Advanced Accelerator Applications Receives FDA Fast Track Designation for Lutathera for the Treatment of Midgut Neuroendocrine Tumors

SAINT GENIS POUILLY, FRANCE / ACCESSWIRE / June 15, 2015 / Advanced Accelerator Applications S.A. (“AAA” or “The Company”), an international specialist in Molecular Nuclear Medicine (MNM), today announced its financial results for the first quarter of 2015.

Recent Highlights

Reported an increase in year-on-year sales of 24.5% for Q1 2015 compared to Q1 2014.

Received FDA Fast Track Designation for key drug candidate Lutathera for the treatment of patients with inoperable, progressive, well-differentiated, somatostatin receptor-positive carcinoid tumors of the midgut

Received Cohort Temporary Authorization for use of Lutathera in France for the treatment of midgut neuroendocrine tumors (NETs)

Received approval of Lutathera compassionate use program in Denmark

Enrolled first patients in a Phase I/II clinical trial for diagnostic candidate Annexin V-128 in rheumatoid arthritis and ankylosing spondylitis·

Signed supply distribution agreement with Lantheus Medical Imaging, Inc. for NEUROLITE(R) (kit for the preparation of Technetium Tc99m Bicisate for injection) for France and Spain

Commenting on the first quarter performance, AAA’s CEO Stefano Buono said: “I am pleased to announce that AAA is performing according to plans or better on both financial and clinical fronts. AAA continues to establish efficiencies in manufacturing, logistics, and financial discipline as we prepare for our global launch of Lutathera.“

“We believe that Lutathera provides the potential to significantly impact how physicians treat NETsoverexpressing somatostatin receptors in the near future. The Fast Track Designation received from the FDA is an important step in broadening the treatment options for these patients, and highlights the significant impact nuclear medicine can play within the treatment paradigm. We expect the results to demonstrate a clinically important and statistically robust improvement in progression-free survival for patients treated with Lutathera.”

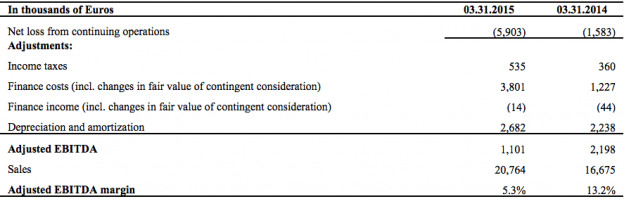

First Quarter 2015 Financial Results

Total sales for Q1 2015 were €20.8 million (USD(1) 23.4 million), a 24.5% year-on-year increase

compared to €16.7 million (USD(1) 18.8 million) in Q1 2014.

For the quarter ending March 31, 2015, operating loss was €1.6 million (USD(1) 1.8 million),

compared to €40K (USD(1) 45K) for the comparable period in 2014.

Net loss for the first quarter 2015 was €5.9 million (USD(1) 6.7 million) versus a net loss for the first quarter 2014 of €1.6 million (USD(1) 1.8 million), a net loss increase of €4.3 million (USD(1) 4.8 million).

Adjusted EBITDA for the quarter ended March 31, 2015 was €1.1 million (USD(1) 1.2 million)

compared to €2.2 million (USD(1) 2.5 million) for the first quarter of 2014, a decrease of €1.1 million (USD(1) 1.2 million).

As of March 31, 2015 the Company had cash and cash equivalents of €39.1 million (USD(2) 42.5 million).

(1) Translated solely for convenience into USD. Applied for income statement of first quarter of 2015 and 2014 is an exchange rate of €1 = USD 1.127 (average for the first quarter of 2015).

(2) Translated solely for convenience into USD. Applied for cash and cash equivalents at the end of the first quarter of 2015 is an exchange rate of €1 = USD 1.085 (rate of March 31st).

Fast Track Designation

The US Food and Drug Administration (FDA) has granted Lutathera Fast Track Designation for the treatment of midgut neuroendocrine tumors (midgut NETs). The New Drug Application (NDA) will also provide data corresponding to previous trials in gastroenteropancreatic neuroendocrine tumors (GEP-NETs).

Lutathera is a novel compound currently in Phase III for the treatment of patients with inoperable, progressive, well-differentiated carcinoid tumors of the midgut (jejunum, ileum, appendix, ascending colon). Lutathera selectively targets somatostatin receptors, which are over-expressed in NETs.

About 80% of all NETs overexpress somatostatin receptors (particularly sstr2). Lutathera is a radiolabeled somatostatin analogue that has a very high affinity for sstr2. Its mechanism of action consists in releasing radiation (high energy electrons) after internalization in the tumor cells through sstr2. A complete treatment consists of only four injections, one every 6-8 weeks.

Lutathera is currently in a pivotal Phase III trial for the treatment of midgut NETs in 51 clinical centers in the United States and the EU (the NETTER-1 clinical study). Patient recruitment was completed in February 2015 and the number of events (74) needed to assess the primary endpoint (Progression-Free Survival) has been reached. Results will be disclosed in September 2015, during the ESMO congress in Vienna.

