Q3 Revenues and Gross Profit Continue Strong Trend

ST. JOHN’S, NL / ACCESSWIRE / August 31, 2015 / Bluedrop Performance Learning “Bluedrop” (TSX-V: BPL) today reported its financial results for the three months ended June 30, 2015.

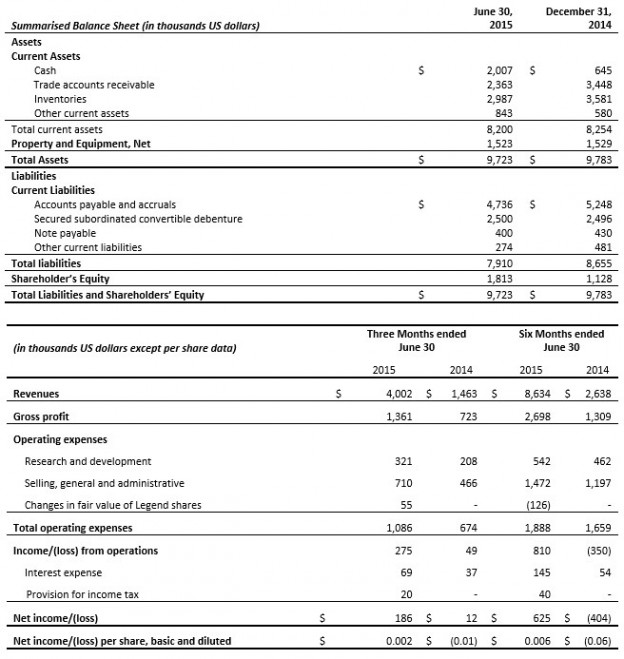

Revenues for the three months ended June 30, 2015 were $5.4 million, up from $4.5 million, an increase of 18% on the same period in the previous year. Gross profit for the period was $2.3 million, an increase of $0.6 million over the three month period ended June 30, 2014. Pre-tax loss was $0.4 million for the three month period compared to a loss of $0.2 million in the same period in the previous year. After tax loss for the period was $0.4 million compared to after tax loss of $0.2 million for the same period in the previous year.

For the first nine month of the year revenues were $15.0 million, versus $11.0 million, an increase of 36% compared to the same period last year. Gross margins were $6.0 million, versus $4.1 million, an increase of $1.9 million versus the same period last year. Pre-tax income was a loss of $0.2 million, versus a loss of $3.7 million, a decrease of $3.5 million versus the same period last year. After tax loss for the period was $0.3 million compared to after tax loss of $2.8 million for the same period in the previous year.

Gross Profit for the quarter was the highest of any quarter yet reported by the Company and operating costs were in line with previous quarters but income was adversely effected in the quarter as the Company took a charge of $0.7 million related to the Scientific Research & Experimental Development (SR&ED) claims from prior periods. This had the effect of reducing income by $0.3 million in the quarter. No SR&ED credits have been accrued for this current fiscal year.

The Training and Simulation group entered into a 5 year agreement with The Boeing Corporation to develop the next generation crew trainer for the Chinook helicopter in July. Under this program Boeing will among other things, provide $2.3 million in cash contributions, provide engineering support, deliver specific intellectual property with respect to details of the Chinook helicopter, and provide global marketing support for the new product. The company expects to increase its levels of research and development spending with these funds.

For further details please see the Financial Statements and Management’s Discussion and Analysis for the quarter ended June 30, 2015 which are available on the Company’s web site at www.bluedrop.com or on SEDAR at www.sedar.com.

Commenting on the results and year to date progress of Bluedrop, Founder and CEO Emad Rizkalla said, “I am pleased with the continued growth in the Training and Simulation business, their consistent financial performance and a special congratulations to the team on the recently announced Boeing program. Learning Networks is presently very engaged in some large pursuits and delivering against some recent awards but as with our new SaaS model and the revenue recognition rules that apply it will take time to show up in the quarterly results. I was disappointed in the SR&ED charge but over the last few years it has been much more challenging to meet the criteria for software development under the program.”

About Bluedrop

Bluedrop Performance Learning (TSX-V: BPL) is an innovator in workplace training for individuals, corporations, military personnel and the public sector. Bluedrop is transforming the workplace by designing, developing and delivering practical, actionable and affordable training content that improves individual and overall performance of organizations.

For more information, visit www.bluedrop.com.

This news release may contain “forward-looking information” as defined in applicable Canadian securities legislation. All statements, other than statements of historical fact included in this release, including, without limitation, statements regarding the impact of the operational restructuring and future plans and objectives of Bluedrop, constitute forward-looking information that involve various risks and uncertainties. Forward looking information is based on a number of factors and assumptions which have been used to develop such information but which may prove to be incorrect, including, but not limited to, assumptions in connection with the operational efficiencies associated with the integration of technological and financial systems and general economic and market conditions. There can be no assurance that such information will prove to be accurate and actual results and future events could differ materially from those anticipated in such forward-looking information.

Important factors that could cause actual results to differ materially from Bluedrop’s expectations include general global economic conditions. For additional information with respect to risk factors applicable to Bluedrop, reference should be made to Bluedrop’s continuous disclosure materials filed from time to time with securities regulators, including, but not limited to, Bluedrop’s Management’s Discussion and Analysis of Results of Operations and Financial Condition For the Year Ended September 30, 2014. The forward-looking information contained in this release is made as of the date of this release and Bluedrop does not undertake to update publicly or revise the forward-looking information contained in this release, whether as a result of new information, future events or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Media contact:

Lynn Hammond

Bluedrop Performance Learning Inc.

lynnhammond@bluedrop.com

709-570-5691

709-330-1260

SOURCE: Bluedrop Performance Learning Inc.

ReleaseID: 431640