Preliminary Economic Assessment Delivers Strong Business Case for the Woodlawn Zinc-Copper Project

WEST PERTH, AUSTRALIA / ACCESSWIRE / April 21, 2015 / Heron Resources Limited (Heron or the Company) is pleased to report the completion of the Preliminary Economic Assessment (PEA) on the Company’s 100%-owned and fully permitted Woodlawn Zinc-Copper Project located in New South Wales, Australia. Highlights include:

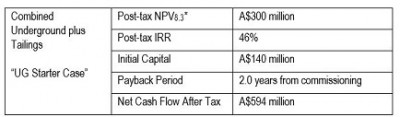

Strong base case NPV / IRR results:

*Results reported using an 8.3% post tax real discount rate (approx. 10% post-tax nominal), with AUD/USD FX trending from 0.80 to 0.73 by 2021, and with flat real commodity prices of US$1.09/lb Zn, US$0.95/lb Pb, US$3.00/lb Cu, US$18.5/oz Ag and US$1,200/oz Au. Other assumptions are detailed later in this release.

Attractive project characteristics:

– Initial 11 year mine life based on underground and tailings resources, and including 1.0Mt Indicated and 2.8Mt Inferred Mineral Resource contribution from underground

– Total life-of-mine (LOM) Production Target of 353Kt of zinc, 77Kt of copper, 112Kt of lead, 8.9Moz of silver and 59Koz of gold

– Processing rate of 1.5Mtpa through standard sequential flotation, with steady state (2020-2023) annual Production Target of 51Kt of zinc, 10Kt of copper, 16Kt of lead, 1.1Moz of silver and 8.7Koz of gold contained within zinc, lead, and copper concentrates

– Utilises existing infrastructure to achieve significant reductions in development costs, with a revised portal location on the west side of the pit enabling first production from the second quarter after underground works commence

Quality resource and mine plan:

– “UG Starter Case” focused on the shallower areas of the deposit reflecting the success of the recent drilling programme – high level of confidence for extensions to the mineralisation at depth and along strike

– Based upon 36% Measured, 35% Indicated and 29% Inferred Mineral Resources, comprising:

–Woodlawn Underground Project (WUP): 32% Indicated and 68% Inferred

–Woodlawn Tailings Retreatment Project (WRP): 47% Measured, 37% Indicated and 16% Inferred

– Conservative approach taken to re-modelling of the underground Mineral Resource, with exclusion of all moderate to higher risk areas – to be reconsidered post mine access and re-assessment from underground

– Highly successful Phase I exploration drilling programme over the last 8 months – of the total underground plant feed of 1.0Mt Indicated and 2.8Mt Inferred Mineral Resources, recent exploration has contributed approximately 2.8 million new Inferred tonnes

– Low-risk underground resource base: 80% of underground tonnes in the production schedule are from areas away from previous mining

Robust economics:

– C1 costs of US$(0.01)/lb zinc and C3 of US$0.44/lb expected to place the Project firmly in the lower half of the cost curve (refer to page 10 for definitions)

– Economics remain robust using current commodity prices (forward curve adjusted), achieving a post-tax NPV8.3 of A$192 million and IRR of 34%

– Significant leverage to zinc, which comprises approximately 47% of total payable metal value

Excellent exploration potential:

– Significant exploration potential remains within the underground including additional shallow, near-surface targets that will be tested in the next stage of drilling with scope to materially increase the Production Target

– Deeper underground extensions to be targeted with underground drilling post-commissioning – management anticipates that any such depth extensions discovered have the potential to add significant project value

Expedited development path:

– Heron’s Board has committed to commence the Feasibility Study (FS) to progress the development of the Project with the objective of completing this study by mid-2016

– New drill programme to commence comprising in-fill drilling and follow up on high priority exploration targets

– Early start up potential, based on a staged development of the tailings (Front-end Engineering & Design “FEED” completed 2012) followed by the integration of underground hard rock components

