Cancer Insurance Market Overview by Coverage Types, Risk & Benefits, Service Providers, Distribution Channels, Business Opportunities & Forecast to 2025

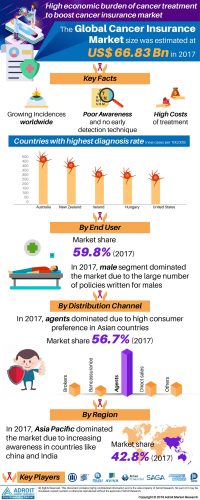

The global cancer insurance market to grow at 6.7% CAGR to reach USD 112.5 billion by 2025. The research report by Adroit Market Research provides extensive analysis on size, share, trend & forecast of cancer insurance market during 2019 to 2025.

Dallas, United States – April 29, 2019 /MarketersMedia/ —

Planning a treatment or health insurance for serious ailments is always a difficult task. But if there is a family history of any medical conditions like cancer, the risk is high and whether your basic insurance plan will cover it or not is also a concern. Cancer treatments can be extremely expensive and in such cases, cancer insurance policy will give peace of mind.

The study covers the global cancer insurance market value for a period ranging in between 2015 to 2025, where 2015 to 2017 imply the historical value with forecast between 2018 and 2025. The global cancer insurance market report also includes qualitative insights of the market such as pipeline analysis, porter’s five forces analysis, drivers and restraints.

Request Sample Pages for more Insights @ https://www.adroitmarketresearch.com/contacts/request-sample/829

The global cancer insurance market is estimated to account for over USD 112.5 billion revenue by 2025, driven by increasing incidences of cancer, growing healthcare awareness and increasing government initiatives is fuelling the growth of this market at a healthy growth rate. The fact, however is that chances of being detected with cancer has increased with the changing lifestyle patterns. Worse there are over 100 types of cancer and any person can fall victim to this deadly disease. According to British Journal of Cancer, the cancer diagnosis rate has increased tremendously over the years and the cancer risk to people born since 1960 stands greater than 50% now.

In the 21st century the probability of getting caner has increased substantially and the treatment cost has increased many fold. In fact the total cost of cancer treatment has a potential to burn the hard earned money and causes financial burden on the uninsured medium and low class society. As per the reports by ‘’The American Cancer Society’’, cancer is the leading cause of death with approximately 1.5 million fresh cancer cases detected in 2017 and over 15 million cancer patients are currently residing in U.S. The cancer has not only put a toll on the health of the patients but has contributed to a tremendous financial burden. In the year 2014, over 80 billion USD were spent on cancer related health care expenditures.

Get more Information about this Report @ https://www.adroitmarketresearch.com/industry-reports/cancer-insurance-market

Key segments of the global cancer insurance market

End User Type Overview, 2015 – 2025 (Revenue)

Male

Female

Distribution Channel Type Overview, 2015 – 2025 (Revenue)

Brokers

Bancassurance

Agents

Direct Sales

Others

For Any Query on the Cancer Insurance Market @ https://www.adroitmarketresearch.com/contacts/enquiry-before-buying/829

Cancer: A major national concern in America

Cancer is one of the most important health problem and the most costly illness in the United States. It is also regarded as having a heavy out-of-pocket health care costs which is often physically and emotionally difficult for those living with it. For people suffering with cancer, the yearly out of pocket expenditures is USD 1,061 which is approximately three times more as compared to people without it i.e. USD 375. These surplus expenditures particularly become burdensome for low income category which end up paying a higher amount for health care. Also the people having cancer and having annual income below USD 20,000.0 spend approximately 9% of their annual income on healthcare as compared to 1% expenditure by people having cancer and annual income of USD 55,000. With the rising number of cancer detection cases and burden of healthcare expenditure, cancer insurance can help to provide a financial cushion to help through the time of need and recovery.

The prominent players operating in the global cancer insurance market are Allianz SE, Munich Reinsurance America, Inc., American Express Company, Cancerex Insurance Services, Atlas Cancer Insurance Services Ltd., Aviva PLC, Saga PLC, Bajaj Finserv Limited, China Pacific Life Insurance Co., Ltd., AFLAC INCORPORATED, Munich Reinsurance Company, Ping An Insurance Company of China, Ltd.,

About us:

We are here to provide credible market intelligence with actionable insights. We believe that with the fast changing business environment and rapid turns in economic cycles, a lot is overlooked. With the aid of technology, a large amount of data is produced which is waiting to be analyzed and patterned. The insights which can be mined from such a large amount of data can enable businesses to grow at a pace of their choosing, be it long term goals or short-term goals. Being aware of the market movements allows for agility and agility is one of the highest rated characteristics of modern businesses.

Contact Info:

Name: Ryan Johnson

Email: Send Email

Organization: Adroit Market Research

Address: 3131 McKinney Ave Ste 600, Dallas, TX75204, U.S.A.

Phone: +1 (214) 884-6068

Website: https://adroitmarketresearch.com/industry-reports/cancer-insurance-market

Source: MarketersMedia

Release ID: 507323