Accretive Capital Partners Expresses Grave Concerns Relating to Actions Semiconductor; Will Explore Extraordinary Corporate Transactions

NEW HAVEN, CT / ACCESSWIRE / April 30, 2015 /

An Open Letter to the Board of Directors of Actions Semiconductor Co., Ltd

Mr. Hsiang-Wei Lee

Mr. Chin-Hsin Chen

Mr. Jun Tse Huang

Mr. Yu-Hsin Lin

Mr. Nan-Horng Yeh

Actions Semiconductor Co., Ltd.

No. 1 Ke Ji Si Road

Technology Innovation Coast of Hi-Tech Zone

Zhuhai, Guangdong, 519085

People’s Republic of China

To the Board of Directors of Actions Semiconductor:

As you know, we received your correspondence-written by the Corporate Secretary to Actions Semiconductor (NASDAQ: ACTS), delivered more than four months after making our director nominations, sent to us by the Company’s IR representative instead of you, and informing us of your extraordinary decision to reject the Accretive Capital Partners director nominees. We find your behavior utterly despicable and blatantly conflicted–yet perfectly consistent with your abusive behavior towards shareholders of Actions Semiconductor, including the largest shareholder of the Company. We cannot fathom how any one of you can possibly claim to be acting in the best interest of the Company or its shareholders.

For more than eight long and excruciating years, Accretive Capital Partners and its affiliates have been among the largest and most supportive shareholders of Actions Semiconductor Co., Ltd. (“Actions” or the “Company”). We own over 33.3 million ordinary shares (or approximately 5.6 million ADS shares) held by our fund and its affiliates.

SEC Documents here: http://www.sec.gov/Archives/edgar/data/1118118/000106299315002251/sc13da.htm

Our ownership now equates to approximately 15.6% of the outstanding shares (based on 213,530,033 ordinary shares outstanding, as reported by the Company in its Form 20-F filing on April 24, 2015), as compared to less than 1% held by the entire Board of Directors and management combined.

Despite your total disinterest in purchasing ownership and your failure to provide management with any direction to build or even to preserve value at Actions, we nevertheless take pride in being value-added partners to the Company and our fellow shareholders. We have worked hard to provide constructive advice during the past eight years, despite the extraordinary destruction of shareholder value authorized by you, as directors of our Company.

We believe that investment firms like ours serve an important societal role in identifying outstanding business managers and supporting them as they turn their visions of fulfilling market needs into realities of new products or better services, improving life for everyone. We strive to achieve our professional responsibilities by investing in and partnering with exceptional CEOs who have demonstrated their success at allocating assets as they build superior businesses. And we are committed to allocating the funds entrusted to us by our investors intelligently, honorably, and just as rationally.

It is with these responsibilities in mind that we come to the disheartening conclusion that the Board of Directors at Actions Semiconductor shares none of our values.

We are writing you once again to advise you of our:

1. Grave concerns relating to your conflicts of interest and related-party transactions at Actions Semiconductor and our continued questions which have gone unanswered by the Board of Directors for over six months;

2. Intention to consider extraordinary corporate transactions with Actions, including but not limited to a merger, reorganization, liquidation, or offer to purchase the outstanding securities of the Company;

3. Amendment to our Schedule 13D filing with the U.S. Securities and Exchange Commission to report these developments;

4. Recommendation that you replace your director nominations with the candidates nominated by Accretive Capital Partners on December 8, 2014; and

5. Interest in hearing from other concerned shareholders, who may contact as at the following email or phone number: info@accretivecapital.com or 203.794.6360.

We are extremely troubled by the obvious conflicts of interest and related-party transactions with Nan-Horng Yeh (“Mr. Yeh”) and Yu-Hsin Lin (“Mr. Lin”), and we are shocked that other Board members do not understand the risks of providing continued support to these two directors.

