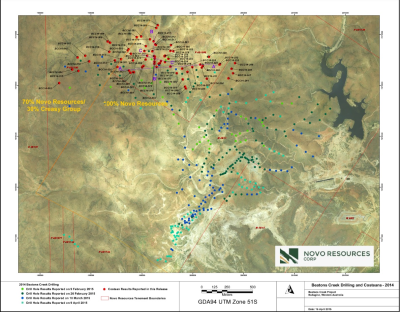

VANCOUVER, BC / ACCESSWIRE / April 21, 2015 / Novo Resources Corp. (CSE: NVO; OTCQX: NSRPF) (“Novo” or the “Company”) is pleased to announce assay results from costean (trench) bulk samples at its Beatons Creek gold project near Nullagine, Western Australia (please see attached Drill Hole Plan Map). Results include 0.6 m @ 7.13 gpt Au from costean BCC14-218, 0.9 m @ 6.17 gpt Au from costean BCC14-219, 0.9 m @ 7.21 gpt Au from costean BCC14-225, 0.9 m @ 4.82 gpt Au from costean BCC14-564, 1.0 m @ 10.21 gpt Au from costean BCC14-565, 1.0 m @ 4.74 gpt Au from costean BCC14-573, 0.9 m @ 7.47 gpt Au from costean BCC14-575, 0.9 m @ 5.86 gpt Au from costean BCC14-576, 0.8 m @ 6.84 gpt Au from costean BCC14-577, 1.0 m @ 9.79 gpt Au from costean BCC14-579, 0.8 m @ 5.12 gpt Au from costean BCC14-580, 1.5 m @ 9.72 gpt Au from costean BCC14-589, and 0.5 m @ 8.20 gpt Au from costean BCC14-592 (please see table titled “Beatons Creek Costean LeachWell Gold Results” and accompanying Drill Hole Plan Map and various Cross Sections). Costean samples were taken from thoroughly oxidized gold-bearing conglomerate (reef) material collected from shallow, approximately one-meter wide trenches dug using an excavator or by hand. Given their large size, these samples are considered bulk samples (45-60 kg).

“Gold assays from our first costean bulk samples are frequently higher than those seen in nearby reverse circulation drill holes,” commented Dr. Quinton Hennigh, President and CEO of Novo Resources Corp. “This likely relates to the larger volume of rock being sampled from costeans than from the drill holes. Also, costean samples are more representative of the unit being sampled because they are taken over widths of around a meter rather than limited to the narrow width of a reverse circulation drill hole. Lastly, costean samples are collected from top to bottom of a reef whereas reverse circulation drill samples are collected over one-meter intervals and commonly sample both reef and barren wall rock material resulting in diluted grades.”

Novo collected several hundred costean samples in October and November, 2014 and more recently in March and April, 2015. The 71 samples presented in this news release are from the northern part of the area being targeted for shallow, oxide gold mineralization that can potentially be developed into a modest, low-cost mine (please refer to multiple news releases issued by Novo during the latter half of 2014). Recent metallurgical work indicates mineralized reef material at Beatons Creek is potentially amenable to simple, inexpensive gravity processing (please refer to the Company’s news release dated December 10, 2014). Additional costean sample results will be released over the next few weeks.

Comparison of Costean Sampling and Reverse Circulation Drilling

Costean samples were taken using pneumatic hammers from thoroughly oxidized gold-bearing reef material exposed in shallow, approximately one-meter wide trenches dug using an excavator or by hand. Costean samples can be considered bulk samples given their large size (45-60 kg). Because costean samples are collected from the top to bottom of a gold-bearing conglomerate horizon over widths of around one meter, they can be considered representative of what is exposed in the trench.

In contrast, reverse circulation drill holes are much narrower (5 1/4 ” (0.133 m) diameter), resulting samples are smaller (17-20 kg), and samples are collected on one-meter intervals that may include both gold-bearing reef as well as barren wall rock material thus resulting in diluted grades.

Through various studies of gold-bearing conglomerates from Beatons Creek, Novo has determined the vast majority of gold occurs as coarse grains scattered in sandy and silty matrix material residing between boulders and cobbles that make up the framework of these conglomerates. Due to the erratic distribution of matrix material from place-to-place, results from costean samples and drill holes are expected to be markedly different. Figure 1 below illustrates reasons for these differences. Figure 2 shows photographs of a gold-bearing conglomerate horizon.

The Importance of Sample Size

In addition to the highly variable distribution of gold-bearing matrix material within conglomerates, gold mineralization is also nuggety. For this reason, Novo has implemented sampling protocols for both reverse circulation drill and costean sampling by which large samples are collected and processed for analysis.

