VANCOUVER, BC / ACCESSWIRE / April 28, 2015 / Eagle Hill Exploration Corporation (TSXV: EAG) (“Eagle Hill” or the “Company”) is pleased to announce the results of an independent Preliminary Economic Assessment (“PEA”) for its 100%-owned Windfall Lake Gold Project (“Windfall Lake” or the “Project”) in Quebec, Canada. All figures are quoted in Canadian dollars unless otherwise noted.

Conference call and webcast to discuss PEA results

Tuesday, April 28, 2015 • 1:30pm PST (4:30pm EST)

Conference call: 1-877-881-1303 • Webcast: www.eaglehillexploration.com

The PEA outlines the design of a 1,200 tonne per day (“tpd”) underground mine producing 106,200 ounces of payable gold annually for 7.8 years at an average total cash cost of $558/oz of gold (US$480/oz). At a base case gold price of US$1,200/oz the project has a pre-tax internal rate of return (“IRR”) of 23.6% and a pre-tax net present value discounted at 5% (“NPV5“) of $241.4 million. Initial project capital costs are estimated at $240.6 million. Eagle Hill intends to complete a pre-feasibility study for the Windfall Lake project by 2017. Next steps include extending the existing ramp and taking a bulk sample, drilling both from surface and underground with the objective of expanding and upgrading the quality of the resource and testing continuity of grade, and finalizing the various studies required for a pre-feasibility study.

“The results of the PEA are very encouraging, and we believe that optimization of the deposit and proposed mine construction plan could further improve project economics,” said David Christie, President & CEO of Eagle Hill. “Additional drilling at surface and at depth, along with underground drilling and a bulk sample, could both expand and upgrade the resource, bringing additional value to the project.”

PEA Highlights 1

|

Total LOM production

|

828,000 ounces of payable gold

|

|

Average LOM annual production

|

106,200 ounces of payable gold

|

|

Average LOM operating cash cost

|

C$547 per ounce (US$471)

|

|

LOM total cash cost

|

C$558 per ounce (US$480)

|

|

LOM total cash cost plus sustaining capital

|

C$623 per ounce (US$536)

|

|

Mine life

|

7.8 years

|

|

Throughput

|

1,200 tpd

|

|

Average mined grade

|

8.26 g/t gold

|

|

Gold recovery

|

95.7%

|

|

Pre-production capex

|

C$240.6 million (US$206.9 million)

|

|

Sustaining capex

|

C$53.5 million (US$46.0 million)

|

|

Pre-tax NPV5

|

C$241.4 million (US$207.6 million)

|

|

Pre-tax IRR and payback

|

23.6%, payback in 3.4 years

|

|

Post-tax NPV5

|

C$135.2 million (US$116.3 million)

|

|

Post-tax IRR and payback

|

17.2%, payback in 3.9 years

|

|

Base case gold price

|

US$1,200 per ounce

|

|

Base case exchange rate

|

US$0.86:C$1

|

| |

|

1 Operating cash cost = all on site operating costs. Total cash cost = operating cash cost plus royalties plus refining plus transport. Total cash cost plus sustaining = total cash cost plus sustaining capital costs (excludes initial capex).

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. There is no certainty the results of the PEA will be realized.

The PEA was led by TetraTech Inc.’s Canadian Mining Division (mine design, infrastructure and financial analysis), with contributions from Soutex Inc. (metallurgy and mill trade-off study), Golder & Associates Ltd. (environmental), WSP Global Inc. (tailings evaluation) and SRK Consulting (Canada), Inc. (mineral resource estimate). A technical report prepared in accordance with National Instrument 43-101 will be filed on SEDAR within 45 days.

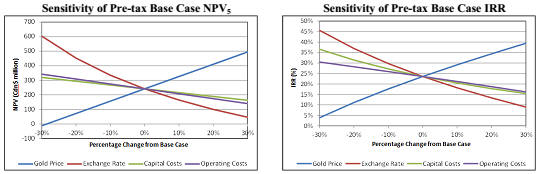

PEA Economic Results and Sensitivities

Project economics were calculated at a base case of US$1,200/oz and exchange rate of US$0.86:C$ 1, with sensitivities calculated to +/- 30%.

