VANCOUVER, BC / ACCESSWIRE / August 28, 2015 / (TSX Symbol: ACC) – Amica Mature Lifestyles Inc. (“Amica” or the “Company”) is pleased to announce the Company’s operating and financial results for the fiscal year and fourth quarter ended May 31, 2015.

FOURTH QUARTER HIGHLIGHTS

– FFO increased 17.2% or $0.018 per share to $0.128 compared to Q4/14;

– AFFO increased 31.1% or $0.033 to $0.138 per share compared to Q4/14;

-Revenues increased 3.9% to $36.3 million compared to Q4/14;

– Overall occupancy in mature same communities(1) at May 31, 2015 was 89.8%, compared to 90.1% at May 31, 2014;

– Overall occupancy in the Company’s community in lease-up (Amica at Aspen Woods) at May 31, 2015 was 69.7% compared to 46.9% at May 31, 2014;

– Mature same communities MARPAS increased by 2.6% compared to Q4/14. The Company has experienced monthly year-over-year MARPAS increases in its mature same communities for 65 consecutive months;

– Amica at Oakville construction advanced and is expected to become operational in September 2015, as of August 24, 2015, 70% of suites are reserved;

– On June 1, 2015, the Company reduced its working capital deficiency by approximately $17 million or 7% on refinancing its demand operating loan including obtaining a new $21 million term loan;

– The Board approved a Fiscal 2016 first quarter dividend of $0.105 per common share to be paid on September 17, 2015 to shareholders of record on September 10, 2015.

“Fiscal 2015 represented a very important transitional year, critical to unlocking the value inherent in our portfolio while strengthening our foundation to support future growth,” said Samir Manji, Amica’s Chairman and CEO. “The fourth quarter of Fiscal 2015 built on the momentum generated in the prior three quarters with a 3.9% increase in revenue and a 31.1% or $0.033 per share increase in AFFO diluted per share to $0.138.”

“We experienced 8.1% growth in retirement community margin in the fourth quarter as compared to the prior year, while increasing occupancy across the portfolio by 90 basis points over the third quarter,” said David Minnett, Amica’s President. “These improvements are driven by a series of initiatives implemented over the course of the year, and we expect to see the full extent of their benefits unfold as we move into Fiscal 2016.”

Financial Highlights

The following table provides operational highlights for the three months ended May 31, 2015 (“Q4/15”) compared to the three months ended May 31, 2014 (“Q4/14”) and the year ended May 31, 2015 (“Fiscal 2015”) compared with the year ended May 31, 2014 (“Fiscal 2014”):

(1) This is a Non-IFRS Financial Measure used by the Company in evaluating its operating and financial performance. Please refer to the cautionary statements under the heading “NON-IFRS FINANCIAL MEASURES” in this news release. See also “DEFINITION AND RECONCILIATION OF NON-IFRS FINANCIAL MEASURES” section of the Company’s MD&A for Fiscal 2015 which is available on SEDAR at www.sedar.com for additional information on Non-IFRS Financial Measures including reconciliations thereof to net income/loss and comprehensive income/loss.

Consolidated revenues

Q4/15 revenues increased by 3.9% to $36.3 million compared to $35.0 million in Q4/14. Fiscal 2015 revenues increased by 5.2% to $144.7 million compared to $137.5 million in Fiscal 2014. The increase in Q4/15 consolidated revenues is from retirement communities revenue and the increase in Fiscal 2015 consolidated revenue is from retirement communities revenue and other income from the Amica at Kingston co-tenancy.

Retirement communities revenue, expenses and margin

Q4/15 retirement communities revenue increased 4.1% to $36.3 million (Q4/14: $34.9 million), compared with a 2.1% increase in retirement communities expenses to $23.8 million (Q4/14: $23.3 million). Fiscal 2015 retirement communities revenue increased 5.0% to $143.9 million (Fiscal 2014: $137.0 million), compared with a 2.7% increase in retirement communities expenses to $94.3 million (Fiscal 2014: $91.9 million).

The following table summarizes the Company’s consolidated retirement communities margin (retirement communities revenues less retirement communities expenses before finance costs and depreciation expense) on a mature community and lease-up community basis for Q4/15 compared to Q4/14:

Consolidated retirement communities margin increased $0.9 million from $11.6 million in Q4/14. This increase was approximately equally split between mature communities as a group and the lease-up community. The overall, consolidated retirement communities margin percentage increased 1.3% to 34.4% in Q4/15 from 33.1% in Q4/14.

