A Brewing Bucha Opportunity in the Functional Beverage Space

REDONDO BEACH, CA / ACCESSWIRE / September 22, 2015 / The craft brewing industry may be

struggling amid intensifying competition, with companies like Craft Brew

Alliance Inc. (NASDAQ: BREW) falling some 36% over the past 52 weeks, but

there’s another type of brew that has been taking off over the past couple of

years.

Kombucha is a brewed and fermented probiotic

tea that could grow from $122.7 million in 2013 to upwards of $500 in 2015. In

many Whole Foods Inc. (NASDAQ: WFM) stores, for instance, the category accounts

for about

a third of its refrigerated functional beverage shelf space. The market

also remains rather fragmented with only one market leader – GT – and a number

of much smaller competitors looking to secure a share of the market.

Despite its introduction thousands

of years ago, consumers have just now been embracing kombucha in increasing

numbers due to its perceived healing and cleansing characteristics. Kombucha

teas include probiotics from the fermentation and a number of potentially

beneficial byproducts found in the tea itself, such as polyphenols,

antioxidants, and flavonoids. Some manufacturers are also developing coffee,

beer, and other styles of kombucha.

In this article, we’ll take a look

at a company that’s leveraging its experience in craft brewing to introduce a

revolutionary kombucha product into health and grocery stores nationwide.

Capitalizing on Kombucha

American Brewing Co. Inc. (OTCBB:

ABRW) is a Washington-based craft brewer with four beers in its portfolio,

including the Flying Monkey Dogfight Pale Ale, Breakaway IPA, American Blonde,

and Caboose Oatmeal Stout. After getting its start in the beer industry, the

company expanded into the kombucha category with its bucha(TM) Live Kombucha brand

of gluten-free, organic, sparkling kombucha teas back in April of 2015 with

distribution throughout North America.

When the company was acquired there

was distribution into 1800 stores including health, natural and grocery chains.

The company is looking to double that store count over the next 12 months with

distribution into all major U.S. markets utilizing a new national broker

network.

Its proprietary blend

differentiates itself from other kombucha producers through its proprietary

extraction process that reduces the sour taste and may appeal to a larger

audience. In fact, the sour nature of most kombucha could be a leading factor

that’s holding back wider consumer adoption.

Profitable & Growing

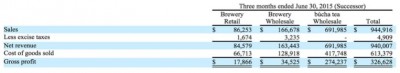

American Brewing reported revenue

of $940,007, gross profit of $326,628, and net income of $19,217 during the

quarter ended June 30, 2015. Following the acquisition of bucha(TM) Live Kombucha,

the company generated 73% of its revenue and 84% of its gross profit from its

bucha tea Wholesale division. The oversized impact on gross profit suggests

that the transition into kombucha will continue improving overall margins over

time.

Figure 1 – Q2 Earnings – Source: SEC Filings

In terms of near-term potential, investors

may want to take a look at Reed’s Inc. (NYSE: REED) success in entering the

market. Reed’s reported second quarter kombucha sales that increased 11% as it

worked to improve its production techniques and add additional flavors –

including the addition of a coffee-based kombucha. According to their 10-K

filing, kombucha has grown to account for about 12% of the company’s $43.4

million in net sales – or about $9.5 million.

American Brewing has a market

capitalization of just $7 million, which leaves substantial room for upside if

can capture just a fraction of the market. Reed’s trades with a price-sales

ratio of about 1.4x, while many larger beverage companies trade with even

higher multiples. The company’s pure-play focus on kombucha could lead to an

above-market multiple, since it would presumably be able to grow faster than

its diversified competitors.

Looking Ahead

Kombucha is the largest growth

segment of the functional beverage category of food and drinks, which includes

coconut water, yogurts, and fresh juices. The refrigerated juices section of

the market alone grew by approximately $200 million in 2012 to an estimated

market of about $600 million (50% growth), according to SPINS data. Kombucha

accounts for an overwhelming majority of that explosive growth and accounts for

a large part of the segment.

With its growing distribution

footprint and product innovation, American Brewing is well-positioned to become

a virtual-pure-play in the kombucha space. Investors interested in the

functional beverage space may want to take a closer look at the stock given

these catalysts. In particular, investors in micro-cap functional beverage

stocks, like DC Brands International Inc. (OTC Pink: HRDN), or nutraceutical

firms, like Nutraceutical Int’l Corp. (NASDAQ: NUTR), may want to take an

especially close look at the stock.

For more information, visit the

company’s website at www.americanbrewing.com.

Legal Disclaimer:

Except for the historical information presented herein, matters

discussed in this release contain forward-looking statements that are

subject to certain risks and uncertainties that could cause actual

results to differ materially from any future results, performance or

achievements expressed or implied by such statements. Emerging Growth

LLC is not registered with any financial or securities regulatory

authority, and does not provide nor claims to provide investment advice

or recommendations to readers of this release. Emerging Growth LLC may

from time to time have a position in the securities mentioned herein and

may increase or decrease such positions without notice. For making

specific investment decisions, readers should seek their own advice.

Emerging Growth LLC may be compensated for its services in the form of

cash-based compensation or equity securities in the companies it writes

about, or a combination of the two. For full disclosure please visit: http://secfilings.com/Disclaimer.aspx.

SOURCE: Emerging Growth LLC

ReleaseID: 432120