IMPORTANT NOTE: A Preliminary Economic Assessment (PEA) is a formal study in standard form prescribed by Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) which includes an economic analysis of the potential viability of Mineral Resources, but which is not a pre-feasibility study or feasibility study. In accordance with Canadian requirements in relation to preliminary economic assessments, the Company advises that the preliminary economic assessment is preliminary in nature, that it includes some Inferred Mineral Resources considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorised as Mineral Reserves, and that there is no certainty that the economics set out in the preliminary economic assessment will be realised. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

The completed PEA study document will be published on Heron’s web site, the ASX (ASX:HRR) and SEDAR www.sedar.com (TSX:HER) within 45 days of this news release.

Heron’s Chairman, Mr. Craig Readhead, said “This PEA study confirms not only the economic viability of the Woodlawn Project, which has the potential to deliver a long term supply of zinc into a supply constrained market, but also the quality of this asset with a very competitive cost of production within the current market. The project is underpinned by a revised, high quality Mineral Resource, including the discovery of 2.8 million tonnes from recent drilling and has achieved its aim of establishing a robust resource base on which to build a new operation. The PEA study demonstrates that the approach of co-treating the low risk tailings resource with the high-grade underground resource can deliver a robust outcome and a low cost, long life, mining operation. We are now committed to advancing this project rapidly through to feasibility study stage.”

Please refer to page 12 for important Cautionary and Forward Looking Statements that are to be read in conjunction with this release.

SUMMARY OF THE PEA

Project Overview

Woodlawn is a high-grade, volcanogenic massive-sulphide (VMS) deposit situated in New South Wales, Australia, located approximately 50 km northeast of Canberra, and 250 km southwest of Sydney (refer Figure 1).

The Woodlawn Project benefits from a mining lease (SML 20) that has recently been renewed for a further 15 years, and major project approvals (statutory approval) that allows for mining operations at the Woodlawn site until 31 December 2034. The mineral rights and production are 100%-owned by Heron. Figure 2 shows the Woodlawn site layout including location of the proposed plant site.

The Woodlawn site (SML 20) is surrounded by a larger exploration license (EL 7257) which is held 100% by Heron. This exploration license, of 179 square km, includes the previous Currawang Mine located 9km to the north of Woodlawn. The Currawang Mine provided satellite feed to the previous Woodlawn operations.

Figure 1: Woodlawn location map with relative population sizes

Please click on the following link to view the image: http://www.fscwire.com/sites/default/files/NR/662/6509_image1.png

Please click on the following link to view the image: http://www.fscwire.com/sites/default/files/NR/662/6509_image2.jpg

Underground (WUP) Mineral Resource

Heron is pleased to announce an updated Mineral Resource estimate, as detailed in Table 1 below, for the Woodlawn Underground Project compiled under JORC 2012 and NI 43-101 guidelines and incorporating the results of the Phase 1 drilling programme and an extensive review of historic data. As announced on 6 March 2015, during the Phase 1 drill programme a total of 20 diamond core holes (DDH) for 7,613m and 11 reverse circulation (RC) holes for 1,201m were completed. Figure 3 provides an oblique view through the Mineral Resource block model.

Drilling focused initially on the Kate Lens before drilling key positions within the near-surface portions of other lenses. The deepest hole (WNDD0006) was drilled to a depth of 940m and intersected multiple massive sulphides in the I and D lens positions. It became apparent during the course of the program that there was scope to expand the resource base within the upper 500m of the system, deferring the need to drill deeper targets. While considerable resource potential exists in deeper parts of the system, the PEA focus has been only on the shallower, up-dip lens positions, with the result that the underground Mineral Resource used in the production schedule for the PEA extends the depth of the mine only 80m below previous workings.

Heron has taken a deliberately cautious approach to areas that would be considered remnant, which has reduced the underground Mineral Resource compared with the previously published estimate. There are numerous areas adjacent to historical mining which have been excluded from the new resource estimate, and there is considerable potential to re-incorporate these zones into the mine plan once operations are under way and underground access facilitates closer and more detailed assessment.