About Advanced Accelerator Applications

Advanced Accelerator Applications (AAA) is a radiopharmaceutical company founded in 2002 to develop innovative diagnostic and therapeutic products. AAA’s main focus is in the field of Molecular Imaging and targeted, individualized therapy for the management of patients with serious conditions (“Personalized Medicine”). AAA currently has 17 production and R&D facilities able to manufacture both diagnostics and therapeutic MNM products, and has over 340 employees in 11 countries (France, Italy, UK, Germany, Switzerland, Spain, Poland, Portugal, Israel, U.S. and Canada). In 2014 AAA reported sales of €69.9 million (+29.9% vs. 2013). For more information please visit: www.adacap.com

About Lutathera and ongoing clinical trials

Lutathera (or 177Lu-DOTATATE) is a Lu-177-labeled somatostatin analogue peptide currently under development for the treatment of gastroenteropancreatic neuroendocrine tumors (GEP-NETs). This novel compound has received orphan drug designation from the European Medicines Agency (EMA) and the US Food and Drug Administration (FDA), which provides post market authorization exclusivity in the US (7 years), and Europe (10 years). It has been approved for treatment of all NETs on a compassionate use and named patient basis in ten European countries.

Lutathera belongs to an emerging form of treatments called Peptide Receptor Radionuclide Therapy (PRRT) which involves targeting carcinoid tumors with radiolabeled somatostatin analogue peptides.

There is a real unmet medical need for an effective treatment of inoperable, advanced NETs and there are currently no therapeutic options available for patients with NETs other than pancreatic (about 10% of NETs are pancreatic) who are progressive under somatostatin analogues. Currently at the end of its Phase III development with the NETTER-1 pivotal study, Lutathera is the most advanced candidate in development for PRRT.

NETTER-1 is an international, multi-center, randomized, Phase III study comparing treatment with Lutathera to a double dose of Octreotide LAR in patients with inoperable, progressive under Octreotide LAR treatment, midgut carcinoids (midgut NETs) overexpressing somatostatin receptors. The primary endpoint of the trial is the assessment of progression-free survival. Secondary endpoints include safety, objective response rate, time to tumor progression, overall survival and quality of life. The study is conducted in 51 clinical centers in the United States and Europe. Enrollment was completed in February 2015 and 74 events are expected to meet the primary endpoint. Lutathera is aiming at covering an unmet medical need, as after progression from “cold” analogues of somatostatin such as Octreotide LAR (Novartis) or Somatuline (Ipsen), there are no alternative therapies approved in this indication.

About Molecular Nuclear Medicine (“MNM”)

Molecular Nuclear Medicine is a medical specialty using trace amounts of active substances, called radiopharmaceuticals, to create images of organs and lesions and to treat various diseases, like cancer. The technique works by injecting targeted radiopharmaceuticals into the patient’s body that accumulate in the organs or lesions and reveal specific biochemical processes. Molecular Nuclear Diagnostics employs a variety of imaging devices and radiopharmaceuticals. PET (Positron Emission Tomography) and SPECT (Single Photon Emission Tomography) are highly sensitive imaging technologies that enable physicians to diagnose different types of cancer, cardiovascular diseases, neurological disorders and other diseases in their early stages.

*Reconciliation of EBITDA to net loss for Q1 2015 from continuing operations

Cautionary Statement Regarding Forward-Looking Statements

This press release may contain forward-looking statements. All statements, other than statements of historical facts, contained in this press release, including statements regarding the Company’s strategy, future operations, future financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements reflect the Company’s current expectation regarding future events. These forward-looking statements involve risks and uncertainties that may cause actual results, events or developments to be materially different from any future results, events or developments expressed or implied by such forward-looking statements. Such factors include, but are not limited to, changing market conditions, the successful and timely completion of clinical studies, EMA, US FDA and other regulatory approvals for our product candidates, the establishment of corporate alliances, the impact of competitive products and pricing, new product development, and uncertainties related to the regulatory approval process or the ability to obtain drug product in sufficient quantity or at standards acceptable to health regulatory authorities to complete clinical trials or to meet commercial demand. Except as required by applicable securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Contacts:

AAA Media Relations

Laetitia Defaye

Head of Corporate Communications

laetitia.defaye@adacap.com

Tel: +33 (0)6 86 65 73 52

Véronique Mermet

Communications Officer

info@adacap.com

Tel: +33 (0)4 50 99 30 70

AAA Investor Relations

Jordan Silverstein

Director of Investor Relations

jordan.silverstein@adacap.com

Tel: + 1-212-235-2394

Media enquiries:

FTI Consulting (UK)

Julia Phillips

Julia.Phillips@fticonsulting.com

Tel: +44 (0)203 727 1000

Natalie Garland-Collins

Natalie.Garland-Collins@fticonsulting.com

Tel: +44 (0)203 727 1000

iCorporate (Italy)

Elisa Piacentino

elisa.piacentino@icorporate.it

Tel: +39 02 4678754 – +39 366 9134595

JV Public Relations NY (US)

Janet Vasquez

jvasquez@jvprny.com

Tel: + 1-212- 645-5498 – +1-917- 569-7470

SOURCE: Advanced Accelerator Applications

ReleaseID: 429819