Gold deposits displaying little or no nugget effect might require collection of small, 3-4 kg samples of drill cuttings, or approximately 10% of the material that comes from a one-meter interval from a 5 1/4 ” (0.133 m) diameter drill hole. At Beatons Creek, Novo determined that 50% of the drill cuttings (17-20 kg) must be collected to achieve acceptable variability. For costeans, a sample size of at least 40 kg is required.

Following processing (crushing and pulverizing), analysis is conducted on a very large, 3 kg split of pulverized material. Novo is primarily utilizing the LeachWell technique, a 6-hour accelerated CN leach and mass spectrometry for gold analysis. Figure 3 illustrates the need for large sample size in nuggety gold systems. Figure 4 is a photograph of coarse gold grains from Beatons Creek.

Costean samples announced in this news release utilize a 3 kg sample split as described above. It is important to note, however, that most drill results published to date (please refer to multiple news releases issued by Novo between February-April, 2015) are considered preliminary because they utilize a smaller, 1 kg split of material. This approach was used to reduce costs. Now that all preliminary drill results have returned, samples that contain appreciable gold will be subjected to full processing and analysis.

Critical Observations about Mining and Processing

Recent earthworks have provided invaluable data about the mineability of gold-bearing conglomerates at Beatons Creek. While constructing access roads in late 2014, it was noted that throughout the project area, oxidized bedrock is easily rippable using a bulldozer (Figure 5). Such observations suggest that drilling and blasting will not be needed to break up overburden. While digging costeans, it was found that gold-bearing conglomerate horizons are readily discernable from waste rock above and below them (Figure 6) indicating they can likely be selectively mined with minimal dilution. Gold-bearing matrix material readily breaks away from barren, hard quartz boulders (Figure 7) suggesting the latter can be selectively removed before processing thus potentially upgrading resulting mill feed as well as reducing the overall volume of material requiring processing.

Novo views recent results from reverse circulation and costean samples favourably, especially in light of the likelihood that appreciable gold recoveries (+80%) can be achieved by means of simple, low-cost gravity (+/- floatation) methods (please refer to Novo’s news release dated December 10, 2014). Additional metallurgical testing is currently underway looking at optimizing recovery as well as establishing a processing flow-sheet. Although these results are not due back for a few weeks, it is already certain that chemical processing (use of CN) will not be needed to treat oxide mineralization at Beatons Creek. Novo is of the view that permitting a mill and tailings facility for such a simple operation should be straightforward and achievable within a year.

Fast-Tracking Beatons Creek toward Production

In a news release dated April 2, 2015, Novo announced it completed the acquisition of a 100% interest in Beatons Creek from its joint venture partner, Millennium Minerals Ltd. Given this pivotal event, the Company is now set to fast-track Beatons Creek toward production.

Novo has recently settled on a conceptual mine site layout (Figure 8). Only oxide mineralization is considered in this mine plan. The proposed mill site is situated on a plateau away from any shallow oxide resources. A proposed valley tailings storage facility (TSF) is situated northwest of the mill. Lodging and office arrangements are available in Nullagine, thus eliminating the need to build a camp. The Nullagine power station is situated near the main access to site. It is anticipated that, with certain electrical upgrades, power from this plant is potentially available for mine use. Electrical needs will potentially fall between 800 Kw and 1 Mw.

In the latter half of 2014, Novo completed various floral environmental surveys. Final faunal surveys will be completed within a month. Various geochemical and hydrological surveys are underway as are drilling and trenching needed to provide data for permitting the TSF.

Advanced metallurgical testing is forthcoming and results are expected to provide a basis for determining a flow sheet for processing. Once in hand, analysis of the cost of building and operating a mill as well as projected metallurgical recoveries can be more formally evaluated to help determine potential economics of the project. Novo also anticipates further evaluating mining methods to better evaluate their costs.

“Since purchasing a 100% interest in the mining leases at Beatons Creek, we have been very busy laying out aggressive plans to advance this exciting project toward production,” commented Hennigh. “We have a lot of things working in our favour…shallow well-oxidized mineralization, simple cheap processing with potentially good recoveries, and proximity to Nullagine.”

Quality Control and Quality Assurance

Costean samples discussed in this news release were collected under the supervision of Dr. Quinton Hennigh, Novo’s Chief Executive Officer, President and Director. These samples were taken using pneumatic hammers from thoroughly oxidized gold-bearing reef material exposed in shallow, approximately one-meter wide trenches dug using an excavator or by hand. Costean samples can be considered bulk samples given their large size (45-60 kg). Because costean samples are collected from the top to bottom of a gold-bearing conglomerate horizon over widths of around one meter, they can be considered representative of what is exposed in the trench.

