Kalimantan Gold Fiscal 2014 Results

Kalimantan Gold’s Shareholder Meeting Results and Annual Results

VANCOUVER, BC / ACCESSWIRE / May 1, 2015 / Kalimantan Gold Corporation Limited (TSX VENTURE: KLG) (“KLG” or the “Company”) is pleased to announce that its shareholders voted in favour of all resolutions brought before them at the Company’s Annual General and Special Meeting of Shareholders held April 30, 2015 (the “AGM”) in Vancouver.

Existing KLG directors Peter Pollard, Tony Manini, Faldi Ismail, Stephen Hughes and Raynard von Hahn were elected as directors of the Company. The size of the board has been increased to six with one casual vacancy to be filled by the Board of Directors when it determines appropriate.

Also at the AGM, Ernst & Young LLP were appointed as the Company’s auditors for the 2015 fiscal year, the stock option plan was renewed and the authorized share capital was increased to US$8,000,000 divided into 800,000,000 common shares of US$0.01 par value each. Finally, the Shareholders authorized the Board of Directors to change to the Company’s name to Asiamet Resources Limited, which is subject to the approval of the TSX Venture Exchange.

Kalimantan Gold Annual Results

Attached are the audited Consolidated Statements of Financial Position, Consolidated Statements of Comprehensive Loss, Consolidated Statements of Cash Flows, Consolidated Statements of Changes in Equity (the “Financial Statements”) of Kalimantan Gold Corporation Limited (the “Company” or “KLG”) for the fiscal year ended December 31, 2014. The Financial Statements and Management Discussion & Analysis (“MD&A”) are available for viewing on www.sedar.com or www.kalimantan.com.

PT Kalimantan Surya Kencana (“KSK”) Contract of Work (“CoW”)

The holder of the KSK CoW is PT Kalimantan Surya Kencana (“KSK”). KSK is owned 75% by Indokal and 25% by PT Pancaran Cahaya Kahayan (“PCK”). Kalimantan Gold holds 100% of the shares of Indokal Limited (“Indokal”) and Indokal owns 100% of PCK.

The KSK CoW was granted to KSK on April 28, 1997 by the Republic of Indonesia under the 6th generation of CoW’s issued.The terms of the KSK CoW defines several periods under which certain types of work on the KSK CoW is to be undertaken. The KSK CoW is now confirmed as commencing the 5th year of the Exploration Period from the date the extension of the forestry permit has been issued, which is expected shortly. The Company under Article 23 of the KSK CoW has the right to request further extensions of the exploration period. The period following Exploration is the Feasibility Study Period which runs for not less than two years, is extendable, and provides time to complete studies and identify the area for mining.

A portion of the KSK CoW is within Hutan Lindung or protected / reserved forest area. The KSK CoW was granted prior to the enactment of the 1999 Government of Indonesia Law No. 41 on Forestry which prohibits open pit mining in Hutan Lindung areas. A subsequent Presidential Decree has confirmed that when the Company’s property meets the necessary criteria it may apply for a permit to exploit that portion of the properties within the KSK CoW that fall within the Hutan Lindung, either by underground mining or by applying to change the forestry permit. On March 12, 2012 (as amended April 8, 2013), KSK received a 2-year forestry permit granting permission to explore certain areas of the KSK COW. On December 2, 2013, the Company applied for a 2-year renewal of the forestry permit for a total area of 7,688ha of which 170.25ha falls within the Hutan Lindung. This 7,688ha area covers all of the main prospect areas within the KSK CoW. This renewal has been processed and is expected to be issued shortly.

The Beruang Kanan Copper Project (BK) is situated within the eastern part of the KSK CoW area, in Gunung Mas Regency. The project is accessible by sealed and unsealed road, from Palangkaraya the capital city of Central Kalimantan. The forestry status of the BK is production forest, and a forestry permit is required to conduct exploration activities.

BK comprises four prospects, namely Beruang Kanan Main (BKM), Beruang Kanan South (BKS), Beruang Kanan West (BKW) and Beruang Kanan Polymetallic Zone (BKZ). The most advanced project is BKM. The Company recently announced an independently estimated maiden Mineral Resource for BKM as: an Inferred Resource of 47 million tonnes averaging 0.6% Cu or 621,700,000 pounds of copper.