| |

Gold Price |

Pre-tax IRR |

Pre-tax NPV at variable discount rates |

| % Change |

(US$/oz) |

(%) |

($000) |

| |

|

|

0% |

3% |

5% |

8% |

| -30% |

840 |

3.9 |

55,274 |

10,707 |

12,360 |

39,359 |

| -20% |

960 |

11.1 |

170,264 |

106,031 |

72,210 |

31,844 |

| -10% |

1,080 |

17.6 |

285,253 |

201,355 |

156,781 |

103,048 |

| Base Case |

1,200 |

23.6 |

400,243 |

296,679 |

241,351 |

174,251 |

| +10% |

1,320 |

29.1 |

515,233 |

392,003 |

325,922 |

245,454 |

| +20% |

1,440 |

34.4 |

630,222 |

487,327 |

410,492 |

316,658 |

| +30% |

1,560 |

39.4 |

745,212 |

582,652 |

495,063 |

387,861 |

| |

|

|

|

|

|

|

| |

Gold Price |

Post-tax IRR |

Post-tax NPV at variable discount rates |

| % Change |

(US$/oz) |

(%) |

($000) |

| |

|

|

0% |

3% |

5% |

8% |

| -30% |

840 |

2.5 |

32,861 |

(6,080) |

(26,216) |

(49,743) |

| -20% |

960 |

8.0 |

109,317 |

58,432 |

31,704 |

(99) |

| -10% |

1,080 |

12.8 |

179,893 |

117,753 |

84,827 |

45,260 |

| Base Case |

1,200 |

17.2 |

247,321 |

174,201 |

135,242 |

88,141 |

| +10% |

1,320 |

21.1 |

312,047 |

228,286 |

183,489 |

129,104 |

| +20% |

1,440 |

24.8 |

374,713 |

280,556 |

230,061 |

168,574 |

| +30% |

1,560 |

28.2 |

435,809 |

331,340 |

275,202 |

206,697 |

| |

|

|

|

|

|

|

Project economics are most sensitive to the exchange rate and gold price and least sensitive to operating costs, as evidenced in the charts below.

To view an enhanced version of this chart, please visit:

https://orders.newsfilecorp.com/files/1654/15106_eagleh1_enhanced.jpg

| Capital Costs |

Pre-Production |

Sustaining |

Total |

|

Underground mining

|

$43.2 M |

$39.3 M |

$82.5 M |

|

Processing

|

$51.0 M |

– |

$51.0 M |

|

Tailings and water facility

|

$18.8 M |

$4.1 M |

$22.9 M |

|

Site Infrastructure

|

$45.1 M |

– |

$45.1 M |

|

|

|

|

|

|

Indirect capital

|

$27.0 M |

$1.2 M |

$28.2 M |

|

Owner’s cost

|

$15.5 M |

– |

$15.5 M |

|

Incl. pre-production opex ($3 M)

|

|

|

|

|

Incl. royalty purchase ($1 M)

