West Red Lake Gold: “South Austin is a Very Important Part of the Mine Restart Plan”

WRLG’s flagship asset – The Madsen Gold Mine was targeted for acquisition by Canadian philanthropist and financier Frank Giustra who formed Wheaton River Minerals which was sold to Newmont for USD $10 billion in 2019.

Vancouver, British Columbia, Canada – May 9, 2024 —

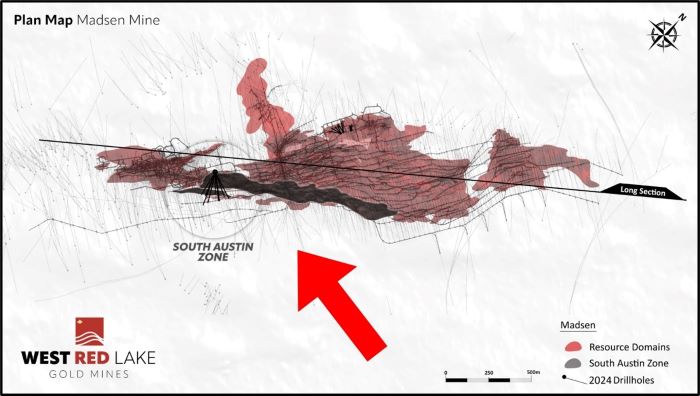

Global Stocks News – In a press release dated May 7, 2024, West Red Lake Gold Mines (TSXV:WRLG) (OTC:WRLGF) reported drill results, focused on the high-grade South Austin Zone at its Madsen project in Ontario, Canada.

WRLG’s flagship asset – The Madsen Gold Mine was targeted for acquisition by Canadian philanthropist and financier Frank Giustra who formed Wheaton River Minerals which was sold to Newmont for USD $10 billion in 2019.

The Madsen Gold Mine is fully permitted and has a brand-new 800+ tonne per day mill, a tailings and water treatment facility. [1]

The strategy for the Madsen Mine Restart is: 1. De-risk Resources (in-fill and expansion drilling, UG development 2. Restart Planning (engineering, mill expansion assessment, optimisation 3. Restart Execution (assembling team, community relations, focus on operability and profitability).

“South Austin is an important part of the mine restart plan,” Will Robinson, WRLG VP of Exploration told Guy Bennett, CEO of Global Stocks News. “There are 1.7 million ounces of Indicated gold in the Austin zone – higher confidence ounces at a solid grade of 7.4 g/t gold – South Austin adds to that.”

“Our infill holes are returning gold where expected, which supports our geologic model, and our step out holes are expanding the zone,” continued Robinson. “Having development and access to this area is a huge benefit logistically because it means we can drill South Austin with short, efficient holes from almost any angle we desire.”

“We are focused on South Austin because it is directly adjacent to existing infrastructure and has relatively continuous mineralization which should allow for efficient mining,” stated Robinson. “We have similar hopes for the North Austin area. Together, we see good potential for these zones to be the foundation of a robust mine restart plan.”

May 7, 2024 South Austin Drill Highlights:

· Hole MM24D-07-4198-012 Intersected 3.1m @ 21.33 g/t Au, from 83.9m to 87.0m, Including 0.5m @ 32.74 g/t Au, from 85.50m to 86.00m; also Including 1.0m @ 28.78 g/t Au, from 86.00 to 87.00m; And 1.0m @ 16.97 g/t Au, from 9.00m to 10.00m.

· Hole MM24D-07-4198-009 Intersected 9.0m @ 6.75 g/t Au, from 103.0m to 112.0m, Including 0.9m @ 27.91 g/t Au, from 104.0m to 104.9m; also Including 1.0m @ 23.47 g/t Au, from 111.00m t0 112.00m.

· Hole MM24D-07-4198-010 Intersected 2.55m @ 6.08 g/t Au, from 75.45m to 78.00m, Including 1.0m @ 11.08 g/t Au, from 76.0m to 77.0m.

· The high-grade mineralization encountered near the collar (top of hole) in Hole MM24D-07-4198-012 is believed to be the down-dip continuation of a mineralized domain defined further up in the system.

“We are happy to report more encouraging results out from the South Austin definition program,” stated Shane Williams, WRLG President & CEO. “De-risking this high-priority area of the Madsen deposit will be a key component for the mine restart plan.”

On May 07, 2024 WRLG announced that bookrunner Raymond James has agreed to purchase, on a “bought deal” basis, 27,778,000 units and 11,236,000 charity-flow through units of WRLG at a price of C$0.72 per Unit and C$0.89 per Charity Flow-Through Unit respectively, raising approximately C$30 million.

“Flow-through shares enable public companies to transfer exploration expenditures to investors who can take advantage of the corresponding tax incentives, thereby ‘flowing their benefits through’ to the shareholder,” writes CG Wealth Management.

“This financing offers units with a half warrant,” explained WRLG President and CEO Shane Williams in a May 7, 2024 message to shareholders.

“Full warrants are exercisable at $1 for 24 months,” continued Williams. “I truly believe West Red Lake Gold will be a very different company 24 months from now – a miner with a profitable operation in one of the richest gold districts in Canada, working to grow at Madsen via exploration and beyond through M&A – and will carry a much higher valuation.

We are homing in on a robust mine restart plan grounded in a confident, high-grade reserve with ample mining optionality, which is essential for success with an underground operation.

Once the mine is generating cashflow, we will be able to dig into the bigger opportunity around Madsen, following up on the tantalizing drill hits at the 8 Zone, Deep Austin, and Sidecar.

There is real potential to discover gold zones that transform Madsen the way the High-Grade Zone transformed the Red Lake Mine and the Swann zone transformed the Fosterville mine,” concluded Williams.

On May 2, 2024, West Red Lake Gold revealed that, during a ball mill cleanup, it recovered 415 troy ounces of gold worth about $750,000.

It is anticipated that WRLG may recover 2,500 oz of gold from the clean up, worth a total of USD $5.75 million @$2,300 gold.

“The previous operators only ran the mill for a short time before shutting down,” recalled Maurice Mostert, WRLG VP of Technical Services. “They did not have the opportunity to optimize the mill process or sort out the gold traps.”

“We realized that we could capitalize on those inefficiencies, “Mostert continued. “Our objective was to capture the value of the gold and to better understand the traps and how to fix them.”

The Madsen Mine deposit presently hosts an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [2.] [3.]

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid GSN $1,500 CND for the research, writing and dissemination of this content.

References:

1. SRK Consulting. (2021). Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada (West Red Lake Gold Mines, Ed.) [Review of Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada.

2. Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

3. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the purpose of the updated report. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

Contact Info:

Name: Guy Bennett

Email: Send Email

Organization: Global Stocks News

Website: http://www.globalstocksnews.com

Release ID: 89129434

If you encounter any issues, discrepancies, or concerns regarding the content provided in this press release, or if there is a need for a press release takedown, we urge you to notify us without delay at error@releasecontact.com. Our expert team will be available to promptly respond within 8 hours – ensuring swift resolution of identified issues or offering guidance on removal procedures. Delivering accurate and reliable information is fundamental to our mission.