A technical report in accordance with NI 43-101 in respect of the Mineral Resource estimate discussed in this report is titled “Beruang Kanan Main Zone, Kalimantan Indonesia: 2014 Resource Estimate Report” dated effective September 2014, written by Duncan Hackman, B. App. Sc., MSc. MAIG of Hackman and Associates Pty. Ltd, and is filed on SEDAR.

Historical exploration activities were predominantly centered on the BKM prospect, where strong copper in soil and stream sediment samples was identified.

Systematic exploration activities undertaken throughout the project area include:

– Extensive drilling (approximately 26,100 metres);

– Geochemical sampling (rock chips and channels, grid and ridge and spur soils, stream sediments);

– Geophysics (IP/resistivity and magnetic surveys); and

– Extensive geological mapping.

In 2014 the Company announced a Maiden Resource for its flagship BK Copper Project, The Mineral Resource estimate is only for the Main Zone (BKM), a portion of the Beruang Kanan mineralized area and is based on assays from 74 diamond drill core holes that were drilled from 1998 to 2007 and then from 2012 to 2013. The Mineral Resource is contained within a near-surface, shallow-dipping and strongly mineralized system, that extends over an area of 1000m (N-S) and 950m (E-W) with depth extents ranging from surface to between 100m and 350m below surface (top to bottom). The mineralization remains open in several directions.

A review of mapping data, drill core logs and photos, and surface geochemical data has provided additional insight into the geologic setting and mineralization style at BKM. These data indicate BKM is a volcanoclastic hosted hydrothermal deposit (possibly affected by low grade metamorphism) and located within and adjacent to an interpreted thrust fault-coupling or ramping zone. At least four different breccias are recognized in drill core, including tectonic breccia (referred to as Wispy Breccia), andesitic volcanic breccia, polymict hydrothermal breccia and an intrusion breccia. Late stage diorite dykes have been observed in drill core, but appear to be post mineral and unrelated to the copper mineralization. Deep drilling intersected ia large diorite porphyry at depth, but it is not mineralized.

Mineralization is typically confined to breccia zones, in sulphide veins, in milky white quartz veins, as prominent coarse masses and clots filling open spaces, and on fracture faces. Copper mineralization includes chalcocite, covellite, and digenite with lesser chalcopyrite and bornite at depth. The deposit shows a vertical zonation of copper minerals, accordingly from top to bottom: pyrite→chalcocite+-digenite, pyrite→chalcocite-covellite+-digenite, pyrite→ covellite and a deeper zone of pyrite→chalcopyrite+-bornite. It is unclear if the copper species identified to date are of hypogene or supergene origin, but most likely the latter.

In the field, there are 10’s of outcrops of erosional resistant quartz veins that resemble “silica ledges”, but do not appear to be of the high sulphidation style. The ledges are 2-15m in width and can protrude out of the ground up to 15-20m in height; they are impressive to observe in their sheer size, height and density throughout the project area.

An infill and expansion drilling program was designed to expand the recently released BKM copper Resource as defined in the NI 43-101 Technical Report prepared by Hackman & Associates Pty Ltd. A total 80 holes are planned for 6500m, drilling at 50m intervals along 100m spaced section lines. Sighter metallurgical testwork is planned early in program to establish material types/copper species and test recoverability i.e. leaching and/or flotation.

Desktop technical reviews were conducted on other priority targets within the BK project, namely BKS, BKW and BKZ prospect areas; each within 1.5km of the BKM inferred resource. Soil and rock geochemistry, drilling and field mapping data indicate the presence of near surface copper mineralization similar in style to that occuring at BKM. The prospects are summarized as follows:

– BKS prospect : Drill hole KBK-28 intersected 10.5m @ 0.88% Cu from 14.5 meters depth and rock chips assayed up to 17.6% Cu. Drill hole KBK-28 also intersected high grade gold mineralization from 11.5m, returning 3m @ 11.52g/t Au, (including 1.5m @ 21.7g/t Au). The copper in soil anomaly at BKS measures 800m by 900m and is open to the south.