|

|

|

|

|

|

|

|

|

|

Contingency

|

$39.9 M |

$8.9 M |

$48.8 M |

|

Total

|

$240.6 M |

$53.5 M |

$294.1 M |

| |

|

|

|

|

Operating Costs

|

Cost / tonne |

Cost / oz |

| Underground mining |

$76.0 |

$299.4 |

| Processing |

$35.7 |

$140.6 |

| G&A |

$9.0 |

$35.3 |

| Site services |

$18.3 |

$71.9 |

| Royalties |

$1.8 |

$6.96 |

| Refining, transport, insurance |

$0.7 |

$2.75 |

| Deductions |

$0.4 |

$1.4 |

| Total cash costs |

$141.7 |

$558.4 |

| Sustaining capital |

$16.4 |

$64.6 |

| Total cash costs plus sustaining |

$158.1 |

$623.0 |

| |

|

|

PEA Production Estimates by Year

| |

|

|

Year |

Year |

Year |

Year |

Year |

Year |

Year |

Year |

Year |

Year |

| Life-of-Mine |

|

|

-2 |

-1 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

| Mine production |

tonnes |

3,263,000 |

|

68,000 |

420,000 |

420,000 |

420,000 |

420,000 |

420,000 |

420,000 |

420,000 |

255,000 |

| Mill production |

tonnes |

3,263,000 |

|

– |

420,000 |

420,000 |

420,000 |

420,000 |

420,000 |

420,000 |

420,000 |

323,000 |

| Gold grade |

g/t |

8.26 |

|

– |

7.90 |

8.21 |

8.08 |

9.08 |

8.05 |

8.15 |

8.04 |

8.63 |

| Contained metal |

oz |

866,314 |

|

– |

106,613 |

110,839 |

109,143 |

122,646 |

108,673 |

110,029 |

108,585 |

89,786 |

| Recovery |

|

95.7% |

|

|

|

|

|

|

|

|

|

|

| Recovered metal |

oz |

829,063 |

|

– |

102,029 |

106,073 |

104,450 |

117,373 |

104,000 |

105,298 |

103,916 |

85,925 |

| Payable metal |

oz |

828,234 |

|

– |

101,927 |

105,967 |

104,345 |

117,255 |

103,896 |

105,193 |

103,812 |

85,839 |

| Total cash cost |

$/oz |

558.4 |

|

– |

565.7 |

557.4 |

576.6 |

516.5 |

586.3 |

588.3 |

580.0 |

499.5 |

| Pre-tax cash flow |

$000 |

400,243 |

(83,704) |

(156,900) |

50,153 |

78,890 |

72,448 |

93,274 |

83,687 |

87,048 |

84,981 |

92,053 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Mining and Processing

For the purposes of the PEA, mineral resources in all categories have been considered in the mining evaluation, including the vertical interval from surface to 890 m below surface. Over the vertical interval from surface to the 890 Level, the potentially mineable resource consists of gold lenses with a wide variation in thickness from approximately 2 to 32 m, with the majority dipping at 85° to 90°. There are a number of shallow lenses or zones that dip at approximately 40° to 45°, some of which are high-grade areas. The zones strike nominally southwest-northeast with varying strike lengths up to approximately 150 m.

The mine plan assumes an underground mining operation using the existing ramp and the development of another portal to access the western portion of the deposit. Both ramps will be connected at approximately 180 m below surface. The predominant extraction method is longitudinal longhole retreat with cemented rockfill for the subvertical lenses (69% of the production) and mechanized cut and fill (19%) for the inclined lenses, including the high-grade crustiform veins. Both methods are commonly used in underground mining operations in accordance with industry standard practices, proven trackless equipment, and a well-established labour skillset. The remaining portion of production (12%) will come from sill development to prepare and access the longhole stopes.

Long section of mine schedule for Zone 27

To view an enhanced version of the Long section of mine schedule for Zone 27, please visit:

https://orders.newsfilecorp.com/files/1654/15106_eagleh2_enhanced.jpg

Underground

production |

Production per

mining method |

Cost per tonne

(C$) |

External dilution |

Grade of external

dilution (g/t) |

| Sill |

12% |

42.24 |

– |

– |

| Mechanized cut and fill |

19% |

85.85 |

10.0% |

0.67 |

| Longhole |

69% |

68.65 |

16.6% |

1.19 |

| Total |

100% |

75.99 |

15.3% |

1.12 |

| |

|

|

|

|

The mining production schedule comprises a total of 3,263,474 tonnes grading 8.26 g/t gold for a total of 866,000 contained ounces, obtained from 2,979,874 tonnes of material located inside the mine shapes plus 455,363 tonnes of external dilution. The external dilution is established at 16.6% grading 1.19 g/t gold for the longhole mining shapes, and 10% at a grade of 0.67 g/t gold for the mechanized cut and fill mining shapes. Of the mining material, 50.4% comes from mineralization included in the indicated category of the mineral resource and 49.6% comes from the inferred category. The mining shapes were built using a 5 g/t cut-off grade inside the mineral resource.

The bulk of gold mineralization in the Main Zone is associated with pyrite stockwork. The pyrite stockwork also contains minor amounts of sphalerite, pyrrhotite, arsenopyrite, tetrahedrite and bismuth sulfosalts. The distribution of the pyrite stockwork is greatly influenced by the geometry of porphyry dikes, specifically for Zone 27 and the Caribou corridor. Some of the fragments in porphyry dikes were altered and mineralized prior to being brecciated and porphyry dikes locally crosscut the pyrite stockwork mineralization, suggesting that emplacement of the gold mineralization was broadly coeval with the intrusion of the porphyry dikes.