Costean samples were submitted to Genalysis Laboratories, Perth, WA for analysis. Preparation entails crushing the entire sample to -2 mm and pulverizing a 9 kg split to P80 -100 microns. A 3 kg split of pulverized material is subjected to the LeachWell technique, an accelerated CN leach (6 hour leach time) then subjected to analysis by mass spectrometry.

Dr. Quinton Hennigh, the Company’s Chief Executive Officer, President and Director and a Qualified Person as defined by National Instrument 43-101, has approved the technical contents of this news release.

About Novo Resources Corp.

Novo’s focus is to evaluate, acquire and explore gold properties. The company holds a 100% interest in the core of the Beatons Creek project and a 70% interest in approximately 1,800 square kilometers surrounding Beatons Creek and at nearby Marble Bar in the Pilbara region, Western Australia. For more information, please contact Leo Karabelas at (416) 543-3120 or e-mail leo@novoresources.com.

On Behalf of the Board of Directors,

Novo Resources Corp.

“Quinton Hennigh”

Quinton Hennigh

CEO and President

Forward-looking information

Some statements in this news release contain forward-looking information (within the meaning of Canadian securities legislation) including, without limitation, the statement as to the mining concept and statements as to the expected receipt of results from various exploration and testing activities. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, the ability to undertake and complete the planned exploration activities, the receipt of successful results as exploration proceeds, customary risks of the mineral resource exploration industry, dependency upon third parties, assumptions made by management of Novo, as well as Novo having sufficient cash to fund the planned drilling and other activities.

The Canadian Securities Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of the content of this news release.