The following table summarizes the Company’s consolidated retirement communities margin on a mature community and lease-up community basis for Fiscal 2015 compared to Fiscal 2014:

Consolidated retirement communities margin increased $4.4 million from $45.1 million in Fiscal 2014. The increase is from a $2.2 million increase in mature communities margin and a $2.2 million increase in margin from one lease-up community. The overall, consolidated retirement communities margin percentage increased 1.5% to 34.4% in Fiscal 2015 from 32.9% in Fiscal 2014.

Other income

Q4/15 other income was $nil compared to $0.1 million in Q4/14. Fiscal 2015 other income increased to $0.9 million (Fiscal 2014 – $0.5 million) principally due to the interest income and distributions from the Amica at Kingston investment.

Finance costs

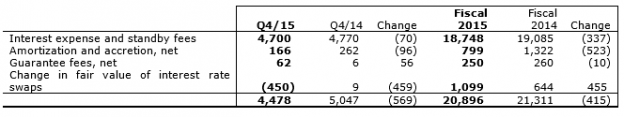

Finance costs are summarized as follows:

Interest expense and standby fees decreased by $0.1 million to $4.7 million in Q4/15 and by $0.3 million in Fiscal 2015 to $18.7 million principally due to interest rate reductions achieved on mortgage renewals and refinancing; in Fiscal 2015 these savings were partially offset by an increase in interest expense on the Company’s demand operating loan due to a higher average outstanding loan balance.

Guarantee fees increased by $0.1 million to less than $0.1 million in Q4/15 and remained unchanged at $0.3 million in Fiscal 2015.

In Q4/15, an unrealized gain of $0.5 million was recorded in respect of interest rate swap contracts on floating rate mortgages compared to a nominal unrealized loss for Q4/14. For Fiscal 2015, there was an unrealized loss of $1.1 million compared to an unrealized loss of $0.6 million for Fiscal 2014 in respect of interest rate swap contracts. Assuming the Company holds these mortgages and the interest rate swaps for their full terms, any unrealized gains or losses will reverse and the Company will not realize any gains or losses in respect of these interest rate swaps.

General and administrative (“G&A”) expenses

G&A expense decreased by 9.9% to $2.5 million in Q4/15 (Q4/14 – $2.8 million) and remained unchanged at $10.1 million in Fiscal 2015 compared to Fiscal 2014. Included in G&A expense are severance and retirement compensation costs of less than $0.1 million and $0.6 million for Q4/15 and Fiscal 2015 respectively. The severance costs relate to the Fiscal 2015 objective to simplify the organization and were incurred in reorganizing the Company’s corporate functions supporting the retirement communities and include a reduction in personnel. Going forward, the re‑organization is anticipated to result in a net annual G&A expense savings of approximately $0.5 million. Fiscal 2015 G&A expenses also include $0.3 million in savings from the actual Fiscal 2014 bonus compensation being less than the amount accrued at May 31, 2014.

Depreciation expense

Depreciation expense for Q4/15 increased by 1.1% to $7.5 million compared to Q4/14 and were virtually unchanged at $29.8 million in Fiscal 2015 compared to Fiscal 2014.

Net Loss and comprehensive loss

For Q4/15, the net loss was $1.7 million compared to $15.9 million in Q4/14. For Fiscal 2015, the net loss was $8.6 million compared to $26.1 million in Fiscal 2014. The decrease in net loss is primarily attributable to the $16.2 million impairment loss in Q4/14, improved retirement community margin, the income from the Amica at Kingston settlement of mortgages receivable and a reduction in net finance costs.

The Q4/15 net loss attributable to Amica shareholders was $0.7 million compared to

$12.2 million in Q4/14. The Fiscal 2015 net loss attributable to Amica shareholders was $4.2 million compared to $15.7 million in Fiscal 2014.