A second style of gold mineralization is locally associated with moderately dipping, northeast-trending, brecciated quartz veins with colloform and crustiform banding. With a minimum width of 0.5 m and an average width of approximately 1.5 m the colloform-crustiform veins can reach a thickness of nearly 6 m, locally. Although not volumetrically important, this type of vein represents very high-grade lenses cross-cutting the pyrite stockwork.

Metallurgical test work completed on several Windfall Lake samples provided sufficient data to design the appropriate process flowsheet for Windfall Lake mineralization. The Windfall Lake precious metals bearing mineralization is amenable to recovery by conventional processing routes. Gold recovery is estimated at 95.7% and silver recovery is expected to be around 74%, based on a process that incorporates flotation of the ground material followed by the cyanide leaching of both flotation products, although silver recovery was not assumed in the PEA. Cyanide from the flotation concentrate stream and one for the flotation tails stream will be eliminated in a cyanide destruction tank with an SO2-air process using metabisulphite. Copper sulphate will be added as needed to catalyze the cyanide destruction reaction. Once the cyanide is destroyed, the non-sulphide tails and the sulphide-rich tails will be gravity fed for disposal in the tailings pond.

As part of the PEA study, Eagle Hill personnel completed a number of high-level trade-off studies with respect to mill location. Three options were considered: having the mill on site adjacent to the deposit, using a third-party mill, or locating the mill near the closest community of Lebel-sur-Quévillon. It was apparent, based on these early studies, that the most economic option is to locate the mill on site, using liquefied natural gas electric generation on site to power both the mine and mill.

Three power options were also considered: bringing hydro electricity lines to site, or using either liquefied natural gas or diesel power generation on site. While using liquefied natural gas power generation is currently considered the most cost effective option, with a generation cost of $0.172 per kwh, Eagle Hill will continue to review power options as the project advances with the objective of reducing operating costs.

Eagle Hill is located within the region covered by Quebec’s Plan Nord. The Plan Nord is intended to support projects that enhance and develop the economic potential of Northern Quebec, while ensuring that development proceeds in a sustainable and responsible way that safeguards the environment and the needs of local communities. One of the Plan Nord objectives is to ensure competitively priced power for mine development through extension of the power transmission grid where possible, and negotiation of competitively-priced natural gas and liquefied natural gas for the region. Eagle Hill will monitor Plan Nord initiatives as they are implemented to identify opportunities to enhance the Windfall Lake economics.

Permitting, Environment and Community Relations

The Project is located north of the 49th parallel (49°N) and as such is subject to the provisions of the James Bay and Northern Québec Agreement executed in 1975. The Project is located on Category III lands and Aboriginals have shown an interest in the territory. In October 2012, Eagle Hill signed an Advanced Exploration Agreement with the Cree First Nation of Waswanipi, the Grand Council of the Crees, the Cree Regional Authority and the Waswanipi Development Corporation regarding exploration and development of the Windfall Lake Project. Eagle Hill’s senior management team continues to work closely with the Cree to ensure that the Cree are involved at each stage of development to maximize benefits through training and employment opportunities for the Cree community members.

Eagle Hill believes development of Windfall Lake would bring substantial benefits to local communities, both directly and indirectly. Eagle Hill’s senior team is actively engaged with the local communities of Lebel-sur-Quévillon, Waswanipi and Val-d’Or through dialogue and presentations to ensure community members are apprised of project developments. As the Project progresses, Eagle Hill will develop a formal communication and consultation plan to engage both the Aboriginal and non-Aboriginal stakeholders. The objectives of these activities will be to inform and consult the First Nations and the public on the Project activities, to answer questions and address their concerns, and to solicit feedback. Other agreements will need to be negotiated with the First Nations involved as the Project progresses.

Since 2007, several environmental studies and reports have been completed for the Project. Complementary studies and fieldwork will be undertaken as the Project progresses to pre-feasibility. In particular, Eagle Hill will need to complete an environmental baseline study and characterize the chemistry of dewatering mine water, as well as mineralized material and waste rock.

Noront Resources, a previous operator at Windfall Lake, carried out advanced underground exploration activities under a certificate of authorization issued in December 2007 under Section 22 of the Environment Quality Act. The certificate of authorization remains valid, and Eagle Hill expects to transfer the certificate for its planned underground development activities. An additional certificate of authorization will be required to dewater the existing ramp.