– BKW prospect: A coincident copper in rock chip and soil anomaly measuring 1700m by 1000m, with rock chips returning up to 0.80% Cu. Road mapping identified covellite in strongly clay altered breccia within the soil anomaly. Only one drillhole (KBK027) tested the edge of the copper anomaly and intersected elevated copper (4m @ 0.14% Cu) and arsenic (up to 207ppm As), the same geochemical signature as BKM.

– BKZ Polymetallic prospect: Drill hole BKZ-1 testing outcropping massive sulphide style mineralization intersected 16m @ 5.75% Zn, 2.78% Pb, 0.64g/t Au, 57.5g/t Ag and 0.16% Cu (including 6m @ 11.63% Zn, 5.99% Pb, 0.71g/t Au, 98g/t Ag and 0.32% Cu). A grid-based soil sampling program over the area defined a 400m by 200m anomalous zone of Pb-Zn-Cu soil geochemistry, which requires additional drilling.

Beutong Project

The holder of the Beutong IUP is an Indonesian company, PT Emas Mineral Murni, (“PT EMM”). PT EMM is owned 80% by Beutong Resources Pte Ltd. (“Beutong Singapore”) a Singapore company. Beutong Singapore is owned 50% by Tigers Copper Singapore No. 1 Pte Ltd. (“Tigers Singapore”). Tigers Singapore is owned 100% by Kalimantan Gold Corporation Limited. Therefore, Kalimantan Gold holds an effective 40% interest in the Beutong IUP at this stage (80% x 50% x 100% = 40%). PT Media Mining Resources (“PTM”) owns the remaining 20% of the shares of PT EMM.

Pursuant to a joint venture agreement between PTM and Tigers Singapore dated February 11, 2011, as most recently amended November 19, 2014 (the “Option Agreement”), Tigers Singapore can increase its shareholding in Beutong Singapore from its current 50% ownership to 100% by completing expenditure and development milestones thus ultimately holding an effective 80% interest in the Beutong IUP.

The Beutong Project is located within the Beutong IUP in the province of Aceh, Indonesia, some 60 kilometres inland from the coastal city of Meulaboh on the island of Sumatra. Excellent infrastructure exists with major road, grid power and a port located nearby.

PT EMM lodged the initial IUP Production conversion application with Nagan Raya Regency in March 2013. In early 2014 Nagan Raya Regency sought clarification from the Central Government on the IUP Production “issuing authority”. Formal confirmation was received, confirming the Minister of Energy and Mineral Resources (MEMR) within the Central Government in Jakarta is responsible for issuing an IUP Production license to an Indonesian company with foreign ownership (PMA Company). PT EMM’s application was submitted to the Central Government MEMR and the application remains under process, with technical reviews ongoing. EMM continues to provide MEMR with supporting documentation as requested. A Production IUP is valid for 20 years and extendable for two subsequent periods, each of 10 years duration.

Due to the uncertainty related to determining the Government authority with responsibility for processing the IUP Production application, PT EMM was granted a one year suspension of the Beutong IUP exploration license on June 6, 2014. According to Law 4, 2009, suspension of mining business activities shall not reduce the validity period of Mining Permits and therefore the IUP Exploration license expiry date is pushed back one year to June 15, 2015, and the suspension is extendable one year.

The forestry status of the IUP comprises 3,617 Ha classified as Areal Penggunaan Lain (APL) or land allocated for other purposes (also known as non-forest area) and the remaining 6,383 Ha is classified as Hutan Lindung (HL) or protected forest. The Beutong Copper Project comprises three prospects, namely the Beutong East (“BEP”) and Beutong West (“BWP”) Porphyries and the Beutong Skarn. All fall within forest areas classified as APL, and therefore do not require a forestry permit to conduct exploration activities.

Once granted, the IUP Production License provides a key part of the necessary approval pathway to the further development of the Beutong Project. The application process remains on track and PT EMM continues to provide supporting documentation as requested by MEMR. Upon receipt of the IUP Production the Company intends to re-active field programs aimed at extending near surface Resources and progressing development of the project.