The Mineral Resource has been reported undiluted to a lower cut-off grade of 7% ZnEq, a value that approximates the estimated lower cut-off grade for the mining methods considered by the PEA study.

For further information please refer to the item entitled “Compliance with ASX Listing Rule 5.8.1 for updated Underground Mineral Resources” on page 13 for technical details associated with the Resource estimation process.

Figure 3: Woodlawn underground Mineral Resource. Oblique sectional view looking north-east – block model coloured by ZnEq grades

Please click on the following link to view the image: http://www.fscwire.com/sites/default/files/NR/662/6509_image3.jpg

Table 1: Mineral

Resource Estimate – Woodlawn Underground Project (WUP)

Notes to accompany Mineral Resource Table: 1) Please refer to the page 33 of this release for Qualified Persons statements; 2) ZnEq% refers to a calculated Zn equivalent grade the formula for which is stated in Appendix 1; Polymetallic Type refers to polymetallic massive sulphide mineralisation with high-grade Zn and Pb; Copper Type refers to Cu dominated massive and stringer sulphide mineralisation; Values are rounded to two significant numbers and some rounding related discrepancies may occur in the totals; the Mineral Resource is reported in accordance with the guidelines set out in the JORC (2012) and NI 43-101 Codes; further details of the Mineral Resources estimation can be found in Appendix 1 and in the JORC Code (2012) Table 1 Appendix 2.

Tailings (WRP) Mineral Resource

A Mineral Reserve was previously stated for the Woodlawn Tailings Retreatment Project (WRP) as part of the Bankable Feasibility Study which was completed in 2008. This PEA does not replace the WRP Feasibility Study, and the previously published tailings Mineral Reserves remain unchanged. For the purposes of the PEA, the plant design is based primarily on the 2012 FEED study design for the WRP, and adopts the processing of this tailings material in combination with underground material.

The tailings are reported here as a Mineral Resource as part of this PEA study with Table 2, below, detailing the previously disclosed estimate. This Mineral Resource contributes some 11.2Mt (9.4Mt of Measured and Indicated and 1.8Mt of Inferred) to the total PEA plant feed as detailed in the following sections.

Notes to accompany Mineral Resource Table: 1) Please refer to the page 33 of this release for Qualified Persons statements; 2) ZnEq% refers to a calculated Zn equivalent grade the formula for which is stated in Appendix 1 and these are different to the originally reported (May 2009) ZnEq grades which were based on a different formula; 3) Values are rounded to two significant numbers and some rounded related discrepancies may occur in the totals; 4) The Mineral Resource is reported in a manner compliant with the JORC 2004 and NI 43-101 Codes. This information was prepared and first disclosed under the JORC Code (2004) in May 2009. It has not been updated since to comply with the JORC Code 2012 on the basis that the information has not materially changed since it was last reported. 5) TriAusMin acquired more drill hole data in 2008, subsequent to the Mineral Resource estimation. That data however does not materially alter the Mineral Resource estimate and due to data collection problems it is not viable for use in a re-estimate. Nevertheless, statistics of the later assays confirm the reported estimated grades.

PEA Scope & Plant Feed

The PEA was prepared by SRK Consulting (Australasia) Pty Ltd (SRK) with contributions from GR Engineering Services Limited (GRES), other consultants and Company employees.

The Project will be developed as a combined underground project together with a tailings retreatment project, with feed processed through a single plant designed for co-treatment. The base case Plant Feed Estimate, detailed in Table 3 below, of 15Mt (“UG Starter Case”) assumes the following parameters:

– Underground tonnages above a variable 4.7 to 6.6% ZnEq cut-off grade depending on stoping method;

-Underground mining recoveries ranging from 85 to 98% depending on the stoping method and stope width;

– Underground dilution of mineralisation includes a minimum mining width of 3m and in addition dilution ranging from 9 to 20% at zero grade depending on lens location and stope width;

– Tailings tonnages above the 0% ZnEq cut-off grade;

– Tailings mining recovery based on an average expected loss of 20cm of tailings material in contact with other material; and

– Tailings dilution equivalent to 10cm average vertical gain at no grade to account for potential contamination from the original ground surface.

