption of new business strategies –

Established players operating in the digital banking market are engaged in a series of growth strategies like product innovations, strategic collaboration, and business expansion to enhance their customer base and overall market share. Taking October 2020 for instance, HSBC launched a new cash flow forecasting tool for enterprises functioning from the US. The move would improve a range of HSBC’s digital commercial banking products.

About Global Market Insights, Inc.

Global Market Insights, Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider, offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy, and biotechnology.

Contact Info:

Name: Arun Hegde

Email: Send Email

Organization: Global Market Insights Inc.

Address: 4 North Main Street, Selbyville, Delaware 19975 USA

Phone: 1-302-846-7766

Website: https://www.gminsights.com/pressrelease/digital-banking-market

Source URL: https://marketersmedia.com/digital-banking-market-trends-2021-growth-analysis-and-forecasts-2026/89037991

Source: MarketersMedia

Release ID: 89037991