Updated Mineral Resource Estimate

The basis for the PEA is the mineral resource estimate prepared by SRK Consulting (Canada), Inc. with an effective date of November 13, 2014. The November 2014 resource estimate is an update to the previous report issued in March 2014, based on re-logging of archived core, structural geology investigations, and modifications to the geological and gold mineralization wireframe models. These changes improved confidence in the modeled continuity of the gold mineralization found at Windfall Lake. The November 2014 resource included all drilling data up to July 28, 2014, but did not include 2,029 metres of deep drilling from five extended boreholes that was completed during the summer and fall of 2014. With additional drilling, Eagle Hill believes there is an opportunity to upgrade the mineral resource classification within the currently modeled geological and mineralization wireframes, in particular through the Caribou corridor and within the pyrite stockwork adjacent to modeled grade domains. Eagle Hill also believes there is potential to extend mineralization at depth below the Red Dog intrusion (“Red Dog”), where previous drilling intersected significant gold mineralization but is too widely spaced for inclusion in the mineral resource estimate.

Using a gold price of US$1,200 per ounce and a cut-off grade of 3 g/t gold, mineral resources for the Windfall Lake Gold Project are estimated at:

Mineral Resource Statement, Windfall Lake Gold Project, Quebec 1

SRK Consulting (Canada) Inc., November 13, 2014

| Classification / Zone |

|

Tonnes |

|

|

Grade |

|

|

Gold |

|

| |

|

|

|

|

(g/t) |

|

|

(ounces) |

|

| Indicated |

|

|

|

|

|

|

|

|

|

| Zone 27 |

|

1,714,000 |

|

|

8.48 |

|

|

468,000 |

|

| Caribou |

|

910,000 |

|

|

6.99 |

|

|

204,000 |

|

| Mallard |

|

123,000 |

|

|

10.29 |

|

|

41,000 |

|

| Colloform Quartz Veins |

|

16,000 |

|

|

70.67 |

|

|

35,000 |

|

| Total Indicated (Main Zone) |

|

2,762,000 |

|

|

8.42 |

|

|

748,000 |

|

| Inferred |

|

|

|

|

|

|

|

|

|

| Zone 27 |

|

335,000 |

|

|

6.16 |

|

|

66,000 |

|

| Caribou |

|

336,000 |

|

|

4.90 |

|

|

53,000 |

|

| Mallard |

|

85,000 |

|

|

11.27 |

|

|

31,000 |

|

| Colloform Quartz Veins |

|

154,000 |

|

|

18.68 |

|

|

92,000 |

|

| Below Red Dog |

|

447,000 |

|

|

9.14 |

|

|

131,000 |

|

| Main Zone Subtotal |

|

1,357,000 |

|

|

8.57 |

|

|

242,000 |

|

| F17 Zone |

|

167,000 |

|

|

7.51 |

|

|

40,000 |

|

| F51 Zone |

|

47,000 |

|

|

4.43 |

|

|

7,000 |

|

| Pyrite Stockwork |

|

1,665,000 |

|

|

7.55 |

|

|

404,000 |

|

| Red Dog Sill/Dikes |

|

248,000 |

|

|

4.04 |

|

|

32,000 |

|

| Fragmental Dike |

|

34,000 |

|

|

3.99 |

|

|

4,000 |

|

| Total Inferred |

|

3,512,000 |

|

|

7.62 |

|

|

860,000 |

|

| |

|

|

|

|

|

|

|

|

|

Reconciliation of Mineral Resource Statements 1

| |

Inferred Category |

Indicated Category |

| |

Quantity |

Gold |

Contained |

Quantity |

Gold |

Contained |

| |

(tonnes) |

Grade (g/t) |

Gold (ounces) |

(tonnes) |

Grade (g/t) |

Gold (ounces) |

| March 2014 |

3,084,000 |

7.37 |

731,000 |

2,375,000 |

9.75 |

744,000 |

| November 2014 |

3,512,000 |

7.62 |

860,000 |

2,762,000 |

8.42 |

748,000 |

| Change from March 2014 |

+14% |

+3% |

+18% |

+16% |

-14% |

+1% |

| |

|

|

|

|

|

|

| 1. |

Both resource estimates were calculated by SRK Consulting (Canada) Inc. using a 3 g/t cut-off grade, assuming an underground extraction scenario with an assumed gold price of US$1,200 per ounce. The March 2014 resource estimate assumed metallurgical recovery of 91.7%, with an effective date of March 3, 2014. The November 2014 resource estimate assumed metallurgical recovery of 96%, with an effective date of November 23, 2014. All figures have been rounded to reflect the relative accuracy of the estimates. Inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher category. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