Notes to accompany Woodlawn PEA Plant Feed Estimate Table 3: 1) Please refer to the page 33 of this release for Qualified Persons statements; 2) ZnEq% refers to a calculated Zn equivalent grade, the formula for which is stated in Appendix 1. Values are rounded to two significant numbers and some rounding related discrepancies may occur in the totals.

Whilst the current Mineral Resource base forms the foundation of the PEA and will also be the starting point for the future FS, the Board is of the view that there is very strong potential for the Project to deliver significantly greater tonnages from underground based on the exploration potential of the Woodlawn mineralised system.

Plant Design

GR Engineering Services Limited have updated the previous Woodlawn Retreatment Project Feasibility Study / FEED Study design for the 1.5Mtpa tailings processing facility to deliver a plant that has been designed on the basis of a 50% blend of fresh underground material being co-treated with 50% reclaimed tailings over life-of-mine . The design allows initial operations to treat 100% reclaimed tailings, whilst at the same time the development of the initial mine decline will be undertaken to provide access for mining of fresh material. The contribution from underground approaches 700Ktpa during the middle years of the current preliminary mine life and the mill feed blend ratio will be reviewed further in the next stage of the project studies.

For underground production, a two stage crushing circuit has been incorporated into the plant design, together with a primary grind ball mill. For tailings material, a fine grind mill is planned that reduces the particle size down to 30µm, a size which previous and current testwork confirms maximises recovery performance from the flotation circuit. For the underground material, the initial float (copper concentrate) is undertaken at a 75µm grind size, with a regrind of copper tails to 30µm being employed subsequent to that stage to maximise the recoveries from the lead and zinc flotation stages.

The flotation circuit comprises a talc, copper, lead and zinc differential flotation sequence. The overall plant design is consistent with the design of the original 1978-1998 plant that was historically used to successfully treat Woodlawn ore. Talc cleaner concentrate recovered from the talc flotation cleaner cell will be discarded to final tails to remove some of the talcose gangue ahead of the differential flotation circuit. A differential flotation circuit for copper, lead and zinc will be utilised with concentrate regrind stages in the copper, lead and zinc circuits to produce marketable copper, lead and zinc concentrates. The copper circuit will also utilise a rougher and scavenger tailings regrind circuit prior to the lead flotation stage. Tailings from the flotation plant will be thickened for recovery of process water and underground paste fill, with slime tailings deposited into a new tailings storage facility TSF4.

As outlined in the Company’s release of 11 February 2015 – “Successful Metallurgical Testwork”, the PEA metallurgical testwork program was undertaken by Australian Mineral Metallurgical Laboratories Pty Ltd (“AMML”) in their Gosford testing facility with input from GRES and focused on the underground massive sulphides at the Woodlawn Zinc-Copper Project. This work represents the first full suite of metallurgical tests undertaken on the underground mineralisation since the 1998 mine closure, and also the first tests on a combination of the tailings and fresh zinc-copper mineralisation. The overall results from this work have demonstrated better than historical operational performance and reflect the advancements made in the field of sulphide flotation, and in-particular fine grinding technology. The testwork demonstrated the ability to produce three readily saleable concentrates.

Concentrates from the copper, lead and zinc flotation circuits will be thickened and subsequently filtered for road transport. Copper and zinc concentrates will be shipped via Port Kembla in bulk carriers. Transport of the concentrate from site will be by road with concentrate loaded into half-height containers via front end loader at site. The high precious metals lead concentrates will be loaded into “bulka” bags via a bagging plant at the process plant. Loaded bags will then be containerised for dispatch via Port Botany or Port Kembla.

