HMS – A Blockchain-based Mutual Support Community Building Their Own Support Contracts

Hi Mutual Society (HMS) is a blockchain based start-up tackling the problems we see today in society with insurance. Blockchain with insurance is an important direction of concern to the financial industry, but unfortunately has no particularly successful application scenarios so far.

Cayman Islands – March 15, 2018 /MarketersMedia/ —

HMS believes that similar mutual support with insurance is a more marketable landing scenario. The nature of insurance is security, and security often spreads risks through mutual support. Blockchain smart contracts and centralized technology can improve the operational efficiency and credibility in the field.

Arthur, Head of Product Operations, stated:

“HMS (Hi Mutual Society) hopes to build a global mutual support community on the blockchain. First of all, starting with To Clients business, HMS will launch different mutual support plans based on different scenarios, such as mutual plan with sickness, mutual plan in bad weather, and mutual plan in disasters. These mutual support plans are similar to standard insurance policies, except that they are not “rigidly redeemed”.

The HMS Ethos

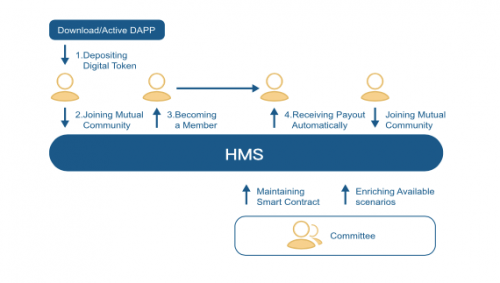

In order to realize the operation of the platform, HMS plans to create Hi Mutual Certificate (HMC) as the basis for membership benefits and participation in mutual support plans. A user needs to lock a certain number of HMCs before joining a specific mutual support plan.

Users who join the mutual support plan receive equal shares from other users if the condition is triggered. Those who already joined mutual plan, if their HMC balance is lower than the minimum requirement for a single payout, they will temporarily lose membership. Client-end users will have accesses to the platform through the DAPP.

The platform will enable services such as joining mutual plan, managing account, uploading required materials, and participating the operation of community.

In Terms of Business

HMS plans to establish a mutual support ecology and application platform, this allows third parties to create their own mutual support contracts in the contract ecosystem. Once the development of DAPP is completed, HMS will open access to its source code and provide unified user system, IM, Token account and other modules on the platform. Third-party organizations only need to edit smart contracts on the platform according to the underlying logic.

Arthur believes that blockchain-based HMS platform offers the following advantages over traditional insurance or centralized platforms:

HMS will improve the credibility of the platform. Based on the smart contracts on the blockchain, the number of users, operational logic and trigger conditions for mutual support plans are all open and transparent and cannot be modified. The original user’s trust in mutual support plans is based on the credibility of the platform. In any normal circumstance if the platform has its data breached, such as the number of users and the total amount of money, then users’ interests will suffer. Blockchain will completely avoid any kind of similar moral hazard.

HMS will reduce operating costs. Blockchain smart contracts will be able to eliminate unnecessary labor costs, automate the process of joining, paying, clearing and other processes to shorten the payout cycle and improve operational efficiency.

Elaborating on the point that if the whole payment process is based on a smart contract, the claims settlement will be avoided under the ideal condition, the claims settlement cycle will also be shortened. Insurance product user experience is often affected by claims disputes, insults grievances that the user does not report the contents of the contract or belong to the scope of liability exemption.

The industry believes that this is mainly due to asymmetric and opaque information between the two sides, of which the investigation and forensics will take a lot of time and effort to improve the operating costs of insurance companies, resulting in claims not being processed on time, which greatly reduces the user experience. Under the application of blockchain technology, user information will be protected and stored in the most fairly manner, which improves the accuracy and the efficiency of information exchange between the two parties in the insurance.

However, in reality, the problem with insurance or mutual support industries is that it is difficult to be completely “online” because, in addition to a full line of insurance such as flight delays and shipping costs, the data required for the extensive claims for health insurance are not digitized or shared.

HMS endures user privacy and confidentiality. Before the blockchain, the centralized companies had mastered a large number of sensitive customer information in the process of underwriting and claims, the latter stored in a centralized server, which has the risk of leakage and being attacked. Blockchain can solve those problems. HMS encrypts users’ personal data in the blockchain and uses private key to authorize the smart contract.

For the Globalization of Users

The platform form is conducive to the diversification of mutual support products and the globalization of users. HMS introduced a platform that allows third parties to set up their own mutual support plans, which Arthur sees as more possibilities, expanding the market for the platform, not only for insurance and mutual support but also for new users introduced through experience optimization.

“In the past two years, the number of domestic mutual support plans has grown to about 50 million, of which only some are original insurance users and more are new users brought by institutional optimization. The obvious trend is that Token can break through the regional boundaries of insurance, so I think there is a huge potential user base for mutual support markets. “

There are two main platform profit models, one is to charge a certain percentage of the fees generated from the mutual support plan, and the other is to charge the third party mutual support developer the initial Fee and Gas.

HMS plans to release the platform-level community products and DAPP around March 9th, 2018

The HMS team has about 15 people, mainly product, operation, and technology. The core team mainly comes from the financial technology company QFund, and the payment company Circle.

The Qfund team is responsible for the development, and global operations as early core member in the management committee. Arthur has 10 years of product experience and have worked for Circle.

Media Contact

Name: Ankur Teen

Location: Cayman Islands

Email: business@hms.io

Visit the Website: https://hms.io

Read the Whitepaper: https://hms.io/Whitepaper_20180111.pdf

Follow on Twitter: https://twitter.com/HMSCommunity?lang=en

Join on Facebook: https://www.facebook.com/HMStoken/

Chat on Telegram: https://t.me/enhmsglobal

HI Mutual Society is the source of this content. Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. This press release is for informational purposes only. The information does not constitute investment advice or an offer to invest

Contact Info:

Name: Ankur Teen

Email: business@hms.io

Organization: Hi Mutual Society

For more information, please visit https://hms.io/

Source: MarketersMedia

Release ID: 314250