|

Surface Projection of Windfall Lake Gold Mineralization

To view an enhanced version of the Surface Projection of Windfall Lake Gold Mineralization, please visit:

https://orders.newsfilecorp.com/files/1654/15106_eagleh3_enhanced.jpg

Opportunities and Recommendations

Eagle Hill and the PEA consultants have identified a number of opportunities to optimize the project.

Power supply optimization. The PEA base case assumes LNG generation with a $0.172/kwh ($12.73/tonne) operating cost and $17 million capital cost. Eagle Hill will review the opportunity to bring hydro power to site ($0.055/kwh), which would reduce Project operating costs and help reduce the cut-off grade.

Additional exploration to expand and upgrade the resource. Additional drilling not included in the PEA confirms that mineralization continues at depth below the Red Dog intrusion and to the west along strike with the main deposit. The PEA recommends completing infill drilling to convert a maximum amount of the inferred resource into the indicated category prior to the next level of study. An underground exploration program is recommended to gain additional confidence in grade continuity of the deposit through underground mapping and definition drilling. Eagle Hill intends to extend the existing ramp by approximately 2,000 metres and take a bulk sample from three different lenses in three locations, generating over 25,000 tonnes of material. Eagle Hill also plans to drill from both surface and underground with the objective of expanding and upgrading the quality of the resource and gaining confidence in the deposit, from a grade and geometry point of view and also from a metallurgy point of view. In addition, Eagle Hill is planning surface exploration at the property scale to explore a number of untested geophysical, geological and geochemical anomalies identified on the large 12,400-hectare property.

Potential to Expand the Resource below Red Dog

To view an enhanced version of this image, please visit:

https://orders.newsfilecorp.com/files/1654/15106_eagleh4_enhanced.jpg

Silver credits. The existing mineral resource estimate and project economics do not include any value for silver credits, although a sub-set of drill core assay results indicates that the project exhibits a 1:1 gold:silver ratio. Eagle Hill will assay historical sample pulps for silver with the objective of enhancing the project economics by including silver credits in the pre-feasibility study.

Project optimization. Pre-feasibility work will include a trade-off study to compare the merits of extending the existing ramp or using a shaft to access mineralization. Drilling in 2013 and 2014 identified the potential for significant mineralization at depth, below the Red Dog intrusion. If additional drilling is successful and Eagle Hill is able to greatly expand the mineral resource below 600 metres, the project would likely be redesigned to use a shaft rather than the ramps contemplated in the PEA. Shaft access to deeper areas would make it more effective to move material, people and equipment, improving project economics. Mining optimization will also look at improved stope design to reduce dilution. There are also opportunities to potentially reduce the consumption of cyanide in the flotation concentrate by instituting a cyanide recovery process, and to reduce consumable costs such as compressed air by installing an oxygen generator.

Technical studies. The PEA also recommends undertaking additional environmental base line work and further validation of the tailings storage facility design, with technical studies focused on hydrogeological and geotechnical examinations of crown pillar, stope spans and the proposed tailings storage facility location.

“Completion of the PEA is an important milestone for the Windfall Lake project, and lays the foundation to transition Eagle Hill from the exploration stage to a company focused on developing a high-grade gold project,” continued Mr. Christie. “With preliminary economics in hand, Eagle Hill is planning a significant exploration and technical program to advance the project to pre-feasibility, with the potential to move quickly to feasibility.”

Mr. Christie also noted that, “Concurrent with pre-feasibility work, Eagle Hill is preparing for a property-scale exploration program during Summer 2015 to define new targets, and a deep drilling program to infill drill the mineralization found below Red Dog.”

On Behalf of the Board of Directors

“David Christie“

President & CEO

About Eagle Hill Exploration Corporation

Eagle Hill Exploration Corporation is a Canadian mineral exploration company focused on the exploration and development of the high-grade Windfall Lake gold deposit, located between Val-d’Or and Chibougamau in Quebec, Canada. The bulk of the mineralization occurs in the Main Zone, a southwest/northeast trending zone of stacked mineralized lenses, measuring approximately 600 metres wide and at least 1,400 metres long. The deposit remains open at depth and along strike. Additional exploration and technical work is planned for 2015 and 2016 as the project advances to pre-feasibility. More information is available at www.eaglehillexploration.com.