Earnings Before Interest Taxes and Depreciation (EBITDA)

Q4/15 EBITDA increased by $17.3 million to $10.0 million, compared to EBITDA of ($7.3) million in Q4/14 primarily as a result of the $16.2 million impairment charge in Q4/14. Excluding the impairment charge, EBITDA increased by $1.1 million for Q4/15 compared to Q4/14. Fiscal 2015 EBITDA was $40.5 million compared $19.3 million in Fiscal 2014 (an increase of $5.0 million excluding the $16.2 million impairment charge). The primary reasons for the increase in Q4/15 and Fiscal 2015 EBITDA (excluding the impairment charge in Q4/14) are the increase in retirement communities margin, the income related to the Amica at Kingston settlement of mortgages receivable, and a reduction in net finance costs.

Funds From Operations (FFO)

Q4/15 FFO increased 17.2% to $4.0 million ($0.128 per share diluted) compared to $3.4 million in Q4/14 ($0.110 per share diluted). Fiscal 2015 FFO increased 13.6% to $16.8 million ($0.544 per share diluted) compared to $14.8 million in Fiscal 2014 ($0.478 per share diluted) and includes a contribution of $0.6 million related to the

Amica at Kingston investment (Q4/14 and Fiscal 2014 – $nil).

Adjusted Funds From Operations (AFFO)

Q4/15 AFFO increased 31.1% to $4.3 million ($0.138 per share diluted) compared to $3.3 million in Q4/14 ($0.105 per share diluted). Q4/15 maintenance capital expenditures were a net $0.1 million ($1.2 million actual expenditures less $1.1 million applied from the Fiscal 2015 maintenance reserve (Q4/14 – net $0.5 million, $1.3 million actual less $0.8 million applied from the Fiscal 2014 maintenance reserve).

Fiscal 2015 AFFO increased 13.3% to $16.3 million ($0.528 per share diluted) compared to $14.4 million in Fiscal 2014 ($0.466 per share diluted). Fiscal 2015 maintenance capital expenditures were $1.7 million (Fiscal 2014 – $2.5 million).

The Amica at Kingston investment contributed $0.2 million to AFFO in Fiscal 2015 (Q4/14 and Fiscal 2014 – $nil).

COMMUNITY UPDATE

Mature same community MARPAS increased by 2.6% for Q4/15 compared to Q4/14 and increased 2.8% for Fiscal 2015 compared to Fiscal 2014. The Company has experienced monthly year-over-year MARPAS increases in its mature same communities for 65 consecutive months. In addition to the ongoing focus on occupancy and ancillary revenue, the continued success on the MARPAS front is the result of the Company wide efforts to raise rents and rates upon turnover, to more accurately reflect the quality of the services provided by Amica.

The following is a summary of occupancy in the Company’s mature same communities:

(1) Amica at Quinte Gardens, Amica at Bayview Gardens and Amica at Windsor became Mature Communities effective February 1, 2015, July 1, 2014 and August 1, 2014 respectively. All occupancy figures in the above table, including comparatives, reflect Amica at Quinte Gardens, Amica at Bayview Gardens and Amica at Windsor to report on a Mature Same Community basis.

The spring months, which were the last few months of Fiscal 2015, saw an increase in traffic in both the Ontario communities and British Columbia Communities. The mature Ontario communities finished Q4/15 at 89.0%, up slightly from 88.9% at Q4/14. Occupancy in the British Columbia communities rebounded from Q3/15 by 2.8% to 92.2% at Q4/15. While this still represents a decline of 1.0% from Q4/14, it is not a reflection of Amica’s brand health in the region. The Company has been facing challenges within two communities that have been combating significant and unforeseen attrition. The Management is confident these communities will rebound in Fiscal 2016. Overall occupancy for mature communities at Q4/15 increased by 0.9% over Q3/15 and decreased by 0.3% compared to Q4/14. All management remain focused on increasing occupancy and extracting value for the services Amica provides and, in conjunction with effective expense control, ensuring those gains flow to the bottom-line in the communities.

The following is a summary of overall occupancy in the Company’s community in lease-up(1):

(1) At May 31, 2015, there is one community in lease-up: Amica at Aspen Woods. Amica at Aspen Woods became a lease-up community as of its opening on August 9, 2013.

(2)Anticipated to increase to 71.0% following an additional 1 net pending move-in which reflect suites that have been reserved with a deposit made for the reservation, less suites for which notice of termination has been received

Amica at Aspen Woods, the Company’s first community in Calgary, continues to experience improvements in occupancy and remains on track to achieve stabilized occupancy within proforma.