Final flotation tailings will be de-slimed and used in the paste fill plant which will generate a cemented paste that will be reticulated underground and used to backfill completed stopes.

Outotec has completed an initial set of testwork on the paste fill, including rheology and strength testing, using tailings samples from the recent metallurgical testing. Whilst this is sufficient for the PEA, further work will be undertaken during the FS including leachability tests, additional trial mix tests to optimise binder type and mix to deliver adequate strength to mine fill, and longer term strength and stability tests.

Underground Mining

Beck Engineering (Beck), an east coast Australia-based specialist consultancy, was engaged to assist with the rock mechanics input to the proposed underground operation. As a component of their work, the extensive historical mine records have been reviewed to better understand the ground conditions previously encountered at Woodlawn and previous ground control practices. In addition to this historical knowledge base, inspection and geotechnical logging of Kate Lens diamond drill core has led Beck to note that the hanging wall appears competent for this new lens. This competency, together with the use of competent backfill, are important input parameters for the selection of an appropriate mining method that provides for maximum recovery and high productivity.

A number of changes to historic work practices will improve the future management of the ground conditions. These include:

– Full time geotechnical resources on site to provide timely day-to-day support to mine operations;

– Whole-of-mine structural modelling to improve the predictive capacity for mine planning;

– Adoption of alternative extraction techniques to minimise creation of isolated sill pillars; and

-Implementation of cemented paste fill as a competent support medium that will enable significantly higher resource recovery whilst providing local and regional ground support to the mine excavations.

The deposit will be accessed with a box cut located on the western side of the existing open-pit, which provides for early access to underground material. Stoping areas will be accessed by rehabilitating some of the existing workings and constructing additional underground declines and levels to access the new areas.

The mining methods have been selected to mine both areas of unmined and remnant material around the previously mined areas of the deposit. The mining method selection takes into consideration the location of the existing open-pit above the deposit which is being used as a bioreactor by Veolia Environmental Services Ltd (Veolia). The mine design has assumed that stopes will be filled with paste fill, and multi-level continuous fill method areas will be filled using rock fill.

Production will be transferred from stoping areas to loading bays and a haulage fleet used to deliver plant feed to the run-of-mine (ROM) pad.

Appendix 1 provides details of the proposed production schedule. The production schedule for the underground benefits from the inclusion of significant material discovered from the recent drilling campaigns, with approximately 2.8 million tonnes of Inferred Mineral Resources identified from this work. Importantly, 80% of the total underground plant feed material is away from former mining areas and is amenable to low cost, low risk mining methods. Figure 4 below shows the stope designs currently planned, with stopes coloured green being material which is away from previously mined areas and hence amenable to lower cost, lower risk mining methods, with areas in orange being adjacent to previously mined areas for which more conservative mining methods have been employed.

Figure 4: PEA Stope Design (SRK)

Please click on the following link to view the image: http://www.fscwire.com/sites/default/files/NR/662/6509_image4.jpg

Previous mining was undertaken to a depth of 620m below surface. The underground Resource within the production schedule for the PEA extends this by only 80m to 700m. Considerable potential remains to investigate further depth extensions to the mineralisation, which will best be assessed by underground drilling once underground access is secured.

Capital and Operating Costs

Capital costs have been estimated to a +/-25% accuracy. Tailings retreatment process plant capital costs have been updated to allow for installation of equipment sized to also accommodate the underground feed, potentially allowing a staged development of the project to be undertaken. Initial capital costs to Peak Cash Draw are estimated at A$101.4 million for the tailings components, with an incremental A$38.6 million required to complete the underground access and plant additions, for a total of A$140.0 million including contingency. Refer to Appendix 1 for full details.

Operating costs have been estimated by GRES for the plant component and by SRK for the mining component, with additional costs estimated by Heron. The detailed cost breakdown is provided in Appendix 1. The resulting cost profile for the operation based on the Production Target provides C1 costs of US$(0.01)/lb or US$(30)/tonne) of zinc in concentrate produced over the initial 11 year mine life.

