Oculus Innovative Sciences: The Cheapest Stock Available In An Active Dermatology Sector And A New Player In Atopic Dermatitis

This Article Is Written By Edward Vranic and Can Also Be Found At His Blog on Seeking Alpha

REDONDO BEACH, CA / ACCESSWIRE / July 21, 2015 / Biotechnology stocks with a focus on dermatology have performed quite

well in 2015. Dermatology covers a broad range of conditions from

cosmetic such as wrinkle and acne care to dealing with serious medical

problems like atopic dermatitis. Anacor Pharmaceuticals, Inc. (NASDAQ: ANAC) soared over 50% on July 13 after it released positive Phase 3 data on its Crisaborole Topical Ointment for atopic dermatitis while Dermira, Inc. (NASDAQ: DERM)

has risen over 40% from its IPO price of $16 since last October.

Dermatology gets ignored by some investors as it’s rarely related to

life-threatening conditions like diabetes, cancer or heart disease and

there are plenty of generic drugs or other treatments available for some

aspects of it. However, strong margins and favourable pricing drive

this industry and plenty of large pharmaceutical companies have taken

this sector seriously over the last several years as there has been a

consistent wave of acquisitions. Companies with patented technology and

cheap valuations will continue to be absorbed by larger players who want

in on the field.

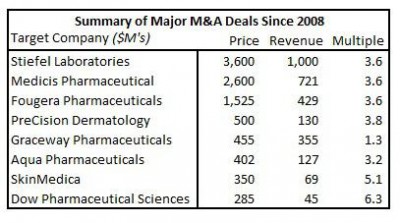

Leading the way on the acquisition front has been Valeant Pharmaceuticals International, Inc. (NYSE: VRX) which has become a leader in dermatology care through its purchases of Dow Pharmaceutical Sciences for $285 Million in 2009, Medicis Pharmaceutical for $2.6 billion in 2012 and PreCision Dermatology for $500 million in 2014. Other significant deals include GlaxoSmithKline PLC (NYSE: GSK) acquiring Stiefel Laboratories for $3.6 billion in 2009, Novartis (NYSE: NVS) acquiring Fougera Pharmaceuticals for $1.5 billion in 2012, Almirall buying Aqua Pharmaceuticals in 2013 for $402 million inclusive of milestone payments and Allergan PLC (NYSE: AGN) acquiring SkinMedica for $350 Million in 2012.

Even companies in deep financial trouble have found a suitor at reasonable valuations. Graceway Pharmaceuticals was bought out

by Medicis in 2011 in a bankruptcy sale for $455 million. Graceway had

$355 million in net sales in 2009 but its revenue took a huge hit as its

lead product Aldara lost exclusivity and dropped from 85% of the

company’s total sales to just 16% in the span of a year. Even under

these dire circumstances, Graceway was still purchased for 1.3 times of

2009 sales. The table below summarizes these deals along with the

revenue multiple associated with each of them based on the annual

revenue in the year prior to the acquisition.

The

revenue multiple for these buyouts other than Graceway broadly ranges

between 3 to 6 times of revenue. While the larger deals valued the

companies at around 3.5x of revenue, the two smallest ones valued the

companies in excess of 5.0x of revenue. Investors can benefit greatly by

being on the lookout for companies in the dermatology field that are

valued at a lower revenue multiple.

One company which particularly stands out is Oculus Innovative Sciences, Inc. (NASDAQ: OCLS),

which produces prescription and over-the-counter products based on its

Microcyn platform technology. It has a history of sales across the globe

in the skin and wound care and animal health care industry, but has

recently been gaining significant traction in the dermatology sector

particularly in the United States where it received FDA clearance and received a new U.S. patent

for the use in medical devices for the treatment of atopic dermatitis.

This traction is already being seen in the financials as its Q4 results

(ended March) showed that its U.S. sales increased by almost four

times, growing to $412,000 for the quarter compared to $110,000 for the

period ended March 2014, with the growth being due to the expanding

dermatology business.

At $1.50 per share, OCLS’ market cap is only

$22.5 million. Considering that it has over $6 million in cash as of

its fiscal year ended March 2015, its enterprise value is only $16.5

million compared to $14 million in revenue achieved for the year. OCLS

is trading at a revenue multiple of 1.2x which is less than what

Graceway was purchased as a distressed company with its lead product in

steep decline. ANAC has added over $2.7 billion in market cap and over

$60 per share in less than two weeks following the positive Phase 3

results, reflecting the bullishness investors have over its New Drug

Application for atopic dermatitis in 2016. The skin disease impacts

about 18 to 25 million people in the United States alone, so that

bullishness can be justified.