Development and pre-development projects

Amica at Oakville, in Ontario, which commenced construction (excavation and site servicing) in Q2/13 is expected to become operational in September 2015. Building occupancy approval was obtained in August 2015. The pre-opening marketing program has been very successful with approximately 70.0% of suites reserved as at August 24, 2015. Residents are being scheduled for move-in for mid September 2015 onwards.

Some site preparation activities commenced in June 2015 for the Amica at Dundas expansion and a term sheet has been received for construction financing. Upon finalizing the construction financing and board approvals, the Company plans to proceed with the Amica at Dundas expansion. Upon obtaining construction financing, board approvals and required permits, the Company plans to proceed with the Amica at Swan Lake expansion. The Amica at Aspen Woods expansion is not expected to commence construction in the next twelve months.

Amica at Kingston investment

In January 2015, the Company and the Amica at Kingston co-tenancy completed the settlement of three mortgages receivable related to the former Amica at Kingston proposed development site. The following table summarizes the impact of the Amica at Kingston results reflected in the statement of comprehensive loss:

The Amica at Kingston co-tenancy now has nominal assets and liabilities, and it is intended to wind-up this co-tenancy in the next several months.

Acquisition of additional ownership interests in co-tenancies

On June 1, 2015, the Company increased its ownership in Amica at Whitby by 48.75% from 51.25% to 100%. The aggregate cash consideration was $4.1 million. As the Company controlled the property prior to the acquisition of the additional interest, the non-controlling interests were reduced by $2.7 million for the portion that the Company acquired.

FINANCIAL POSITION

The Company’s consolidated cash and cash equivalents balance, as at May 31, 2015, was $3.7 million compared to $5.3 million at May 31, 2014.

On June 1, 2015, the Company completed a refinancing of its previous $20 million demand operating loan facility which had an outstanding balance of $13.5 million at May 31, 2015. The new loan facility includes two components (i) $21.0 million term loan that matures on June 1, 2020, the interest rate on this component was fixed for its term at 3.31% with an interest rate swap contract; and (ii) $10.0 million demand operating loan facility bearing interest at prime plus 0.25%.

Proceeds of the new term loan were used to repay the previous demand operating loan facility, for the acquisition of the additional 48.75% in Amica at Whitby and to increase the Company’s cash and working capital position. On August 27, 2015, the balance on the new demand operating loan facility is $1.3 million.

At May 31, 2015, the Company has a working capital deficiency of $241.9 million (May 31, 2014 – $262.6 million). This working capital deficiency includes:

In the normal course of business, the Company finances its properties in development and lease-up using mortgages payable due on demand and regularly has mortgages on other properties that mature within one year of the balance sheet date – these mortgages are reported in the current portion of mortgages payable and contribute $202.5 million to the working capital deficiency at May 31, 2015 (May 31, 2014 – $232.6 million).

The Company’s due on demand mortgages payable are primarily on properties that have not achieved stabilized occupancy. The Company monitors property occupancy and income growth for opportunities to seek conventional term mortgage financing to replace the due on demand loans.

Amica believes that its funds on hand as at May 31, 2015, combined with funds from: operations; its co-tenancy investments and loan receivables; the new term loan and demand operating loan facility as described above; opportunities to increase financing on existing properties; and debt financing arrangements, are sufficient to fund its operating and capital expenditures for at least the next 12 months.

Re-financed/Renewed in Q4/15

In March 2015, the terms of a $45,433,000 due on demand mortgage maturing in February 2018 were revised. The revised mortgage has been bifurcated into two tranches with the first tranche of $14,787,000 incurring interest at the pre-existing rate of prime plus 0.5% or BA plus 2% and the second tranche of $30,646,000 incurring interest at a new rate of prime plus 1.5% or BA plus 3%. There are annual operating income milestones included as part of the amended mortgage terms that annually either decreases the interest rate on the second tranche by 0.25% or requires a principal repayment on the mortgage. Additionally pursuant to the amended terms, on May 25, 2015, the Company made a $2,800,000 principal payment on the second tranche.

In April 2015, the Company entered into a new interest rate swap contract for a non-CMHC insured variable rate, BA based second mortgage with principal outstanding of $9.6 million. The interest rate swap contract locks in the rate at 3.8% to June 1, 2018.