|

Beatons Creek Costean LeachWell Gold Results |

||

|

Costean Sample Number |

True reef thickness (m) |

Au (gpt) |

|

BCC14-002 |

0.80 |

0.98 |

|

BCC14-004 |

0.60 |

0.55 |

|

BCC14-008 |

1.50 |

0.90 |

|

BCC14-009 |

1.65 |

0.77 |

|

BCC14-010 |

0.50 |

0.57 |

|

BCC14-012 |

0.90 |

0.96 |

|

BCC14-013 |

1.00 |

2.52 |

|

BCC14-014 |

0.85 |

0.43 |

|

BCC14-015 |

0.90 |

0.31 |

|

BCC14-016 |

0.86 |

0.48 |

|

BCC14-017 |

0.80 |

1.39 |

|

BCC14-018 |

0.80 |

0.40 |

|

BCC14-020 |

0.70 |

0.47 |

|

BCC14-200 |

0.92 |

1.09 |

|

BCC14-201 |

1.80 |

1.40 |

|

BCC14-202 |

1.00 |

1.33 |

|

BCC14-203 |

1.90 |

0.73 |

|

BCC14-204 |

0.80 |

2.26 |

|

BCC14-205 |

0.80 |

4.30 |

|

BCC14-208 |

0.60 |

0.93 |

|

BCC14-209 |

1.00 |

0.43 |

|

BCC14-211 |

0.90 |

3.05 |

|

BCC14-212 |

0.80 |

0.49 |

|

BCC14-213 |

0.65 |

1.57 |

|

BCC14-214 |

0.80 |

2.26 |

|

BCC14-215 |

2.00 |

0.79 |

|

BCC14-216 |

0.80 |

2.88 |

|

BCC14-217 |

1.80 |

0.93 |

|

BCC14-218 |

0.60 |

7.13 |

|

BCC14-219 |

0.90 |

6.17 |

|

BCC14-220 |

0.90 |

1.26 |

|

BCC14-222 |

1.90 |

0.59 |

|

BCC14-223 |

0.90 |

3.29 |

|

BCC14-224 |

0.95 |

3.23 |

|

BCC14-225 |

0.90 |

7.21 |

|

BCC14-226 |

0.60 |

6.01 |

|

BCC14-227 |

0.70 |

0.60 |

|

BCC14-228 |

1.80 |

1.34 |

|

BCC14-229 |

1.00 |

1.77 |

|

BCC14-230 |

1.00 |

0.53 |

|

BCC14-231 |

1.00 |

0.66 |

|

BCC14-232 |

0.80 |

0.81 |

|

BCC14-233 |

1.00 |

1.14 |

|

BCC14-234 |

1.00 |

1.64 |

|

BCC14-244 |

1.00 |

1.35 |

|

BCC14-247 |

0.90 |

0.55 |

|

BCC14-248 |

0.90 |

0.57 |

|

BCC14-249 |

1.90 |

1.20 |

|

BCC14-561 |

0.80 |

3.65 |

|

BCC14-564 |

0.90 |

4.82 |

|

BCC14-565 |

1.00 |

10.21 |

|

BCC14-566 |

0.50 |

7.70 |

|

BCC14-570 |

1.00 |

1.08 |

|

BCC14-571 |

0.60 |

0.93 |

|

BCC14-573 |

1.00 |

4.74 |

|

BCC14-574 |

0.90 |

2.73 |

|

BCC14-575 |

0.90 |

7.47 |

|

BCC14-576 |

0.90 |

5.86 |

|

BCC14-577 |

0.80 |

6.84 |

|

BCC14-578 |

0.80 |

4.84 |

|

BCC14-579 |

1.00 |

9.79 |

|

BCC14-580 |

0.80 |

5.12 |

|

BCC14-581 |

1.00 |

0.40 |

|

BCC14-584 |

0.80 |

1.45 |

|

BCC14-585 |

0.80 |

0.70 |

|

BCC14-586 |

0.80 |

1.74 |

|

BCC14-589 |

1.50 |

9.72 |

|

BCC14-590 |

0.40 |

3.51 |

|

BCC14-591 |

0.60 |

3.30 |

|

BCC14-592 |

0.50 |

8.20 |

|

BCC14-616 |

1.00 |

2.87 |

Drill Hole Plan Map

Click Image To View Full Size

Cross Section A – A’

Cross Section B – B’

Cross Section C – C’

Figure 1 (top): A schematic image of a 1 meter thick gold-bearing conglomerate comprised of boulders and cobbles (various shades of gray). Sandstone occurs above and below the conglomerate horizon. Boulders and cobbles are close-packed making the framework of the conglomerate very tight. Gold-bearing sand and silt (black) comprises the matrix between clasts and often contains iron oxide-filled cavities left behind after weathered pyrite. These iron oxide pits are usually a good indicator of gold.

Figure 1 (bottom): The same conglomerate bed as above. Pink vertical stripes indicate zones displaying little or no matrix material. Such zones would be expected to display low gold grades. Yellow stripes indicate zones where moderate amounts of matrix material are present. The green stripe is the only place where abundant matrix material is present. Gold grades would be expected to be highest from here. To help illustrate the variability resulting from drill sampling compared to costean sampling, a 5 1/4 ” reverse circulation drill stem and a one-meter wide costean are shown. Given the narrow width of drill holes, results are expected to be more variable than for costean samples. Also, drill samples are taken at one-meter intervals that may include significant amounts of barren wall rock material that can dilute grades whereas costean samples are carefully taken from top to bottom of the reef.

Figure 2 (left): Photograph of an outcrop of a one-meter thick, close-packed, gold-bearing boulder conglomerate horizon.

Figure 2 (center): Photograph of the same gold-bearing conglomerate horizon showing silty gold-bearing matrix material between close-packed boulders and cobbles. The hammer is about 30 cm long.

Figure 2 (right): Close-up photograph showing silty gold-bearing matrix material with iron oxide pits after weathered pyrite. Such pits are a good indicator of the presence of gold.

Figure 3: A grid of 25 square cells over a volume of rock (white) with randomly scattered coarse gold particles (brown) of various sizes. The two cells shaded in pink have just two small specks of gold each whereas the cell shaded in green has five particles of gold, one of which is quite large. In such a situation, it is imperative to take a large sample (more cells) in order to better evaluate gold grade.

Figure 4: Gold grains panned from approximately 12 kg of pulverized matrix material from a gold-bearing conglomerate at Beatons Creek. The coin is approximately 2 cm across. Gold grains range in size from about 50 microns to 1.4 mm across. A large sample size is required to evaluate grade of such nuggety gold mineralization. Novo is taking large drill and costean samples and analyzing large splits to achieve acceptable variability.

Figure 5: Earthworks conducted in late 2014. A D6 Caterpillar bulldozer easily rips oxidized bedrock material. Such observations suggest drilling and blasting will not be required for stripping overburden at Beatons Creek.

Figure 6: Gold-bearing conglomerate exposed in a costean. Note that sandstone layers above and below are easily distinguishable from the bouldery conglomerate horizon. Such strong visual boundaries should help maintain good grade control and therefore result in minimal mine dilution.

Figure 7: Gold-bearing conglomerate sample collected from a costean. Note that gold-bearing matrix material tends to break free from large quartz boulders suggesting that these barren boulders can be removed before milling, thus upgrading the remaining material and reducing the overall volume of rock requiring processing.

Figure 8: Schematic illustration of the planned oxide mine site at Beatons Creek. Novo anticipates developing resources on its 100% controlled ground before any surrounding areas. The oxide mining area is outlined in dark blue, the mill site in yellow and the TSF in green. Water for milling will be sourced from bore holes proximal to the Grants Hill Fault within the area outlined in light blue. The Nullagine power station is located immediately south of the main access route shown in magenta.

SOURCE: Novo Resources Corp.

ReleaseID: 428039