Specifically: Mr. Yeh is Chairman of the Board and substantial owner of Realtek Semiconductor Corporation (“Realtek”), which has received significant investment capital from Actions; moreover, Mr. Yeh’s elder brother is President of GMI Technology (“GMI”), which is one of the largest distributors of semiconductors for Actions and was sold product for $9.2 million in 2014; and Mr. Lin is Director and Chief Financial Officer of a semiconductor wafer manufacturer, United Microelectronics Corporation (“UMC”), which sells Actions almost all of its semiconductor wafers.

Each of these related-parties stands to lose substantial profits if Actions were to sell the Company to a third party or even to eliminate certain unprofitable product lines so that Actions shareholders could benefit from a profitable business of their own. Meanwhile, Mr. Yeh continues to serve as a director at Actions, charged by our Company with fiduciary duties to Actions-and not to Realtek or GMI. Amazingly, Mr. Lin serves as Chairman of the Audit Committee for Actions, entrusted with the responsibility and power to approve these related party transactions.

In each of the last six (6) years since 2008, Actions has hemorrhaged an operating loss totaling a staggering $102.7 million. Last year alone, under the direction of this Board, Actions destroyed $39.5 million of Company assets with its operating loss.

1. Did Realtek, GMI, or UMC suffer any of these operating losses?

2. What products were sold to GMI for $9.2 million in 2014 and were they sold at a loss or had they been previously written down?

3. How is it that these related parties to Mr. Yeh and Mr. Lin can enjoy profits from Actions when we shareholders must endure these extraordinary losses?

4. How is it that Mr. Yeh and Mr. Lin are acting in the best interest of Actions shareholders by authorizing ongoing operating losses to the benefit of Realtek, GMI, and UMC?

5. How does Mr. Yeh fulfill his fiduciary duties as a director when he is personally conflicted in significant related party transactions with Realtek and GMI?

6. How does Mr. Lin fulfill his fiduciary duties as Chairman of the Audit Committee when he is personally conflicted in significant related party transactions with UMC?

Mr. Yeh and Mr. Lin are unwilling to authorize additional Company stock repurchases, have purchased no Actions stock for themselves, and are unwilling to consider a sale of the Company. We believe the sole purpose for continuing this money-losing business at the expense of Actions shareholders is to enrich the related parties of Mr. Yeh and Mr. Lin.

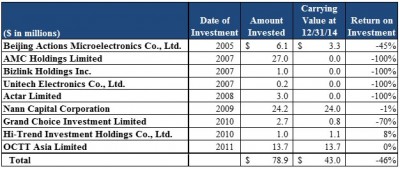

We are also perplexed by the transactions approved by this Board on behalf of shareholders. The following investments, as reported in the Company’s Form 20-F filings since 2005, have resulted in an astounding loss of more than $35.9 million, or 46% of the invested capital:

Beijing Actions Microelectronics Co., Ltd.

On November 17, 2005 Actions established a subsidiary, Actions Microelectronics Co., Ltd. (“Beijing Actions”) which served as a holding company for its research and development center for imaging and video technology. On September 22, 2009, Beijing Actions introduced a group of new shareholders and Actions further invested $1.5 million. The Company subsequently invested an additional $2.6 million on January 25, 2011. Actions total investment reached $6.1 million as of January 25, 2011, and the Company held a minority stake of 46% equity interest in Beijing Actions. The carrying value as of December 31, 2014 was only $3.3 million, a 45% decline in value. (2005 Form 20-F and 2014 Form 20-F)

7. Who owns the other 54% of Beijing Actions?

8. Why is this minority investment in a business controlled by another party that has lost 45% of its value in the best interest of Actions shareholders?

AMC Holdings Limited

In 2007, Actions acquired a minority stake of 5% equity interest in AMC Holdings Limited (“AMC”), which has somehow grown to a total investment of $27.0 million. AMC was established in Taiwan and engages in manufacturing printed circuit board (PCB) laminate and providing other related sub-contractor service. Actions’ investment in AMC is now worthless, with a reported carrying value of $0.0 as of December 31, 2014. (2007 Form 20-F and 2014 Form 20-F)

9. Who owns the other 95% of AMC?

10. Why is a minority investment in a Taiwanese company unrelated to Actions’ core business that lost an astounding $27.0 million in the best interest of shareholders?