On a C3 cost basis, the operation averages costs of US$0.44/lb of zinc in concentrate.

Summary Economics

The Woodlawn project economics have been assessed using the discounted cash flow method, based on a quarterly schedule of tonnes mined and processed from both the WUP and the WRP. Capital and operating costs are applied to mining, processing and overheads. The processed material has recovery factors applied, together with flotation splits to the three concentrates which make up the project production. Shipping and logistics, product payability, treatment and refining costs, state royalties and taxes are adjusted for to derive a Net Present Value (NPV) for the project.

The Project’s post-tax NPV at an 8.3% post-tax real discount rate (approximately equivalent to a 10% post-tax nominal discount rate) is A$300 million and the IRR is 46%. Payback of start-up capital is achieved approximately 2 years from commissioning

(2)C1 costs calculated as total direct cash operating costs including all mining and processing costs, mine site overheads and realisation costs (including transport costs, treatment and refining costs and smelter recovery deductions) net of revenue credits from sale of by products (Pb, Cu, Ag and Au), divided by the amount of payable zinc produced.

(3)C3 is calculated using the same methodology as C1 but incorporates a capital charge and royalties.

Results are based on AUD/USD FX trending from 0.80 to 0.73 by 2021 (forward curve as at 31 March 2015). The Forecast Commodity Price Deck is based on the average of a number of forecasts for each commodity resulting in prices of US$1.09/lb Zn, US$0.95/lb Pb, US$3.00/lb Cu, US$18.5/oz Ag and US$1,200/oz Au. Other economic assumptions are detailed in Appendix 1.

For comparison, the economics are also shown using commodity forward curves which were sourced and applied as at 27 March 2015. The results demonstrate that the project economics remain robust at lower prices. Refer to Appendix 1 for more detailed sensitivity analysis.

The project is highly leveraged to commodity prices. In particular, zinc makes up around 47% of expected total payable metal value for the project. Hence the project provides excellent exposure to what is anticipated to be a market where demand will exceed supply, with positive potential implications for the future price of zinc.

Whilst the UG Starter Case presents a strongly positive economic outcome for the project and will form the basis for the future FS in order to minimise development time and costs, there is potential for the project to deliver significantly greater tonnages from underground based on both expansion of the current resource and on the broader exploration potential of the Woodlawn mineralised system.

With plant, underground access and development costs included for mining to a depth of 700 m below surface under the UG Starter Case, the incremental net present value associated with new discoveries and/or conversion of additional resource tonnes into the future mine plan has the potential to be very positive.

Exploration

Very significant exploration potential exists for the Project, with the majority of the recent drilling focused on shallow extensional targets within the underground to develop the production schedule for the PEA. Future exploration will focus on:

– Following up on additional shallow, up-dip targets which have the potential to be added in to the resource base for the underground;

– Regional targets including the Montrose, Cowley Hills and the Currawang prospects; and

– Deeper targets at the Woodlawn mine.

Project Funding Strategy

The funding strategy for the Woodlawn Project is to finance the project through a combination of debt and equity.

An early stage development concept is being evaluated which would allow construction of the plant to commence whilst the FS for the underground mine is completed. Under this staged scenario the plant would be commissioned and run on tailings only with underground feed to be introduced as soon as practicable.

Whilst the staged development option is under consideration, the Company continues to be fully funded for the forthcoming FS on the combined Project and is continuing with this work.

Forward Programme

Heron’s Board is delighted with the outcomes of the PEA and has determined that it will continue with the further study of the Woodlawn project through undertaking a FS on the combined underground and tailings project. Whilst detailed planning is under way, the Company considers that the FS could be completed within approximately 12 months.

