OTTAWA, ON / ACCESSWIRE / September 29, 2015 / Carube Copper Corp. (TSXV: CUC) announced today that it has signed a definitive joint venture agreement with a wholly owned subsidiary of OZ Minerals Limited (ASX: OLZ) an Australian copper miner with a market cap of approximately $1B. The farm-in agreement sets out the terms and conditions under which OZ Minerals can earn an interest in each of the projects, OZ Minerals has until December 20, 2015 to elect which projects it wants to include in the joint venture.

The three projects are comprised of four exploration licenses totalling 176 sq kms and are located on Jamaica’s highly prospective Cretaceous Inliers. The four licenses contain certain intrusives that show potassic alteration, with copper, gold and molybdenum distribution in rocks, soils and stream sediments suggestive of porphyry copper + gold ± molybdenum in areas underlain by, and adjacent to, the intrusives. In addition, the projects contain numerous underexplored epithermal gold, oxide copper, copper skarn and structurally-controlled copper prospects. Previously, no sustained effort has been made to investigate the total extent of porphyry copper on these licences. Porphyry copper systems have been identified in a similar geological environment at Bellas Gate, the location of Carube Copper’s existing joint venture with OZ Minerals.

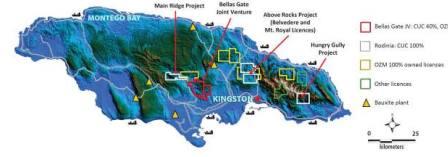

Figure 1: Location of Jamaican projects owned by Carube Copper (CUC) and OZ Minerals (OZM)

To view an enhanced version of Figure 1, please visit:

https://www.accesswire.com/uploads/17460_carube1enhanced.jpg

Mr. Jeff Ackert, President and CEO of Carube Copper stated: “We are extremely excited that OZ Minerals has recognized the copper-gold potential of Carube Copper’s three Rodinia projects and has signed a farm-in agreement allowing them to initiate exploration on the projects they choose. It shows a continuing strong commitment to explore and develop copper-gold assets in central Jamaica’s highly prospective Cretaceous Inliers. The net result for Carube Copper is a potential increase in its value with minimal shareholder dilution.”

Basic Terms of the Farm-in Joint Venture Agreement

The joint venture agreement is between Carube Copper’s wholly owned subsidiary, Rodinia Jamaica Limited, which holds a 100% interest in all four exploration licenses comprising the three Rodinia projects, and a wholly owned subsidiary of OZ Minerals, OZ Exploration Pty Ltd. Airborne geophysics were completed on the three Rodinia Projects by OZ Minerals which was a pre-requisite for entering into this farm-in agreement,

The basic terms listed here apply to each project separately:

– OZ Minerals (OZM) must elect on which projects it wishes to farm-in on before December 20, 2015, (Election Date) and subsequently pay $50,000 to Carube Copper (CUC) within 30 days and spend $500,000 within one year of the Election Date to earn a 40% interest in a project.

– On or before the first anniversary of the Election Date, OZM may elect to advance its interest on the project to 51% by paying $50,000 to CUC and sole funding $1M of expenditures over the following 12 months or return the project to CUC should it not elect to proceed.

– On or before the second anniversary of the Election Date, OZM can elect to advance its interest to 60% on the project by paying $75,000 to CUC and sole funding $2M of expenditures over the next 18 months.

– At or before the 3.5 year anniversary of the Election Date, OZM can elect to advance its interest to 70% by paying $100,000 to CUC and sole funding $3M of expenditures over the next 18 months. For OZM to earn 70% in the project it will have paid $275,000 to CUC and sole funded $6.5M of expenditures over a period of 5 years or less.

– OZM may advance its interest to 80% on the project by sole funding a N.I. 43-101 compliant, JORC standard feasibility study.

– At Carube’s request, OZ Minerals will have the option to purchase a further 10 or 20% interest in the Rodinia joint venture at a price based on the project’s NPV and/or finance Carube’s remaining interest to production.

– Upon a decision to mine on a project’s specific mining licence area, a separate mining joint venture agreement will be negotiated that will respect the terms of the farm-in joint venture agreement.

Details of the Rodinia Projects — Above Rocks, Main Ridge and Hungry Gully

The Rodinia Projects are held by Rodinia Jamaica Limited, a wholly-owned subsidiary of Carube Copper. This ownership is subject to a 2% NSR Royalty. OZ Minerals has the right to buy back one half of the Royalty. Carube Resources Inc., Carube Copper’s predecessor, originally acquired the Rodinia Projects during a strategic alliance with Tigers Realm Metals Pty. Ltd. and Rodinia Resources Pty. Ltd. in early 2012. (See press releases of December 20, 2011 and March 22 and April 2, 2012)

Summary of Mineralized Prospects on the Rodinia Projects:

The values listed herein are historic and although Carube Copper has not verified them in total, it believes them to be representative of the particular style of mineralization at each prospect.

