AI in BFSI Ecosystem 2020-2025 Details by Size, Share & Trends Analysis Report by Components, Device, Deployment and End-use

AI in BFSI ecosystem Analysis by improve banking, insurance, and financial services in the upcoming years, positively impacting fraud mitigation, customer service, credit scores, and investment advisories.

Dublin, United States – January 8, 2020 /MarketersMedia/ —

Global Analysis of AI in BFSI Ecosystem:

Global AI in BFSI Ecosystem is growing rapidly with the advent of the technology and the availability of the infrastructure. Currently, North America holds the largest share in the AI in BFSI ecosystem and is expected to dominate the global market in the coming years, followed by Europe and Asia Pacific. AI in BFSI ecosystem companies are focusing on automation and optimal utilization of resources, as well as working on a customer-centric approach to improve banking offerings. The digitization in emerging countries will induce the demand for AI in BFSI ecosystem in coming decade.

Get Free Sample Copy of AI in BFSI Ecosystem 2020-2025 Research Summary and Other https://www.alltheresearch.com/sample-request/321

News and Update About AI in BFSI:

The Commonwealth Bank provided service to 6.2 million NetBank and CommBank app users. Thus, creating new opportunities in AI in BFSI sector for real time consumer services. It also suggests solutions such as sending notification and transferring funds. AI in BFSI Support and help for making some tasks for customers, such as paying bills, activating cards, sending bank statements and Other Automatically Manage Systems additional 2020 new update.

Security based AI in BFSI Ecosystem and Revenue:

The major advantages of implementing AI in BFSI ecosystem are tailored customer experience, fraud detection, automated back-end processes, and better turn-around time. According to our estimates, the Global AI in BFSI Ecosystem was valued approximately USD 5.8 Billion in 2018 growing at a CAGR of 23.5%.

AI in BFSI ecosystem includes risk and compliance monitoring companies which are using AI frameworks for audio and video recordings of interactions between clients and bankers and are trying to identify banking terms that are usually monitored by auditors. For instance, Danske Bank has implemented an AI Framework which improved its fraud detection rate by 60%. AI in BFSI ecosystem will enhance the processing of the transactions, customer’s financial tracking and other critical information required for the decision making.

In-Depth Company Profiles Details in AI in BFSI Ecosystem: Microsoft, PayPal, IBM, Bank Of America, Facebook, Amazon, Google, MasterCard and Other 15+ Vendors

AI in BFSI Ecosystem Key Point:

– Ecosystem Report – Table of Content

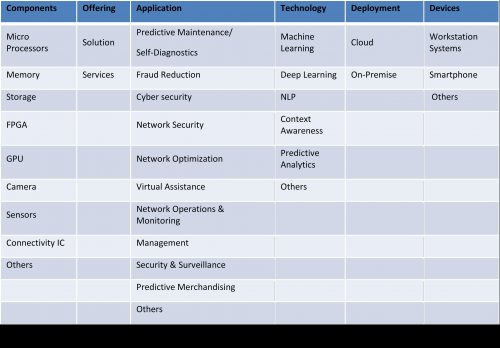

– Ecosystem Positioning: By Components, By Product, Parts & Devices, By Services & Solutions, By Technology, By Application and Other

– Trend Analysis

– Global Artificial Intelligence in BFSI Market Analysis

– Global Artificial Intelligence in BFSI Market Developments

– Global Artificial Intelligence in BFSI Market Sizing, Volume and ASP Analysis & Forecast

– Competitive Intelligence

Buy this Report with Special Feature following @ https://www.alltheresearch.com/buy-now/321

• Real-time Updation

• Ecosystem Mapping

• Trend Analysis – Impact + Importance + Outlook

• Allied Market Impact

• Do-IT-Yourself Analytics (DIYA)

• Interconnectivity Impact and more

Contact Info:

Name: Rohit

Email: Send Email

Organization: AllTheResearch

Address: 39180 Liberty Street Suite 110, Fremont, CA 94538, USA

Phone: 1-888-691-6870

Website: https://www.alltheresearch.com

Source: MarketersMedia

Release ID: 88941964