Blue Dolphin to Expand Nixon Facility

HOUSTON, TX / ACCESSWIRE / June 30, 2015 / Blue Dolphin Energy Company (“Blue Dolphin”) (OTCQX: BDCO) today announced plans to expand the Nixon Facility, recently closing on $28 million of $35 million in approved funding.

On June 22, 2015, Lazarus Energy, LLC and Lazarus Refining & Marketing, LLC, wholly owned subsidiaries of Blue Dolphin, closed on a $25 million term loan (the “LE Term Loan”) and a $3 million bridge loan (the “LRM Bridge Loan”), respectively, with Sovereign Bank, a Texas state bank. The LE Term Loan is guaranteed under the Business & Industry Guaranteed Loan Program administered by the United States Department of Agriculture Rural Development Program (the “USDA”). Proceeds from the LE Term Loan will be used to support the expansion of crude and product storage at the Nixon Facility and refinance approximately $8.5 million in debt owed to American First National Bank. Proceeds from the LRM Bridge Loan will be used to acquire idle refinery process equipment for the Nixon Facility.

The LE Term Loan has a fully amortizing maturity date of June 22, 2034. The total effective interest rate will be 8.0% per year (currently) variable to Wall Street Journal Prime Rate with a prepayment penalty of a flat 5% if repaid within 5 years. Additional details regarding the LE Term Loan and the LRM Bridge Loan, including borrowing terms, payments and interest rates, are included in a related Form 8-K that Blue Dolphin filed with the Securities and Exchange Commission on June 26, 2015.

The Nixon Facility expansion plan has three phases:

– Phase 1: Construct more than 500,000 barrels of petroleum storage tanks (100,000 barrels of crude oil storage, 400,000 barrels of product storage, and 2,142 barrels of LPG / LSR storage) and associated ancillary equipment through the LE Term Loan. By refinancing approximately $8.5 million of existing debt, LE’s net debt increased by approximately $16.5 million. Total debt payments including principal and interest will be approximately $225,000 per month or approximately $150,000 per month more than the prior loan from American First National Bank. Leasing 20% to 30% of the newly constructed storage tanks would fully cover the incremental debt payments.

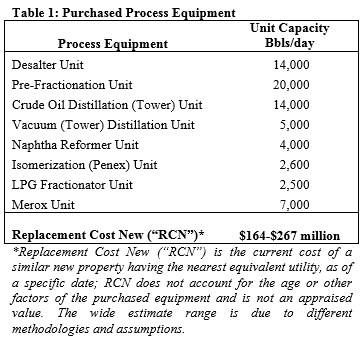

– Phase 2: Purchase idle refinery process equipment through the LRM Bridge Loan. The company believes it will reduce future capital costs by utilizing various process equipment, pumps and compressors that can be cost effectively rebuilt. The process equipment purchased is estimated to be about 2% of the installed replacement cost of comparable new equipment (see Table 1).

– Phase 3: Obtain and close a new $10 million USDA guaranteed loan to LRM with similar terms to those of the LE Term Loan. Sovereign Bank has approved the loan, subject to receiving a loan guarantee from the USDA. We are in the process of obtaining a guarantee commitment from the USDA. Proceeds from this loan, when funded, will be used to refinance the $3 million LRM Bridge Loan and to construct an additional 300,000 barrels of new crude oil storage tanks.

Potential benefits of the Nixon Facility expansion plan include:

– generation of additional revenue from leasing product and crude storage to third parties

– crude and product storage capable of supporting refinery throughput of up to 30,000 barrels per day

– production of a higher octane gasoline blendstock (reformate) by refurbishing and relocating the naphtha reformer

– production of ultra low sulfur diesel (“ULSD”) by refurbishing and relocating a light duty hydrotreater

– increasing the processing capacity and complexity by refurbishing and relocating additional purchased refinery equipment to the Nixon Facility, including a Merox unit, vacuum tower, prefrac tower unit, and LPG fractionator and other recently acquired equipment.

“We are able to lay the groundwork for additional new capital and organic growth through debottlenecking and capital improvements,” said Jonathan P. Carroll, Blue Dolphin’s Chief Executive Officer and President. “Simultaneous with the storage tank expansion project, we continue to identify and vet additional opportunities to increase throughput and diversification of products that will optimize profitability.”

“By securing low cost and long maturity loans, we will be able to finance construction of over 800,000 barrels of crude and product storage tanks at the Nixon Facility, purchase idle process equipment at a small fraction of the replacement cost, and fully fund the debt repayment cost through leases on a small portion of the newly constructed storage tanks,” continued Mr. Carroll.

SME Advisors LC, a Dallas-based Advisory firm, served as exclusive financial advisor to Blue Dolphin throughout the transactions.

About Blue Dolphin

Blue Dolphin Energy Company is an independent refiner and marketer of refined petroleum products in the Eagle Ford Shale. Blue Dolphin’s primary business is refinery operations at the 15,000 bpd Nixon Facility, which includes the refining of crude oil and condensate into marketable finished and intermediate products, as well as petroleum storage and terminaling. Blue Dolphin also owns and operates pipeline assets and has leasehold interests in oil and gas properties. For additional information, visit Blue Dolphin’s corporate website at http://www.blue-dolphin-energy.com.

Contact:

Jonathan P. Carroll

Chief Executive Officer and President

713-568-4725

Certain of the statements included in this press release, which express a belief, expectation or intention, as well as those regarding future financial performance or results, or which are not historical facts, are “forward-looking” statements as that term is defined in the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. These forward-looking statements are not guarantees of future performance or events and such statements involve a number of risks, uncertainties and assumptions, including but not limited to: dangers inherent in oil and gas operations that could cause disruptions and expose us to potentially significant losses, costs or liabilities and reduce our liquidity; geographic concentration of our assets, which creates a significant exposure to the risks of the regional economy; competition from companies having greater financial and other resources; laws and regulations regarding personnel and process safety, as well as environmental, health and safety, for which failure to comply may result in substantial fines, criminal sanctions, permit revocations, injunctions, facility shutdowns and/or significant capital expenditures; insurance coverage that may be inadequate or expensive; related party transactions with LEH and its affiliates, which may cause conflicts of interest; loss of executive officers or key employees, as well as a shortage of skilled labor or disruptions in our labor force, which may make it difficult to maintain productivity; our dependence on Lazarus Energy Holdings, LLC for financing and management of our property and the property of our subsidiaries; capital needs for which our internally generated cash flows and other sources of liquidity may not be adequate; our ability to use net operating loss carry forwards, which are subject to limitation, to offset future taxable income for U.S. federal income tax purposes; and the factors set forth under the heading “Risk Factors” in Part I, Item 1A of Blue Dolphin’s previously filed Annual Report on Form 10-K for the fiscal year ended December 31, 2014. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual results and outcomes may differ materially from those indicated in the forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Blue Dolphin undertakes no obligation to republish revised forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

SOURCE: Blue Dolphin Energy Company

ReleaseID: 430280