Bizlink Holdings Inc.

In 2007, Actions made a $1.0 million investment in Bizlink Holdings Inc. (“Bizlink”), a manufacturer of interconnectivity solutions such as cable, wire and connectors. In 2008, the equity value of this investment was wiped out, resulting in a $0.0 carrying value as of December 31, 2008. (2007 Form 20-F and 2008 Form 20-F)

11. Who were the other investors in Bizlink?

12. Why is this investment, which lost its entire value in 1 year, in the best interest of shareholders?

Unitech Electronics Co., Ltd.

In 2007, Actions invested $100,000 in Unitech Electronics Co., Ltd. (“Unitech”), a manufacturer and designer of automatic identification and data collection products. Actions invested an additional $100,000 in 2008; since increasing its investment in Unitech to $200,000 in 2008, however, Actions has made no mention of this investment in its subsequent 20-F filings. (2007 Form 20-F and 2008 Form 20-F)

13. What has happened to Actions’ investment in Unitech and what is its current value?

14. Why is this investment in the best interest of shareholders?

Actar Limited

In 2008, Actions acquired a 7% minority stake in Actar Limited (“Actar”), which was established in the PRC and engages in the entertainment media industry, for $3.0 million. Since Actions made this investment, Actar has become fully impaired, completed a liquidation process, and has a carrying value of $0.0 as of December 31, 2014. (2008 Form 20-F and 2014 Form 20-F)

15. Who owns the other 93% of Actar?

16. Why is this $3 million minority investment, which resulted in a total loss of capital, in the best interest of shareholders?

Nann Capital Corporation

In August 2009, the Company’s Hong Kong subsidiary, Actions Enterprises (via its Shanghai subsidiary, Actions Technology), obtained land use rights to the Shanghai Zhangjiang High-Tech Park office building. Less than a year later, in July 2010, the Company transferred all ownership interest of Actions Enterprises to Nann Capital (“Nann”) for $1 and the Company further invested $4.4 million for a 40% ownership stake in Nann. The following year, in June 2011, Actions invested an additional $7.1 million in Nann. In April 2014, Actions invested another $3.7 million, and in May 2014, Actions invested an additional $9.0 million, for a total investment of $24.2 million. (2010 Form 20-F and 2014 Form 20-F)

17. Who owns and manages Nann?

18. Where is Nann domiciled?

19. What are the management fees paid by Actions to Nann?

20. What are Actions’ liquidity provisions for this investment?

21. Why is this minority investment in Nann in the best interests of Actions shareholders?

Grand Choice Investment Limited

In February 2010, Actions purchased a 20% minority interest in Grand Choice Investment Limited (“Grand Choice”) for $600,000. Grand Choice is a private company established in February 2010 which designs and manufactures software and hardware for electronic books. In December 2010, Actions invested another $600,000 to maintain its 20% interest, and in March and April 2011, Actions’ ownership was diluted to 15% and 12%, respectively, due to additional capital injection from other investors. In September 2012, Actions invested yet another $1.5 million in Grand Choice, increasing its total investment to $2.7 million and ownership to 19%. The carrying value of Grand Choice is only $819,000 as of December 31, 2014, a 70% loss on investment. (2010 Form 20-F and 2014 Form 20-F)

22. Who owns the other 81% of Grand Choice?

23. Why is this minority investment that has resulted in a 70% loss in the best interest of shareholders?

Hi-Trend Investment Holdings Co., Ltd.

