Feeder Finance Vault of Vaults Launched

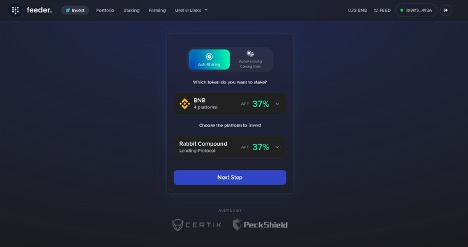

Feeder Finance has released its first set of vaults, the Rabbit Compound, DOP 2Pool Compound, and AutoFarm Compound, as part of the launch of its innovative DeFi Yield Aggregator platform that enables a simplified investment experience for DeFi users into the ecosystem.

July 17, 2021 /MarketersMedia/ —

Feeder Finance has led the charge as a top DeFi aggregator (“Feed”) for diversified yield generation on Binance Smart Chain. Among its other products, the much-awaited Auto Diversify vault aims to allow investors to feed capital into lending platforms, liquidity pools, vaults, and other DeFi products in a simple, automated, and diversified process.

“Maintaining a diversified portfolio, not to mention keeping up with the changes in yields and products, requires a substantial amount of time and effort, something some investors enjoy, while others look for ways to automate the process. That is where Feeder Finance’s Auto Diversify vault comes in,” a representative of the company said in a statement.

Prudent investors look for ways to effectively manage their portfolio while earning yields through DeFi. Feeder Finance stressed that many of the investors currently navigating through multiple different protocols would find that Feeder Finance adds simplicity by allowing a portfolio to be managed from one place. On top of that, its Vault of Vaults products would simplify that down to the product level.

As DeFi evolves, more and more unique yield-generating products are seen to emerge. Feeder Finance, however, said two primary yield generating products stand out: Liquidity Pools/Farms and Vaults/Lending.

“Acting a lot like a real-world feeder fund, we call this vault “Auto Diversify,” capital is invested by the investor through an intermediary, in this case, Feeder Finance, to automate yields generation efficiently,” the representative explained.

Feeder Finance provides a platform for diversification and automation, enabling easy allocation of capital into desired end-products.

On the primary level, Cryptocurrency Vaults are capital pools that automatically generate yield based on opportunities in the market.

“Dozens of those Vaults exist on BSC today, and more are certainly on their way. While each Vault performs based on its underlying algorithms and formulas, Auto Diversify is indifferent to that. Instead, it focuses on what the market thinks, in aggregate, is the right allocation and optimizes as such,” the representative said.

Feeder Finance is making headway in providing a comprehensive strategy for any investor to make investing safer, easier, and comfortable. The company is led by an experienced full-stack developer, a successful online marketing professional, and a former investment banker.

The team said the inspiration for the launch of Feeder Finance came down to a quest to find ways to automate investing in DeFi and failing.

Through shared interests in cryptocurrency and investments, the team came together to collaborate on Feeder Finance, a project they felt was necessary and lacking in the space.

Feeder Finance aims to make DeFi accessible, understandable, and fun.

“Experience peace of mind while we automatically slice one deposit into smaller pieces to invest across all targeted investment strategies, from vaults, liquidity pools,” the representative said.

As participants of various cryptocurrency communities, the team said it recognizes communities’ importance for long-term success, and ultimately Feeder Finance will be governed by FEED holders. The group said the goal is to launch core products and hand the governance over.

Contact Info:

Name: Patrick

Email: Send Email

Organization: Feeder Finance

Address: United States

Website: https://feeder.finance

Source URL: https://marketersmedia.com/feeder-finance-vault-of-vaults-launched/89036895

Source: MarketersMedia

Release ID: 89036895