Maturities in Fiscal 2016

The following is a summary of the loan maturities in Fiscal 2016:

– $5.2 million CMHC insured mortgage bearing interest at 3.46%;

– $19.5 million non-CMHC insured mortgage bearing interest at 4.52%;

– $28.1 million non-CMHC construction loan bearing interest on a BA basis at 3.84%;

– $3.0 million non-CMHC loan bearing interest at 6%;

– $29.6 million non-CMHC construction loan bearing interest on a BA basis at 3.84%;

– $5.0 million non-CMHC loan bearing interest at 6%;

– $1.5 million non-CMHC loan bearing interest at 6%; and

– $38.3 million non-CMHC construction loan bearing interest on a BA basis at 3.54%.

Current 5 and 10 year CMHC insured loan interest rates are approximately 1.6% and 2.5% respectively. Current 5 and 10 year non-CMHC loan interest rates are approximately 3.1% and 3.9% respectively.

Capital expenditures

In Q4/15, the Company incurred $4.2 million (Q4/14 – $2.8 million) in capital expenditures on its consolidated properties and corporate operations and $1.2 million (Q4/14 – $1.3 million) are classified as maintenance capital expenditures on real estate assets and deducted from FFO in calculating AFFO.

Capital expenditures for consolidated communities and corporate operations for Fiscal 2016 are budgeted at $7.4 million excluding development properties, of which $3.9 million are maintenance capital expenditures (Amica’s proportionate share of these budgeted maintenance capital expenditures is $3.0 million). Amica is committed to investing in its properties to maintain the high standard it has set in luxury retirement living.

FIRST Quarter Dividend

The Company’s Board of Directors (the “Board”) has approved a quarterly dividend of $0.105 per common share on all issued and outstanding common shares which will be payable on September 17, 2015, to shareholders of the Company (the “Shareholders”) of record on September 10, 2015.

Results Conference Call rescheduled to september 2, 2015

Amica’s conference call to discuss the results has been rescheduled to take place on Wednesday, September 2, 2015 at 10:00 am Pacific Time (1:00 pm Eastern Time). To access the call, dial (416) 847-6330 (Local/International access) or 1-866-530-1553 (North American toll-free access). A slide presentation to accompany management’s comments during the conference call will be available. To view the slides, access Amica’s website at www.amica.ca and click on “Investor Relations” – “Presentations & Webcasts”. Please log on at least 15 minutes before the call commences.

The Company’s audited financial statements for the year ended May 31, 2015 and the management’s discussion and analysis are available on SEDAR at www.sedar.com and available on the Company’s website at www.amica.ca.

Forward-Looking Information

This news release contains “forward-looking information” within the meaning of applicable securities laws (“forward-looking statements”).