The Company has defined a maiden NI 43-101 resource estimate for the Beutong Project as follows:

Beutong Mineral Resource on a 100% basis comprises:

– Measured and Indicated Resources of 93Mt at 0.61% Cu, 0.13ppm Au, 1.97ppm Ag and 97ppm Mo (0.3% Cu Reporting Cut) for contained metal of 1,241MIbs copper, 373koz gold, 5,698koz silver and 20MIbs molybdenum (0.3% Cu Reporting Cut); and

– Inferred Resources of 418Mt at 0.45% Cu, 0.13ppm Au, 1.11ppm Ag and 129ppm Mo (0.3% Cu Reporting Cut) for contained metal of 4,092MIbs copper, 1,746koz gold, 14,903koz silver and 112MIbs molybdenum (0.3% Cu Reporting Cut).

Beutong Mineral Resource on a relevant attributable 40% interest basis comprises:

– Measured and Indicated Resources of 38Mt at 0.61% Cu, 0.13ppm Au, 1.97ppm Ag and 97ppm Mo (0.3% Cu Reporting Cut) for contained metal of 496MIbs copper, 149koz gold, 2,279koz silver and 8MIbs molybdenum (0.3% Cu Reporting Cut); and

– Inferred Resources of 167Mt at 0.45% Cu, 0.13ppm Au, 1.11ppm Ag and 129ppm Mo (0.3% Cu Reporting Cut) for contained metal of 1,637MIbs copper, 698koz gold, 5,961koz silver and 45MIbs molybdenum (0.3% Cu Reporting Cut).

The technical report supporting this Resource is titled “The Beutong copper-gold-silver-molybdenum mineralization, Aceh Indonesia” dated effective November 2014, written by Duncan Hackman, B. App. Sc., MSc. MAIG of Hackman and Associates Pty. Ltd. This report is available from the Company’s website at www.kalimantan.com.

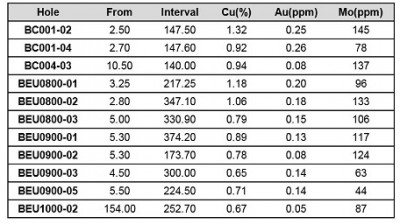

Porphyry copper-gold-molybdenum mineralization at Beutong extends from surface in the BEP to depths greater than 800 meters vertically. The significant portion of the Resource outlined to date occurs in the top 500 meters of the two porphyry bodies (BEP and BWP) and better results from near surface within the BEP include:

The mineral deposit remains open to the east, west and at depth. Targets for additional shallow mineralization occur immediately to the east of section 0700 on the BEP where drill intersections of 384.7m at 0.67%Cu, 0.21g/t Au, 100ppm Mo (BEU700-03 from 74.5m) and 224m at 0.73% Cu, 0.12g/t Au and 74ppm Mo (BEU700-04 from 136m) remain open.

A strongly mineralized copper-gold skarn is located 200 meters north of the BEP and also remains open in all directions. Drill intercepts to date include 33m at 2.31% Cu, 1.23g/t Au from 2.5m depth with soil geochemistry and drilling indicate potential dimensions of 60m width over greater than 2km.

Jelai

With regard to the Jelai Izin Usaha Pertambangan (the “Jelai IUP”), the Company announced that the Indonesian Ministry of Forestry granted JCM an extension to its Borrow and Use Exploration Forestry Permit (IPPKH). The permit, which is renewable, extends the authorization for the Company to conduct exploration activities until December 16, 2015. It covers all the existing permitted areas, namely the Mewet and ten of the other 12 Jelai IUP prospects, comprising 4,675 hectares of the 5,000 hectare IUP.

Mineralization at Mewet comprises multiple veins and vein splays of the low sulphidation epithermal style and is hosted within a sequence of porphyritic andesite, intrusion breccias and diorite dykes. Grid soils, surface mapping and drilling have confirmed a cumulative vein strike length of 6.0 km, which includes the three major north-south trending Mewet, Sembawang and Nyabi veins and their Lipan, Salam, Adau, Tigalima and Obi vein splays. The highest grade gold – silver mineralization is associated with finely banded quartz-adularia and zones of multiphase brecciation of the colloform-crustiform quartz, generally with a weak sericitic / silicified alteration halo.

