Clinton or Trump, It’s Possible to Pay Zero Taxes in 2017

Economic issues, including taxes, are among top voter concerns during election years. With proven strategies to use existing IRS codes, it is possible to pay little to no taxes allowing working Americans to build retirement wealth more quickly with less risk than traditional retirement accounts.

Rancho Santa Fe, CA – August 18, 2016 /MM-LC/ —

The 2016 election year is proving to be one of the most interesting in recent memory. With all the focus on the personalities on both sides of the aisle, real issues – like the economy – are being pushed to the wayside. A Gallup poll conducted earlier this year notes that 40% of voters mention the economy first when asked about the issues most important to them and taxes are among voters’ top economic concerns.

While some economic factors are impossible to control, there is good news: whichever candidate wins, it may be possible upon retirement to legally pay no taxes using proven financial strategies which utilize the Internal Revenue Service’s own rules. What’s more, using these strategies to get into a legal zero tax environment can help working Americans to build wealth more quickly to fund early retirement sooner or other ventures that really matter to them. Rather than putting money into retirement accounts, which are subject to the fluctuations of the market and where withdrawals may also be subject to high tax penalties, making sound investments in other types of assets and using the IRS Tax code to reduce tax liability can make a substantial difference in the amount an individual is able to save.

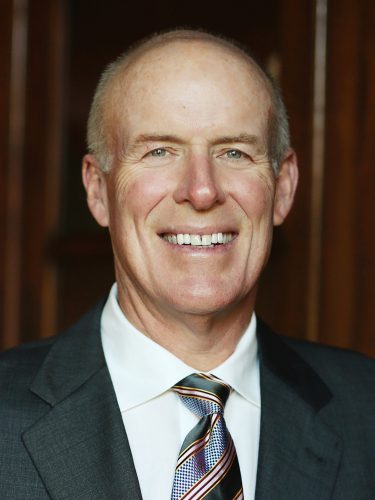

“Most people don’t know about these tax code sections, but they’ve been around for a very long time,” says Earl Eastman, owner of Confidence Financial Partners, a high-end tax planning and financial boutique based in Rancho Santa Fe, California. “These are not loopholes – the government incentivizes certain types of investments and the more money one puts into these areas, the lower their tax liability becomes. It is possible to get to a zero liability, which makes for building more wealth more quickly.”

Early retirement – or, for many, any retirement – is not an option for most Americans. As income stops and various deductions and tax credits disappear, retirees can often find themselves in a higher tax bracket than they were in before, much to their surprise. The tax structure of traditional IRA and 401K accounts that most working people are encouraged to open is complicated, and most earners don’t realize it is possible to lose up to 40% of their income in taxes upon withdrawal. This is not to mention the real risk of losing money in these accounts due to fluctuations in the stock market. While many get starry-eyed over promises of large returns, Eastman cautions that it is tax rates rather than rates of return that should be of primary concern.

“This is really the worst time to be taking risks with the stock market through traditional retirement accounts because it’s not a question of if the market will collapse again but when. The better thing is to invest in assets with principal guarantees, and to focus on after-tax income rather than trying to earn the highest before-tax rate of return. Eastman cautions, “It’s not how much a person makes that counts, but how much they get to keep that is most important. Saving a dollar in taxes now but paying $10 in taxes down the line – which is what happens with a lot of IRA and 401K plans – that’s not savings.”

In addition to saving money through lowered tax liability and investing in assets that won’t depreciate, dual-compounding – or making money work in two places at once – is another means to building wealth more quickly to prepare for a planned retirement. “People are living longer than ever before, if someone retires at 65, they may still have a third of their life ahead of them and it’s important to be financially equipped to go on this 30-year vacation,” Eastman advises. As well, there is always unexpected circumstance, like illness, that may cause a person to exit the workforce earlier than she or he had planned.

Eastman is no stranger to this circumstance as he was forced into early retirement a decade ago due to illness, but that was a blessing in disguise both for him and the clients he now serves as he got to put his financial planning ideas to the ultimate test with much success. “There is no gimmick,” he notes, “These are proven strategies and they can work for anyone.”

For more information, please visit http://www.confidencefp.com/

Contact Info:

Name: Earl Eastman

Email: earl@confidencefp.com

Organization: Confidence Financial Planners

Phone: 858-756-6115

Source: http://councilofeliteadvisors.com/liftmedia

Release ID: 128559