Eagle Hill Contacts

David Christie

President & CEO

Telephone: 647-253-1144

Email:info@eaglehillexploration.com

Rhylin Bailie

Vice President, Communications & Investor Relations

Telephone: 604-697-5791

Email:info@eaglehillexploration.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Qualified Person

The Windfall Lake Project is under the direct supervision of Jean-Philippe Desrochers, PhD, PGeo, Eagle Hill’s Vice President Exploration, and Paul-Henri Girard, Eng, a Director of Eagle Hill, both of whom have sufficient experience relevant to the style of mineralization under consideration and qualifies as a Qualified Person (“QP”) as defined by National Instrument 43-101 (“NI 43-101”). The scientific and technical content of this press release has also been reviewed by Eagle Hill’s QPs.

In addition, each of the individuals listed below are independent QPs for the purposes of NI 43-101. All scientific and technical information in this press release in respect of the Windfall Lake Project or the PEA is based upon information prepared by or under the supervision of those individuals.

For TetraTech Inc.’s Canadian Mining Division, Mike McLaughlin, PEng (mining); for Golder & Associates Ltd., Rodrigue Ouellet, Eng (Environment); for WSP Global Inc., Marie-Claude Dion, Eng (tailings and water storage facility); for Soutex Inc., Pierre Roy, Eng (metallurgy and processing). The geological model was constructed by Dr. Jean-François Ravenelle, PGeo, and Dominic Chartier, PGeo. The Mineral Resource Statement was prepared by Mr. Chartier with the assistance of Dr. Jean-François Couture, PGeo. Dr. Ravenelle, Mr. Chartier and Dr. Couture are full-time employees of SRK Consulting (Canada) Inc. and QPs under NI 43-101, and are independent of the Company.

Quality Control / Quality Assurance

Eagle Hill implemented stringent field procedures in 2009. Core samples were submitted to the International Organization for Standardization (ISO)-accredited ALS Minerals Laboratories (ALS Minerals) in Val-d’Or for sample preparation and analyses. The reliability of the analytical results was monitored using external quality control samples (blank, certified reference material, and duplicate). In addition, a suite of pulps prepared by ALS Minerals was submitted to an umpire laboratory for check assaying. After review, SRK concludes that the sampling preparation, security, and analytical procedures used by Eagle Hill between 2009 and 2014 are consistent with generally accepted industry best practices. There is no evidence that the sampling and analytical procedures introduce a bias.

Cautionary Note Regarding Forward-looking Statements

This document contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). The use of any of the words “intends”, “objective”, “could”, “would”, “will”, “will be”, “will continue”, “will develop”, “will review”, “intended”, “proceeds”, “need to”, “expects to”, “planned”, “plans”, “planning’, “advance”, “opportunity”, “potential” and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Such forward-looking statements should not be unduly relied upon. This document contains forward-looking statements and assumptions pertaining to the following: uncertainty as a result of the preliminary nature of the PEA and the Company’s ability to realize the results of the PEA; uncertainty regarding the inclusion of inferred resources in the mineral resource estimate and the Company’s ability to upgrade the inferred mineral resources to a higher category; uncertainty regarding the ability to convert any part of the mineral resource into mineral reserves; uncertainty involving resource estimates and the ability to extract those resources economically, or at all; uncertainty involving drilling programs and the Company’s ability to expand and upgrade existing resource estimates; uncertainties regarding the market price for gold and its effect on project economics; uncertainties regarding the C$:US$ exchange rate and its effect on project economics; the regulatory process and actions; the need to work with local communities and authorities to advance the properties; the need to work with Dundee Corporation and Southern Arc Minerals to advance the property; technical issues; new legislation; competitive factors and conditions; uncertainties resulting from potential delays or changes in plans; the occurrence of unexpected events; and the Company’s ability to execute and implement future plans. Actual results achieved may vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors, including uncertainty related to drill results and the inclusion of drill results in future resource estimates for the property. The Company believes the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct.

SOURCE: Eagle Hill Exploration Corporation

ReleaseID: 428275