The Mewet system represents several phases of sealing and re-brecciation with a number of phases of colloform-crustiform quartz clasts observed in the chalcedonic quartz. The occurrence of adularia and coarse bladed calcite in high-grade zones and the presence of hydrothermal breccias and chalcedonic quartz are consistent with boiling.

A total 140 drill holes (16,786.15 metres) have been drilled at Mewet, all within the Mewet Prospect area.

Mewet, select significant drilled intercepts (>1.0g/t Au)

The Company has been in discussions with a number of major mineral companies regarding a potential joint venture or similar arrangement in respect of Jelai IUP. These discussions are continuing and some site visits have already been undertaken.

Operations

The Company incurred a loss and comprehensive loss for the year ended December 31, 2014,of $884,912 (2013 – $325,805). The Company earned management fees of $47,388 (2013 – $611,980) pursuant to the joint venture agreement with Surya Kencana LLC, a wholly-owned subsidiary of Freeport-McMoRan Exploration Corporation. All of the Company’s exploration costs in the year, net of funding partner contributions and equipment rental payments, contributed $437,235 to the expenditure (2013 – $89,248). Expenses were otherwise in line or lower than the previous year.

Fourth quarter

The Company began the fourth quarter with $340,781 cash. Cash of $178,770 was used in operating activities; investing activities used $133,617 in cash; and the Company recorded an unrealized foreign exchange gain of $1,988 on its cash, to end the quarter and the year with $30,382 cash.

Liquidity

The Company began the current fiscal year with $973,464 in cash. Operating activities used $936,517 in cash; investing activities used $12,885; financing activities had no cash effects in the year; and recorded $6,320 of unrealized foreign exchange gain on cash balances, to end the year with $30,382 in cash.

The Company will require additional financing, through various means including but not limited to equity financing, for continued operations and for the substantial capital expenditures required to achieve planned principal operations. The Company plans to raise additional financial resources through equity financings during the next twelve months. While the Company has been successful in the past in obtaining financing, there is no assurance that it will be able to obtain adequate financing in the future or that such financing will be on terms acceptable to the Company. These factors indicate the existence of a material uncertainty that may cast significant doubt on the Company’s ability to continue as a going concern.

In January 2015, the Company closed a brokered private placement through the issuance of 51,910,441 common shares for gross proceeds of C$1,193,940 at an issue price of C$0.023 per common share. The Company paid aggregate fees to brokers who introduced the Company to private placement investors of C$29,350.

For further information please contact:

Tony Manini

Deputy Chairman and CEO, Kalimantan Gold

Mobile: +61 3 8644 1300

Email: tony.manini@kalimantan.com

VSA Capital Limited

Andrew Raca / Justin McKeegan

Telephone: +44 20 3005 5004 / +44 20 3005 5009

Email: araca@vsacapital.com

KLG’s Nominated Adviser

RFC Ambrian Limited

Andrew Thomson / Oliver Morse

Telephone: +61 8 9480 2500

Email: andrew.thomson@rfcambrian.com / oliver.morse@rfcambrian.com

About Kalimantan Gold

Kalimantan Gold Corporation Limited is a junior exploration company listed on both the TSX Venture Exchange in Canada and on AIM in London. The Company has three exploration projects in Indonesia: the KSK Contract of Work in Central Kalimantan with potential for multiple copper and gold deposits; the Jelai epithermal gold project in East Kalimantan; and the recently acquired Beutong copper-gold-silver-molybdenum project in Sumatra. For further information please visit www.kalimantan.com and view our most recent company presentation.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements that are based on the Company’s current expectations and estimates. Forward-looking statements are frequently characterized by words such as “plan,” “expect,” “project,” “intend,” “believe,” “anticipate,” “estimate,” “suggest,” “indicate” and other similar words or statements that certain events or conditions “may” or “will” occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such factors include, among others: the actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; possible variations in ore grade or recovery rates; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; and fluctuations in metal prices. There may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

SOURCE: Kalimantan Gold Corporation Limited

ReleaseID: 428398