What makes less sense is that the

market is overlooking OCLS even as it is a well-funded biotech company

that has recently cleared and patented medical devices for atopic

dermatitis selling in the market today along with several other products

that have been granted approval by the FDA through 510(k) clearances.

OCLS is growing its presence in dermatology at this very moment instead

of at some point in the future. OCLS can use its international revenue

and $4.5 million in proceeds from the sale of Ruthigen shares

to fund growth in its dermatology division until it reaches cash flow

positive status. The company has stated that it expects to use existing

funds to get to break even so dilution outside of the exercise of

existing warrants and options are not a big risk.

ANAC’s ointment

will be a major force in the dermatology market and a significant help

to the millions suffering from atopic dermatitis. However, it will not

take 100% of this market and won’t start selling until at least 2017 if

all goes well from here which leaves a significant upside opportunity

for OCLS. ANAC has moved over $2.7 billion in market cap since the

announcement. That is more than 160 times the enterprise value for OCLS.

ANAC’s market cap is $6.5 billion while it achieved $15 million in

revenue during Q1 2015. Annualizing this figure means the company is

valued over 100 times revenue. A portfolio of strong drug candidates is

going to be valued at a higher revenue multiple than a company with a

portfolio of medical devices, even those with several patents and FDA

clearances such as OCLS. But more than a 100x multiple for ANAC compared

to a 1.2x multiple for OCLS is too severe of a difference. If investors

are highly bullish for ANAC’s new drug for atopic dermatitis, they

should also be more bullish for OCLS’ latest successes in treating this

disease than what is currently being demonstrated by its low valuation

and stock price.

Given the 3.0x or greater revenue multiple

valuations for acquisitions in the dermatology field and 5.0x or greater

for microcap companies, ANAC’s multi-billion dollar move after its

Phase 3 results for atopic dermatitis, OCLS’ 300% revenue growth in U.S.

dermatology sales and 37% in overall revenue growth for the last

quarter and the company’s FDA clearances and patent grants for atopic

dermatitis, I believe it is reasonable to expect that the company should

be trading at a 12-month trailing revenue multiple of at least 5.0x.

That would lead to an expected enterprise value of $70 million and an

expected market cap of $76 million, or a price of more than $5 per share

for OCLS.

Disclosure: I am long OCLSW, which are

warrants on OCLS expiring in 2020 at a strike price of $1.30. They act

similar to call options. I believe the warrants are highly under-priced

given the long time to expiry, the volatility on the stock, and the fact

that the warrants are in the money. Warrants represent a leverage

opportunity and a risk management tool. For instance, a purchase of

warrants at $0.50 when the stock price is $1.60 will result in intrinsic

value of $1.90 if the stock price doubles to $3.20. Conversely, the

warrants are worthless if the stock is under $1.30 upon expiry in 2020.

But warrants can also be used to manage risk because an investor can put

up less capital in OCLSW for the same dollar amount of upside compared

to an investment in OCLS. Owning warrants is within my risk tolerance.

Investors should decide if warrants are within their risk tolerance

independently of my recommendation. I have been paid for this article. I

purchased OCLSW prior to any contact or relationship to the company and

this article is an accurate representation of my opinion on OCLS.

Click here to receive future email updates on Oculus Innovative Sciences developments: http://www.tdmfinancial.com/emailassets/ocls/ocls_landing.php.

Disclaimer:

Except for the historical

information presented herein, matters discussed in this release contain

forward-looking statements that are subject to certain risks and

uncertainties that could cause actual results to differ materially from

any future results, performance or achievements expressed or implied by

such statements. Emerging Growth LLC is not registered with any

financial or securities regulatory authority, and does not provide nor

claims to provide investment advice or recommendations to readers of

this release. Emerging Growth LLC may from time to time have a position

in the securities mentioned herein and may increase or decrease such

positions without notice. For making specific investment decisions,

readers should seek their own advice. Emerging Growth LLC may be

compensated for its services in the form of cash-based compensation or

equity securities in the companies it writes about, or a combination of

the two. For full disclosure please visit: http://secfilings.com/Disclaimer.aspx.

SOURCE: Emerging Growth LLC

ReleaseID: 430732