MINNEAPOLIS, MN / ACCESSWIRE / April 30, 2015 / Skyline Medical, Inc. (OTCQB: SKLN) (the “Company”), the producer of the FDA approved STREAMWAY(R) System for automated, direct-to-drain surgical fluid disposal that reduces the risk of exposure to hazardous waste, today reported its results for the fourth quarter and year ended December 31, 2014.

Key 2014 Financial Highlights:

– Trial program sales conversion rate was 95%

– Revenues increased 103% to $951,559

– Units sold increased 263% to 79 year-over-year

– Operating expenses decreased 11% year-over-year

– General and administrative expense decreased 35% year-over-year

– Interest expense decreased 41% year-over-year

Key 2014 Operational and Marketing Highlights:

– Signed contracts with major hospital chains and academic centers, including VA Medical Centers, Penn State Milton S. Hershey Medical Center and Duke University Health System

– Increased installation base to 47 facilities, in 16 states

– Trial program sales conversion rate was approximately 95%, based on 17 trials to date

– Enhanced existing IP portfolio

– Focused on R&D to continuously enhance product

– Began penetrating the from Interventional Radiology departments market

Full-year 2014 revenues rose to $951,559, up 103% compared to $468,125 in 2013. Gross profit for 2014 was $566,236, or 60% of revenues, an increase from $278,418, or 59% of revenues, in 2013.

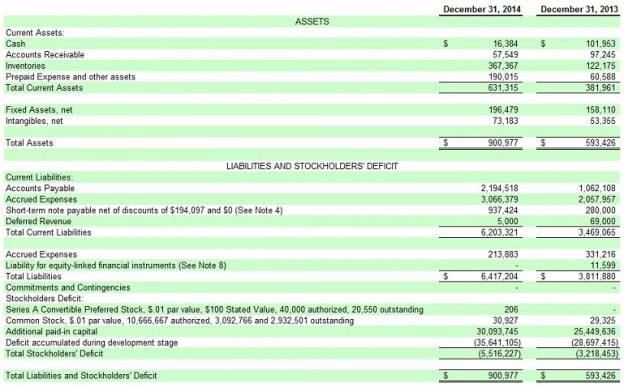

Net loss for 2014 was ($6.8) million, or ($2.29) per diluted share, compared to net loss of ($9.4) million, or ($4.64) per diluted share, in 2013. The improvement in net loss was driven by decreases in General and Administrative, Interest expense, Operations expenses and a gain on the valuation of equity-linked financial instruments, and was partially offset by higher Sales and Marketing expenses.

“Our sales strategy of encouraging medical centers to trial our fluid management system prior to committing to a purchase, is proving to be a very successful method of engaging with new customers and has resulted in a 95% conversion to sales rate and a shorter sales cycle,” commented Josh Kornberg, CEO of Skyline Medical. “The trial system is also helpful in getting our sales team in front of potential customers in previously untapped areas; accordingly, we have seen an increase in interest and orders from Interventional Radiology departments whereas we’d historically been selling primarily to operating rooms.

“Over the year we signed several new contracts and increased our installation base to 47 facilities, in 16 states. This includes large hospital systems across the U.S. as well as smaller facilities. The diversity of our customer base is a testament to the broad appeal of the STREAMWAY System and demonstrates that there is large potential market for our direct-to-drain technology, which is significantly safer, more hygienic and cost efficient for our customers than the outdated canister based method that most hospitals still currently employ.

Kornberg concluded, “Looking ahead, we will continue to work diligently to grow revenues and our sales team is proactive in working to increase our exposure to major Group Purchasing Organizations (GPO’s) which we recognize is an important step in improving our reach in the industry. We also intend to seek the necessary approvals to distribute our products in Europe, Asia, Latin America, Canada, and other areas outside the U.S. The dangers of exposure to infectious fluid waste are well recognized in the medical community. Our marketing efforts are centered on educating medical staff about the risks of contamination using current waste collection procedures and the advantages of the fluid management system in protecting medical personnel from inadvertent exposure. We are leveraging this medical awareness and concern with education of regulatory agencies at the local, state and federal levels.”