Above Rocks Project — comprised of the Mt. Royal licence (SEPL552) and the Belvedere license (SEPL550), totalling 104 sq km in area

– Glengoffe: mineralized porphyry, historic grab samples including 0.8% Cu(1)

– Sue River: historic grab samples including 6.8% Cu(2)

– Jobs Hill: copper oxide zone, historic grab samples including 5% Cu(3)

– Florence Hill, Kingsweston, Providence: mineralized porphyries; magnetite-sulphide veins, historic chip samples including 3.2% Cu over 1m(1)

– Allman Hill: tonalite and potassic altered granite; historic trench results 0.5% Cu over 58m(4)

– Mt Charles – Border: CIDA stream sediment results including 1710 ppb Au(5)

Main Ridge Project — comprised of the Main Ridge licence (SEPL562), totalling 30 sq km in area

– Pennants: 1km long gold anomaly in soils on strike with AusJam’s Pennants gold deposit – 82,000 t at 13.9 g Au/t (historic non-compliant 43-101)(7,8)

– Main Ridge: 3 km long untested copper in soil anomaly, open to the west(5,6)

– Trout Hill: copper oxide with historic grab samples including 0.84% Cu(1)

Hungry Gully Project — comprised of the Hungry Gully license (SEPL559), totalling 42 sq km in area

– Dunrobin and Diggins Ridge: porphyry target, historic soil samples including 4500 ppm Cu(6); Cu-Au porphyry target confirmed at Dunrobin(9)

– Round Hill: Au-epithermal target; historic soil samples including 1500 ppb Au(6)

– Home Hill: large prospective area for copper as defined by CIDA stream sediment survey, including 203 ppm Cu and 44 ppm Au(5)

(1) Tigers Realm Metals 2011, 2012, internal reports; (2) Cominco 1971, exploration reports filed with the Jamaica Government; (3) Burrex Mines, 1956, 1965; (4) Clarendon Mining Limited, 1994; (5) Canadian International Development Agency (CIDA), 1986 stream sediment sampling program; (6) BHP-Utah International Exploration Inc., 1991, 1993; (7) AusJam 1997, internal resource estimate; (8) This value is not to be considered a current reserve (as described); method of determination is not clear other than “only reliable holes” were included and high gold assay values were cut; (9) Carube PR, January 20, 2015.

Recent work on the Sue River Prospect at Above Rocks has confirmed drilling targets, and similarly, the extension of the Main Ridge copper anomaly west of its previous delineation has been confirmed.

Mr. Jeff Ackert, President and CEO of Carube Copper also commented: “Based on our own work and a review of historic data and exploration completed by Tigers Realm and Rodinia Resources on these licences, we are confident that OZ Minerals will have a good deal of success on any or all projects that they may choose to joint venture.”

– END PRESS RELEASE –

Contacts

Jeff Ackert, President and CEO • 1-613-839-3258 • jackert@carubecopper.com

Dr. Vern Rampton, Executive Vice President • 1-613-839-3258 • vrampton@carubecopper.com

Alar Soever, Chairman • 1-705-682-9297 • asoever@carubecopper.com

Darrell Munro, Corporate Administration • 1-613-839-0474 • dmunro@carubecopper.com

This press release has been prepared by Dr. Vern Rampton, P. Eng. in his capacity as a qualified person as defined under NI 43-101 (“QP”). All references to “$” herein are to Canadian dollars unless stated otherwise.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

About Carube Copper Corp.

Carube Copper Corp. (TSXV: CUC) is a Canadian exploration company focused on the rapid exploration and development of precious metal and copper projects in Jamaica and Canada. Through a wholly owned Jamaican subsidiary, Carube Copper owns a 40% beneficial interest (subject to a 2% NSR) in the Bellas Gate Project, which consists of two highly prospective copper-gold licenses covering 84 square kilometresof the Central Inlier. The Bellas Gate Project is the subject of a joint venture agreement with a wholly owned subsidiary of OZ Minerals Limited, an Australian copper-gold producer with a market capitalization of over $1B. OZ Minerals can earn a 70% interest (Carube Copper 30%) in the Bellas Gate Project by spending $6.5M on exploration and can then increase its interest a further 10% by completing a feasibility study. OZ Minerals has flown airborne geophysics over 3 other Carube projects (4 wholly-owned Licences, subject to 2% NSRs, and subsequently can invoke separate joint ventures on each project under similar terms to those applicable to the Bellas Gate Project. Carube Copper also holds a 100% interest in three porphyry copper-gold-molybdenum properties in south-western British Columbia within the Tertiary-aged Cascade Magmatic Arc. Exploration continues on two of these projects, with the goal of joint venturing them to larger exploration and mining companies.

DISCLAIMER AND FORWARD-LOOKING STATEMENTS

This news release includes certain “forward-looking statements” which are not comprised of historical facts. Forward-looking statements are based on assumptions and address future events and conditions, and by their very nature involve inherent risks and uncertainties. Although these statements are based on currently available information, Carube Copper Inc. provides no assurance that actual results will meet management’s expectations. Actual events, results, performance, prospects and opportunities may differ materially from those expressed herein. Factors that can cause results to differ materially are set out in the company’s documents filed on the SEDAR website. Even though Carube Copper believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on it, as it may only apply to a disclosed time frame or not at all. Carube Copper disclaims any obligation to update or revise information in the future other than required by law.

SOURCE: Carube Copper Corp.

ReleaseID: 432306