Digital Banking Market 2019 Share by Key Players, Global Industry Size, Growth Forecast 2024, Business Prospects, Regional Statistics, and Forthcoming Investments

[240 pages digital banking market report] analysis 2024 by Banking Type (Retail, Corporate, Investment), Services (Transactional, Non-Transactional) profiling 23 companies, offers 295 data tables and 37 figures with coverage of 20+ countries.

Selbyville, Delaware , USA – April 29, 2019 /MarketersMedia/ —

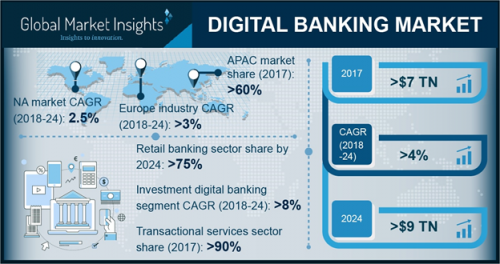

Retail banking holds over 75% share in the digital banking market. The market is driven by the rising adoption of the internet and smartphones across the countries. As the adoption of the internet services and smartphones is increasing, and the information is easily available to customers, the buying of consumers is increasing. This is forcing banking institutes to provide a better customer experience and reach customers on their choice of the channel. Moreover, the increasing adoption of mobile and electronic payment solutions and the attractive offers and incentives offered by the payment solution providers are also the major forces accelerating the adoption of digital banking.

The corporate digital banking market is anticipated to grow at a CAGR of over 6% over the timeline. The increasing competition among Fintech players is the primary factor driving the adoption of digital banking in the corporate banking sector. Moreover, the integration of advanced analytics technologies such as Big Data to manage the assets, will reduce the risks and extract consumer insights, encouraging the adoption of digital solutions.

Request for a sample of this research report @ https://www.gminsights.com/request-sample/detail/2651

Transactional services account for more than 90% share in the digital banking market. The market growth is credited to the growing adoption of electronic & mobile payment solutions. As the younger population across the countries is increasing, the demand for faster, convenient, and safer payment solutions is also rising. This is encouraging banking institutes to develop their own mobile & online platforms and provide services on the digital channel to gain customer loyalty and reduce the churn rate.

Non-transaction services in the digital banking market are anticipated to grow at a CAGR of 14% during the projected timeline. The increasing need to provide enhanced customer experience is driving the adoption of non-transaction digital services among the banking institutes. The digital disruption and generational shift cause fundamental changes in customer behavior that are rapidly influencing customer expectations from banks. Over a third of the millennials (population aged between 16 to 34) believe they will be able to live a bank-free existence in the future. Customers, especially the younger population who are digitally savvy, hyper-connected, and choice conscious have an inclination toward tech-oriented services as their preferences are changing. These customers are accustomed to digital experiences offered by online retailers and expect the same or perhaps a richer experience from the banks.

Make an Inquiry for purchasing this report @ https://www.gminsights.com/inquiry-before-buying/2651

Asia Pacific is dominating the digital banking market with over 60% stake in 2017. The growing penetration of internet services and the adoption of smartphones are supporting market growth. Moreover, the digitalization initiatives launched by the government of emerging economies including India and China will also foster the demand for digital banking.

The North American digital banking market is anticipated to grow at a CAGR of 2.5% during the forecast period. The market is driven by the early adoption of digital solutions among the banking institutes. The high penetration of internet and smartphone users is also augmenting the demand for digital banking solutions. Large volumes of credit card and debit card transactions in the region also promote the market.

The key vendors operating in the digital banking market are Backbase, BNY Mellon, Appway Crealogix, EdgeVerve Systems, ebanklT ETRONIKA, Finastra, Fiserv, Fidor, IE Digital, Halcom Intellect Design Arena, NETinfo, NF Innova, Kony, SAB, SAP, Oracle, Sopra, TCS, Technisys, Tagit, Worldline, and Temenos.

Browse key industry insights spread across 240 pages with 295 market data tables & 37 figures & charts from the report, “Digital Banking Market Size By Type (Retail Banking, Corporate Banking, Investment Banking), By Services (Transactional, Non-Transactional), Regional Outlook (U.S., Canada, UK, Germany, France, Italy, Spain, Netherlands, Russia, Australia, China, India, Japan, South Korea, Singapore, Brazil, Mexico, Argentina, UAE, Saudi Arabia, South Africa), Growth Potential, Competitive Market Share & Forecast, 2018 – 2024” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/digital-banking-market

Table of Contents (ToC) of the report:

Chapter 4. Digital Banking Market – Competitive Landscape, 2017

4.1. Introduction

4.2. Top market players, 2017

4.2.1. Fiserv

4.2.2. Infosys

4.2.3. Oracle

4.2.4. SAP

4.2.5. Temenos

4.3. Innovation leaders, 2017

4.3.1. Holcom.com

4.3.2. Fidor Solutions

4.3.3. NF Innova

4.3.4. ETRONIKA

4.3.5. Kony

4.4. Other prominent vendors

Browse Full Table of Contents (ToC) @ https://www.gminsights.com/toc/detail/digital-banking-market

About Global Market Insights

Global Market Insights, Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider; offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy and biotechnology.

Contact Info:

Name: Arun Hegde

Organization: Global Market Insights, Inc.

Address: 4 North Main Street Selbyville, Delaware 19975 USA

Phone: 1-888-689-0688

Website: https://www.gminsights.com/pressrelease/digital-banking-market

Source: MarketersMedia

Release ID: 507412