In 2010, Actions acquired a 10% minority equity interest in Hi-Trend Investment Holdings Co., Ltd (“Hi-Trend”) for $800,000. Hi-Trend was established in the PRC and engages in developing and manufacturing of integrated circuits and chips. Actions made an additional $202,000 investment and its ownership was subsequently diluted to 9%. The carrying value of Hi-Trend was $1.1 million as of December 31, 2014. (2010 Form 20-F and 2014 Form 20-F)

24. Who owns the other 91% of Hi-Trend?

25. Why is this minority investment in the best interest of shareholders?

OCTT Asia Limited

In January 2011, Actions invested $13.7 million in OCTT Asia Limited (“OCTT”), a private equity fund incorporated in Mauritius for the stated purpose of investing in fabless semiconductor design companies in Taiwan that would provide M&A opportunities for the Company. Of the $70 million managed by OCTT, $30.6 million was invested in Realtek Semiconductor Corporation, whose Chairman and substantial owner is Actions Board member Mr. Yeh. Moreover, in your June 11, 2014 letter to shareholders you stated, “Our investment in the private equity fund OCTT Holding Co., Ltd. has been financially rewarding”; yet the December 31, 2014 carrying value of the OCTT is unchanged from Actions’ original 2011 investment. (2011 Form 20-F and 2014 From 20-F)

26. Who owns and manages OCTT?

27. How is OCTT’s investment in Realtek consistent with Actions’ stated purpose of investing in OCTT?

28. With no investment appreciation, how is the investment in OCTT financially rewarding for shareholders?

34. Why is this minority investment in OCTT in the best interests of Actions shareholders?

Shanghai Real Estate Project

In November 2014, Actions announced that it invested $10 million for a 40% minority stake in Shanghai real estate, which the CEO of Actions stated was “not the core business of Actions Semiconductor.” Yet, just one month later, in a Form 6-K filed with the U.S. Securities and Exchange Commission on December 9, 2014, Mr. Lee described cash as so “scarce” that the Company would not be using it “to buy back shares and, by so doing, limiting our operating flexibility and ability to act quickly, risk[ing] putting the Company at a competitive disadvantage and serv[ing] shareholders poorly.” (2014 Form 20-F)

35. How is a $10 million minority real estate investment more attractive than repurchasing $10 million of additional Company stock at $2.50/share and below, when the Company’s liquidation value is over $3.30/share?

36. Who owns and controls the other 60% of this Shanghai real estate project?

37. Why is this minority investment in real estate in the best interests of Actions shareholders?

We believe these decisions conflict directly with the Company’s Corporate Governance Guidelines transcribed below:

“Transactions with Directors and their Affiliates:

Except for employment arrangements with the CEO and other management directors, the Company does not engage in transactions with directors or their affiliates if a transaction would cast into doubt the independence of a director, would present the appearance of a conflict of interest, or is otherwise prohibited by law, rule or regulation. This includes, directly or indirectly, any extension, maintenance or renewal of an extension of credit to any director or member of management of the Company. This prohibition also includes significant business dealings with directors or their affiliates, substantial charitable contributions to organizations in which a director is affiliated, and consulting contracts with, or other indirect forms of compensation to, a director. The Board will conduct an appropriate review of all related party transactions on an ongoing basis.” – Page 3, Paragraph 3, Actions Semiconductor “Corporate Governance Guidelines”

We are profoundly concerned about the conflicts of interest among the Board of Directors at Actions and by the accelerating pace of extraordinary destruction in shareholder value of our Company and we demand answers to the questions contained in this letter. We remain resolute in correcting this situation and adamant that you follow through with your commitment to support the nomination of our two directors. The disproportionate research and development expenditure must be reduced immediately and the company should be sold to better custodians of capital.

For over eight long and painful years, Accretive remained a patient and supportive long-term investor in Actions, hoping that its Board of Directors would act in the best interests of shareholders. You have failed us and all of our fellow shareholders, and we are determined to stop the Board from destroying additional value of our assets at Actions Semiconductor.

ACCRETIVE CAPITAL MANAGEMENT, LLC

Regards,

Richard E. Fearon, Jr.

Managing Partner

About Accretive Capital Partners:

Accretive Capital Partners is an investment fund focused on value investing in small and micro-cap public companies in which its active partnership with management may help to build and unlock shareholder value.

With inquiries please contact:

Accretive Capital Management, LLC

16 Wall Street, 2nd Floor

Madison, CT 06443

email: info@accretivecapital.com

website: www.accretivecapital.com

phone: 203.794.6360

SOURCE: Accretive Capital Partners, LLC

ReleaseID: 428382