Credit Insurance Market is expected to grow at a CAGR of 2.0 % and will reach 8560 million USD in 2023

The Credit Insurance Market report offers majority of the latest and newest industry data that covers the overall market situation along with future Assessment.

Pune, India – February 25, 2019 /MarketersMedia/ —

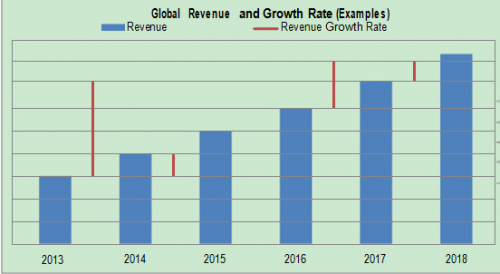

The Global Credit Insurance Market research 2018 highlights the major details and provides in-depth analysis of the market along with the future growth and prospects. The reports also offer important insights which help the industry experts, product managers, CEOs, and business executives to draft their policies on various parameters including expansion, acquisition, and new product launch as well as analyzing and understanding the market trends and demands with the help of 15 Chapters, complete report with 128 Pages, figures, graphs and table of contents to analyze the situations of global Credit Insurance market and Assessment to 2023. Credit Insurance market globally is witnessing good traction which is evident by the global Credit Insurance report. The report provides the customers a thorough coverage of the Credit Insurance industry performance over the last 5 years, and an accurate estimation of the market performance substantiated by the observed market trends over the years. Furthermore, the report covers accurate projection of the Credit Insurance Market for the forecast period of 2018-2023.

Trade credit insurance or credit insurance is an insurance policy and a risk management product offered by private insurance companies and governmental export credit agencies to business entities wishing to protect their accounts receivable from loss due to credit risks such as protracted default, insolvency or bankruptcy. Credit insurance product is a type of property and casualty insurance.

Get the Sample Copy of this Report @ http://www.market-research-reports.com/contacts/requestsample.php?name=972174

The Global Credit Insurance market is expected to witness expansion in the near future. The credit insurance market is a huge market with low penetration. This market has a huge yet unrealized potential. Regulatory and insolvency frameworks vary widely between different countries, and although there is generally an upward trend in corporate insolvencies, the differences in frameworks and in reporting standards make comparison difficult. These factors have contributed to an increased awareness of and focus on trade risks on credit.

Three major European groups – Euler Hermes, Atradius and Coface dominate the market internationally, with a combined market share in 2016 of over 72%.

Geographically, the global Credit Insurance has been segmented into Western Europe, Eastern Europe, North America, Latin America, Middle East & Africa and Asia-Pacific. The Europe held the largest share in the global Credit Insurance market, its revenue of global market exceeds 72% in 2016. The next position is America. China and India have being the most populous country has fast growing Credit Insurance market.

The global Credit Insurance market is valued at 7750 million USD in 2017 and is expected to reach 8560 million USD by the end of 2023, growing at a CAGR of 2.0% between 2017 and 2023.

The Asia-Pacific will occupy for more market share in following years, especially in China, also fast growing India and Southeast Asia regions.

North America, especially The United States, will still play an important role which cannot be ignored. Any changes from United States might affect the development trend of Credit Insurance.

Europe also play important roles in global market, with market size of xx million USD in 2017 and will be xx million USD in 2023, with a CAGR of xx%.

Market Segment by Manufacturers, this report covers:

– Euler Hermes

– Atradius

– Coface

– Zurich

– Credendo Group

– QBE Insurance

– Cesce and more

Inquire for this Report @ http://www.market-research-reports.com/contacts/inquiry.php?name=972174

The Credit Insurance industry report has an in-depth coverage of the market along with multiple segmentations of the Credit Insurance such as by type, application, and region among others.

Market Segment by Regions, regional analysis covers: North America (USA, Canada and Mexico), Europe (Germany, France, UK, Russia and Italy), Asia-Pacific (China, Japan, Korea, India and Southeast Asia), South America (Brazil, Argentina, Columbia, etc.), Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa).

The report further covers the detailed analysis substantiated with suitable statistics of the factors, opportunities, challenges, and prospects for the players in the Credit Insurance. Moreover, the report covers all the top players in the Credit Insurance which is inclusive of a detailed company profile, the products on offer, and revenue and market share of each player.

Market Segment by Type, covers:

– Type I

– Type II

Market Segment by Applications, can be divided into:

– Domestic Trade

– Export Trade

Get a Complete Copy of this Report @ http://www.market-research-reports.com/contacts/purchase.php?name=972174

There are 15 Chapters to deeply display the Global Credit Insurance market.

Chapter 1: to describe Credit Insurance Introduction, product scope, market overview, market opportunities, market risk, market driving force, Chapter 2: to analyze the top manufacturers of Credit Insurance, with sales, revenue, and price of Credit Insurance, in 2016 and 2018

Chapter 3: to display the competitive situation among the top manufacturers, with sales, revenue and market share in 2016 and 2018, Chapter 4: to show the global market by regions, with sales, revenue and market share of Credit Insurance, for each region, from 2012 to 2018

Chapter 5, 6, 7, 8 and 9: to analyze the key regions, with sales, revenue and market share by key countries in these regions; Chapter 10 and 11: to show the market by type and application, with sales market share and growth rate by type, application, from 2012 to 2018

Chapter 12: Credit Insurance market forecast, by regions, type and application, with sales and revenue, from 2018 to 2023, Chapter 13, 14 and 15: to describe Credit Insurance sales channel, distributors, traders, dealers, Research Findings and Conclusion, appendix and data source.

List of Tables:

Market Overview

Manufacturers Profiles

Global Credit Insurance Sales, Revenue, Market Share and Competition by Manufacturer (2016-2018)

Global Credit Insurance Market Analysis by Regions

North America Credit Insurance by Countries

Europe Credit Insurance by Countries

Asia-Pacific Credit Insurance by Countries and more……….

Contact Info:

Name: Hirisikesh Pathwardhan

Email: Send Email

Organization: ReportsandReports

Address: E-mail: sales@reportsandreports.com, Phone: +1 888 391 5441

Phone: 8883915441

Website: http://www.reportsnreports.com/

Source: MarketersMedia

Release ID: 485770