About Skyline Medical, Inc.:

Skyline Medical, Inc. produces a fully automated, patented, FDA cleared, surgical fluid disposal system that virtually eliminates operating room workers’ exposure to blood, irrigation fluid and other potentially infectious fluids found in the surgical environment. Today’s manual surgical fluid handling methods of hand-carrying filled surgical fluid canisters and emptying these canisters is an exposure risk and is not an optimal approach to the handling of surgical fluid waste. Skyline Medical’s STREAMWAY(TM) System fully automates the collection, measurement and disposal of surgical fluids and is designed to result in: 1) reducing overhead costs to hospitals and surgical centers, 2) improving Occupational State and Health Association (OSHA) and other regulatory compliance agencies’ safety concerns, and 3) streamlining the efficiency of the operating room (and thereby making surgeries more profitable). Skyline Medical’s STREAMWAY System is eco-friendly as it contributes to cleaning up the environment. Currently, approximately 50 million bloody, potentially disease infected canisters go to landfills annually in the United States. These tainted canisters can remain in landfills for years to come. With the installation of Skyline Medical’s STREAMWAY System, the number of canisters can be significantly reduced. Skyline Medical, Inc.’s STREAMWAY System is designed to make the operating room and our environment safer, cleaner, and better. Skyline Medical products are currently being represented by independent professional sales representatives that cater to the needs of hospitals and ambulatory surgical centers across the country. For additional information, please visit: www.skylinemedical.com.

Forward-looking Statements:

Certain of the matters discussed in this announcement contain forward-looking statements that involve material risks to and uncertainties in the company’s business that may cause actual results to differ materially from those anticipated by the statements made herein. Such risks and uncertainties include, among other things, continued dependence on financing transactions to generate sufficient cash to stay in operation, with a limited cash balance; current negative operating cash flows of approximately $250,000 per month; our deferral or delay of payments to vendors, suppliers and service providers; our balance of debts, liabilities and cash obligations that are either considered past due or that will become due in calendar 2015 of approximately $6.4 million as of December 31, 2014 and that has continued to increase, including continuing incurrence of interest, late fees and penalties; the terms of any financing, which may be highly dilutive and may include onerous terms; risk of inability to make necessary investments to effectively pursue our business plan; unwillingness of our suppliers, vendors and service providers to supply components or services or extend credit; potential lawsuits from claimants relating to past due balances, who may seek to seize our assets or assert other judicial remedies; and risk of a possible reduction or suspension of our operations, ultimately forcing us to declare bankruptcy, reorganize or go out of business, which may cause an investor to lose all or a significant portion of their investment. Our independent registered public accounting firm has indicated in their audit opinions that they have serious doubts about our ability to continue as a going concern. Further risks include unexpected costs and operating deficits, and lower than expected sales and revenues, if any; uncertain willingness and ability of customers to adopt new technologies and other factors that may affect further market acceptance, if our product is not accepted by our potential customers, it is unlikely that we will ever become profitable, adverse economic conditions; adverse results of any legal proceedings; the volatility of our operating results and financial condition; inability to attract or retain qualified senior management personnel, including sales and marketing personnel; our ability to establish and maintain the proprietary nature of our technology through the patent process, as well as our ability to possibly license from others patents and patent applications necessary to develop products; the Company’s ability to implement its long range business plan for various applications of its technology; the Company’s ability to enter into agreements with any necessary marketing and/or distribution partners; the impact of competition, the obtaining and maintenance of any necessary regulatory clearances applicable to applications of the Company’s technology; and management of growth and other risks and uncertainties that may be detailed from time to time in the Company’s reports filed with the Securities and Exchange Commission, which are available for review at www.sec.gov. This is not a solicitation to buy or sell securities and does not purport to be an analysis of the company’s financial position. See the Company’s most recent Annual Report on Form 10-K, and subsequent reports and other filings at www.sec.gov.

CONTACT:

Skyline Investor Relations Contact:

Phil Carlson

KCSA Strategic Communications

212-896-1233

skyline@kcsa.com

SOURCE: Skyline Medical, Inc.

ReleaseID: 428399