Enerjex Resources Announces Fourth Quarter and Year End Results Including a $5 Million Gain on Oil Hedges

SAN ANTONIO, TX / ACCESSWIRE / April 1, 2015 / EnerJex Resources, Inc. (“EnerJex” or the “Company”) (NYSE MKT: ENRJ) (NYSE MKT:ENRJ.PR), an independent exploration and production company focused on the acquisition and development of oil and natural gas properties located in the Rocky Mountain and Mid-Continent regions of the United States, announced today that it has filed its SEC Form 10-K detailing the Company’s results of operations for 2014.

Financial and Operational Highlights:

Full-Year:

– Completed the listing of EnerJex’s common and Series A preferred stock on the NYSE MKT exchange, improving its ability to access capital and broadening its exposure to both institutional and retail investors.

– Record production of 211,405 barrels of oil equivalent (74% oil), a 75% increase compared to the prior year.

– Record revenue of $14.3 million, a 31% increase compared to the prior year.

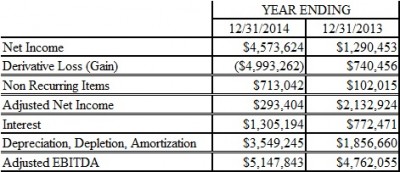

– Record Net Income of $4.6 million, a 254% increase compared to the prior year. Adjusted to exclude the effect of oil hedges and non-recurring items (“Adjusted Net Income”), net income was $0.3 million compared to $2.1 million in the prior year.

– Record EBITDA of $9.4 million, a 141% increase compared to the prior year. Adjusted to exclude the effect of oil hedges and non-recurring items (“Adjusted EBITDA”), EBITDA was $5.1 million compared to $4.8 million in the prior year.

– Drilled 52 new wells with a 98% success rate and recompleted 19 wells with a 100% success rate.

– Reduced long-term debt by $8.5 million or 27% compared to the prior year.

Fourth Quarter:

– Announced the acquisition of 4,040 gross (3,945 net) operated acres in Weld County, Colorado, with potential for more than 100 horizontal drilling locations targeting oil production from the Codell and Niobrara formations (see map: http://www.enerjex.com/img/WeldCountyMap.jpg).

– Reported a gain of approximately $5 million in the value of EnerJex’s oil hedges.

– Production of 44,307 net barrels of oil equivalent (76% oil), a 16% increase compared to the prior year.

– Revenue of $2.7 million, excluding the positive impact of oil hedges, a 28% decrease compared to the prior year.

– Net income of $3.7 million, a 214% increase compared to the prior year. Adjusted to exclude the effect of oil hedges and non-recurring items (“Adjusted Net Income”), net income was a loss of $1.2 million compared to positive net income of $0.4 million in the prior year.

– Earnings before interest, income tax, depreciation and amortization (“EBITDA”) of $5.0 million, a 145% increase compared to the prior year. Adjusted to exclude the effect of oil hedges and non-recurring items (“Adjusted EBITDA”), EBITDA was $0.2 million compared to $1.3 million in the prior year.

Reserve Report Highlights:

– Total proved reserves of 3.0 million barrels of oil (Mmbl) and 8.2 billion cubic feet of natural gas (Bcf).

– Total proved PV-10 value (present value of future net cash flow discounted at 10% per annum) of $64.3 million, of which proved develop producing reserves accounted for 66%, proved developed non-producing reserves accounted for 15%, and proved undeveloped reserves accounted for 19%.

– Total proved, probable, and possible (3P) reserves of 4.9 Mmbl and 64.2 Bcf.

– Total 3P PV-10 value of $149.1 million, of which proved reserves accounted for 43%, probable reserves accounted for 15%, and possible reserves accounted for 42%.

– EnerJex’s 2014 3P reserve estimates were calculated pursuant to SEC guidelines and are based on an average net price of $84.27 per barrel of oil and $4.20 per thousand cubic feet of natural gas.

– The Company’s 2014 reserve report does not attribute any reserves to dozens of potential vertical drilling locations identified within its Mississipian Project in Kansas and more than 100 potential horizontal drilling locations identified within its acreage position in Weld County, Colorado.

Strategic Update

EnerJex’s Board of Directors continues to evaluate a number of strategic initiatives, including but not limited to potential asset acquisitions, mergers, and sales of non-core assets. In addition, EnerJex holds a minority interest in a corporation that is expected to close on a sale of its principal asset this month, which is expected to generate approximately $1.5 million to EnerJex during 2015.

Management Comments

EnerJex’s CEO, Robert Watson, Jr., commented, “EnerJex’s hedging strategy paid off during the fourth quarter and will provide important support for our operations through mid-2016. The Company has hedged 320 barrels of oil per day for 2015 (75% of fourth quarter volumes) at an average price of $85.9 per barrel, and 300 barrels of oil per day for the first half of 2016 at an average price of $85.0 per barrel. EnerJex’s strategy of building a platform of long-lived assets is also paying off, as many of our competitors face sharp production decline rates associated with horizontal shale wells that are no longer economically viable to drill. In addition, EnerJex’s recently completed equity financing for gross proceeds of $3.1 million will provide important support for our balance sheet as we continue to weather the low commodity price environment and pursue strategic initiatives.”

Commenting further, Mr. Watson stated, “Our management team has more than 100 years of combined experience in the oil and gas industry and has navigated numerous downturns in the past. Based on this experience, we are confident that companies with quality assets and carefully executed strategies are the ones that will emerge successfully when this cycle reverses.”