An initial step in the FS is a further drilling program that will cover the required resource in-fill drilling as well as the testing of high priority exploration targets. The in-fill drilling is designed to lift the resource classification to permit the calculation of a Mineral Reserve as part of the FS. The high priority exploration targets include locations previously generated from downhole EM surveys, unexplained high-grade intercepts and interpreted structural positions, all of which have the potential to discover new massive sulphide lenses. The program consists of approximately 18,000 to 19,000 metres and has been approved by the Heron Board.

About Heron Resources Limited:

Heron is engaged in the exploration and development of base and precious metal deposits in Australia. Heron’s projects include the high-grade Woodlawn Zinc-Copper Project located 250km southwest of Sydney, New South Wales, and the Kalgoorlie Nickel Project located north of Kalgoorlie, Western Australia. In addition the Company holds a number of other high quality exploration properties located in the Lachlan Fold Belt, New South Wales.

For further information, please visit www.heronresources.com.au or contact:

Australia:

Mr Wayne Taylor, Managing Director and Chief Executive Officer:

Tel: +61 2 9119 8111 or +61 8 6500 9200

Email: heron@heronresources.com.au

Canada:

Tel: +1 905 727 8688 (Toronto)

Cautionary Statements:

In accordance with Canadian requirements in relation to preliminary economic assessments, the Company advises that the Preliminary Economic Assessment is preliminary in nature, that it includes some Inferred Mineral Resources considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorised as mineral reserves, and that there is no certainty that the economics set out in the Preliminary Economic Assessment will be realised. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

In accordance with the ASX listing rules, the Company advises the PEA referred to in this announcement is based on lower-level technical and preliminary economic assessments, and (other than in relation to the Woodlawn Tailings Retreatment Project) is insufficient to support estimation of Ore Reserves or to provide assurance of an economic development case at this stage, or to provide certainty that the conclusions of the PEA will be realised. The Production Target referred to in this announcement is partly based on Indicated Mineral Resources and on Inferred Mineral Resources detailed herein. There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the Production Target or Preliminary Economic Assessment will be realised.

Forecast financial information provided in this announcement is based on the Production Target disclosed herein. The Company has concluded that it has a reasonable basis for providing the forward-looking statements included in this announcement. The detailed reasons for this conclusion are outlined throughout this announcement and in particular in Appendix 1 headed “Disclosure of Additional Assumptions”. However, the Company cautions that there is no certainty that the forecast financial information derived from the Production Targets will be realised.

Forward-Looking Statements:

This release contains certain “forward looking statements” and certain “forward-looking information” as defined under applicable Canadian and U.S. securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. Forward-looking statements and information are not historical facts, are made as of the date of this press release, and include, but are not limited to, statements regarding discussions of future plans, guidance, projections, objectives, estimates and forecasts and statements as to management’s expectations. These forward looking statements involve numerous risks and uncertainties and actual results may vary. Important factors that may cause actual results to vary include without limitation, certain transactions, the successful completion of a Feasibility Study within the next 12 months, the timing and receipt of certain approvals, changes in commodity and power prices, changes in interest and currency exchange rates, risks inherent in exploration results, timing and success, inaccurate geological and metallurgical assumptions (including with respect to the size, grade and recoverability of mineral reserves and resources), changes in development or mining plans due to changes in logistical, technical or other factors, unanticipated operational difficulties (including failure of plant, equipment or processes to operate in accordance with specifications, cost escalation, unavailability of materials, equipment and third party contractors, delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters), political risk, social unrest, and changes in general economic conditions or conditions in the financial markets. Information concerning Mineral Reserve and Mineral Resource estimates also may be considered forward-looking statements, as such information constitutes a prediction of what mineralisation might be found to be present if and when a project is actually developed. The actual results or performance by the Company could differ materially from those expressed in, or implied by, any forward-looking statements relating to those matters. Accordingly, no assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on the results of operations or financial condition of the Company. Except as required by law, we are under no obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

To view Appendix’s 1, 2 and, Please click on the following link: http://www.fscwire.com/sites/default/files/news_release_pdf/heron04212015.pdf

SOURCE: Heron Resources Limited

ReleaseID: 428079