These forward-looking statements are made as of the date of this news release and the Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as otherwise required by law. Users of forward-looking statements are cautioned that actual results may vary from forward-looking statements contained herein. Forward-looking statements include, but are not limited to, statements regarding future occupancy rates; occupancy rebounding in Fiscal 2016 in two British Columbia communities; anticipated future revenues, revenue and margin growth/enhancement, financial results and operating performance; increasing occupancy and extracting value for the services Amica provides in conjunction with effective expense control, ensuring those gains flow to the bottom line; unlocking unrealized potential within our existing portfolio; future services that will be provided by the Company; future growth and value for shareholders; Amica’s Fiscal 2016 goals and objectives; future MARPAS growth; interest rate savings on future re‑financings and renewals; expected future financing opportunities and construction financing requirements; the ability of the Company to re-finance or extend mortgages and do so on favorable terms; anticipated ability to renew, refinancing of maturing loans; anticipated ability to refinance due on demand mortgages with conventional term mortgages upon the properties nearing or after achieving stabilized occupancy; the Company’s expectations that the demand operating loan and the mortgages payable due on demand will be available for their term and will not be called; holding interest rate swaps for their full term; the potential to increase debt on certain communities to generate additional cash resources; the Company’s ability to fund operating and capital expenditures for at least 12 months; management of cash resources; opening Amica at Oakville in September 2015; advancing the development of new and expanded Amica residences; the number of new developments the Company will undertake; acquisition/development of further Amica communities; obtaining new development sites; the Company increasing its ownership in existing Amica communities; the opportunity to acquire existing qualified residences and the Company making such acquisitions; the Company’s intent to wind-up the Amica at Kingston co-tenancy; Fiscal 2016 capital expenditures of $7.4 million before development properties with Amica’s proportionate share of maintenance capital expenditures being $3.0 million; Aspen Woods achieving stabilized occupancy within proforma; $0.5 million annual G&A savings from recent reorganization; the timing for payment of contractual obligations and commitments; the creation of long term shareholder value; the Company’s growth prospects; and dividends and other similar statements concerning anticipated future events, conditions or results that are not historical facts. In certain cases, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. While the Company has based these forward-looking statements on its expectations about future events as at the date that such statements were prepared, the statements are not a guarantee of the Company’s future performance and are subject to risks, uncertainties, assumptions and other factors which could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Such factors and assumptions include, amongst others, the effects of general economic and market conditions; actions by government authorities, including the granting of zoning and other approvals and permits; uncertainties associated with potential legal proceedings and negotiations, including negotiations with respect to construction financing and debt refinancing; and misjudgements in the course of preparing forward-looking statements. In addition, there are known and unknown risk factors which could cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Known risk factors include, among others, risks related to dependence on the ability of Amica’s co-tenancy participants to meet their obligations; interest rate volatility in the marketplace; job actions including strikes and labour stoppages; possible liability under environmental laws and regulations, relating to removal or remediation of hazardous or toxic substances on properties owned or operated by Amica; risks associated with new developments, including cost overruns and start-up losses; the ability of seniors to pay for Amica’s services; regulatory changes; risks inherent in the ownership of real property; operational risks inherent in owning and operating residences; the risks associated with global events such as infectious diseases, extreme weather conditions and natural disasters; the availability of capital to finance growth or refinance debt as it comes due; Amica’s ability to attract seniors with its services and keep pace with changing consumer preferences, as well as those factors discussed in the “Risks and Uncertainties” section of the Company’s Management’s Discussion and Analysis for the three and twelve months ended May 31, 2015, and in the “Risk Factors” section of the Company’s Annual Information Form dated August 27, 2015, that will be filed with the Canadian Securities Administrators and available at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements, or the material factors or assumptions used to develop such forward looking statements, will prove to be accurate. Accordingly, readers should not place undue reliance on forward-looking statements.

Non-IFRS Financial Measures

This news release makes reference to the following terms: “Earnings Before Interest, Taxes, Depreciation and Amortization” (or “EBITDA”), “Funds From Operations” (or “FFO”), “Adjusted Funds From Operations” (or “AFFO”), “Monthly Average Revenue Per Available Suite” (or “MARPAS”) and “Retirement Communities Margin” (collectively the “Non-IFRS Financial Measures”). These Non-IFRS Financial Measures are not recognized under IFRS and do not have standardized meanings prescribed by IFRS. The Company considers these Non-IFRS Financial Measures relevant in evaluating the operating and financial performance of the Company, along with IFRS measures such as net earnings (loss) and comprehensive income (loss), basic and diluted earnings (loss) per share and cash provided by (used in) operations. Definitions and detailed descriptions of these terms are contained in the MD&A.

(1) Mature Same Communities: Effective June 1, 2011, mature same communities was defined by the Company to be mature communities that are classified as income-producing properties for thirteen months after the earlier of reaching 90% occupancy or 36 months of operation, with the exception of Amica at Quinte Gardens. Amica at Quinte Gardens will be classified as a mature community thirteen months after the earlier of reaching 90% occupancy or two years post-acquisition by the Company.

About Amica Mature Lifestyles Inc.

Amica Mature Lifestyles Inc., a Vancouver based public company, is a leader in the management, marketing, design, development and ownership of luxury seniors residences. There are 24 Amica Wellness & Vitality(TM) Residences in operation in Ontario, British Columbia and Alberta, Canada. Additionally, Amica has one residence under construction in Oakville, Ontario, one residence in pre-development in Calgary, Alberta and three existing operational residences with expansions in pre‑development. The common shares of Amica are traded on the Toronto Stock Exchange under the symbol “ACC”. For more information, visit www.amica.ca.

For further information, please contact:

Art Ayres

Chief Financial Officer

Amica Mature Lifestyles Inc.

(604) 630-3473

a.ayres@amica.ca

Alyssa Barry

Manager, Investor Communications

Amica Mature Lifestyles Inc.

(604) 639-2171

a.barry@amica.ca

SOURCE: Amica Mature Lifestyles Inc.

ReleaseID: 431598