In conclusion, Mr. Watson stated, “I am proud of our team’s efforts during the past six months, as we have successfully reduced EnerJex’s operating expenses and improved its balance sheet in order to best position the Company to take advantage of the current down-cycle and emerge stronger when oil prices recover. We continue to see strong permitting and drilling activity in Weld County on trend with the company’s recently acquired acreage, and we remain focused on strategic initiatives to create value for our shareholders and take advantage of opportunities as they present themselves.”

GAAP Reconciliation

In addition to revenue and net income determined in accordance with GAAP, we have provided a reconciliation of our EBITDA, Adjusted EBITDA, and Adjusted Net Income in this release. These are non-GAAP financial measures that we use as supplemental measures of our performance. These non-GAAP financial measures are not measurements of our financial performance under GAAP and should be considered as alternatives to revenue, net income, operating income or any other performance measure derived in accordance with GAAP. It should not be assumed that these non-GAAP financial measures are comparable to similarly named figures disclosed by other companies. We define EBITDA, Adjusted EBITDA, and Adjusted Net Income as net income attributed to EnerJex before the effects of the items listed in the tables below.

About EnerJex Resources, Inc.

EnerJex Resources, Inc. (NYSE MKT:ENRJ) (NYSE MKT:ENRJ.PR) is an independent exploration and production company focused on the acquisition and development of oil and natural gas properties located in the Rocky Mountain and Mid-Continent regions of the United States. The Company owns oil and gas leases covering nearly 100,000 acres in multiple prolific hydrocarbon basins located in Colorado, Kansas, Nebraska, and Texas.

EnerJex’s producing assets are characterized by long-lived reserves with low production decline rates, and the Company has identified more than 500 drilling locations within its existing properties. Through its large acreage footprint in the Denver-Julesburg (“DJ”) Basin, EnerJex also has exposure to emerging oil resource plays including the horizontal Niobrara and Codell plays in Weld County, Colorado. The Company’s management team has more than 100 years of combined experience in the oil and gas exploration and production industry, including geology, engineering, operations, and finance. EnerJex’s headquarters are located in San Antonio, Texas, and additional information is available on its website at www.enerjex.com.

Information on Reserves and PV-10 Value

EnerJex’s reserve reports for the years ended December 31, 2014 and 2013 were prepared by MHA Petroleum Consultants, Inc. Future cash inflows relating to the Company’s reserves were computed for the years ended December 31, 2014 and 2013 using the twelve month average price for oil and natural gas (the “benchmark prices”) adjusted for sales contracts and price differentials. Benchmark prices are held constant in accordance with SEC guidelines for the life of the wells. PV-10 value is a non-GAAP measure and is different than the Standardized Measure of Discounted Future Net Cash Flows (“Standardized Measure”), which measure will be presented in EnerJex’s upcoming Form 10-K, in that PV-10 value is a pre-tax number, while the Standardized Measure includes the effect of estimated future income taxes.

The Company’s 100% working interest in its Adena Field Project is subject to a 30% reversionary working interest that will be assigned to an unrelated third party, subject to the terms and conditions of such agreement, after payout of all acquisition, operating, development, and financing costs including interest. The payout balance associated with this reversionary interest was estimated to be approximately $30 million as of December 31, 2014. The impact of this reversionary interest was not included in EnerJex’s year end 2014 proved reserve estimates because the timing associated with the reversion is expected to occur more than ten years from the date of this report and the PV-10 value associated with such interest is minimal. The reversionary interest was not evaluated in the Company’s probable and possible reserve estimates. EnerJex’s Adena Field Project accounted for approximately 38% of the PV-10 value associated with its proved reserves and 34% of the PV-10 value associated with its 3P reserves in its year end 2014 reserve report.

EnerJex’s estimate of proved, probable and possible reserves is provided in this release because management believes it is useful information that is widely used by the investment community in the valuation, comparison and analysis of companies. However, the SEC prohibits companies from aggregating proved, probable and possible reserves in filings with the SEC due to the different levels of certainty associated with each reserve category.

Forward-Looking Statements

This press release and the materials referenced herein include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements give EnerJex’s current expectations or forecasts of future events. The statements in this press release regarding the completion of drilling for and commencement of operations at new wells, successful production at newly drilled wells, expected increases in overall production, the acquisition of operating assets and related agreements, any implied or perceived benefits from any current or future transaction, and any other effects resulting from any of those matters, are forward-looking statements. Such statements involve material risks and uncertainties, including but not limited to: whether newly drilled or newly acquired properties will produce at levels consistent with management’s expectations; market conditions; whether we will experience equipment failures and, if they materialize, whether we will be able to fund repair work without materially impairing planned production levels or the availability of capital for further production increases; the ability of EnerJex to meet its loan covenants under the debt facility that is expected to fund the costs of the new wells and to obtain financing from other sources for continued drilling; the costs of operations; delays, and any other difficulties related to producing oil; the ability of EnerJex to integrate the newly producing assets; the ability to retain necessary skilled workers to operate the new producing wells; the price of oil; EnerJex’s ability to market and sell produced minerals; the risks and effects of legal and administrative proceedings and governmental regulation; future financial and operational results; competition; general economic conditions; the ability to manage and continue growth; and the ability of management to successfully integrate Black Raven. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those indicated. Important factors that could cause actual results to differ materially from the forward-looking statements are set forth in our Form 10-K filed with the SEC. EnerJex undertakes no obligation to revise or update such statements to reflect current events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. EnerJex’s production forecasts are dependent upon many assumptions, including estimates of production decline rates from existing wells and the outcome of future drilling activity. Although EnerJex believes the expectations and forecasts reflected in these and other forward-looking statements are reasonable, it can give no assurance they will prove to have been correct. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties.

CONTACT:

EnerJex Resources, Inc.

Robert Watson, Jr., CEO

Phone: (210) 451-5545

SOURCE: EnerJex Resources, Inc.

ReleaseID: 427405