Cloud Backup Market, By Solution (Primary storage, Disaster recovery and backup storage) – Forecast 2023

Pune, India – July 31, 2017 /MarketersMedia/ —

Cloud Backup Market Overview:

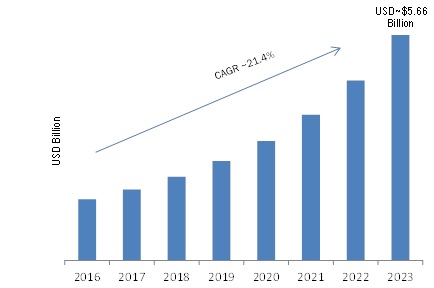

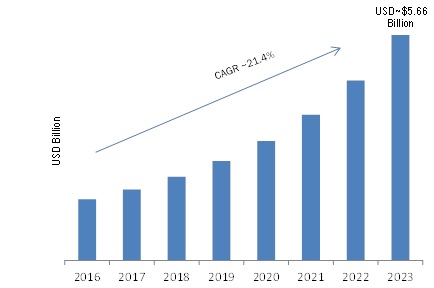

According to a recent study report published by the Market Research Future, The global market of Cloud Backup is forecasted to gain prominence over the forthcoming years. The Market is forecasted to reach to USD 5.66 Billion by 2023 growing with a striking double digit CAGR of 21.4 % of during the forecast period 2017-2023.

The study indicates that the Cloud Backup market is boosted by its solution of making right and informed decisions to achieve the desire outcomes. The cloud backup is also driven by security, storage, savings, and virtualization to a hybrid cloud solution for the data security. It also indicates that the cloud backup is driven by many factors, such as huge volumes of data generation, lower costs and greater efficiency than on-premises backup, and growing adoption of SaaS.

Cloud Backup Market is also known as Online Backup or Cloud Computer Backup. This refers to backing up of data to a remote, cloud-based server. It is a method of supporting the data that is stored in and accessible from multiple distributed and connected resources that comprises a cloud for transferring data over the public cloud with less consumption of bandwidth. The server is usually hosted by a third party service providers. These solutions enable the client to store their data or files on the internet. It collects, compresses, encrypts and transfers data to the requested clients without consuming much time and bandwidth.

Major Key Players:

• Microsoft Corporation (U.S)

• Oracle Corporation (U.S)

• IBM Corporation (U.S)

• Amazon Web Services. (U.S)

• EMC Corporation (U.S)

• Google Inc. (U.S)

• VMware Inc. (U.S)

• Dropbox, Inc. U.S.)

• Barracuda Networks, Inc. (US)

• Veeam Software (Switzerland)

• Datto, Inc. (U.S.)

• Druva Software (US)

• Code42 Software, Inc. (US)

Request a Sample Report @ https://www.marketresearchfuture.com/sample_request/3152

Global Cloud Backup Market Competitive Analysis:

Characterized by the presence of several major well-established players, the global Cloud Backup Market appears to be highly fragmented and competitive. Well established players incorporate acquisition, collaboration, partnership, expansion, and technology launch in order to gain competitive advantage in this market and to maintain their market position.

Strategic partnerships between Key players support the growth and expansion plans of the key players during the forecast period. The Key players operating in the market compete based on pricing, technology, reputation and services. These Players invest heavily in the R&D to develop a technology that is on a completely different level compared to their competition. These Key players strive to develop products with the adept technologies, unrivalled design and features.

Global Cloud Backup Market Segments:

The Cloud Backup Market is segmented in to 6 key dynamics for the convenience of the report and enhanced understanding;

Segmentation by Solution: Comprises Primary storage, Disaster recovery, Cloud storage gateway and backup storage.

Segmentation by Deployment: Comprises Public Cloud, Private Cloud, and Hybrid Cloud.

Segmentation by Organization Size: Comprises SMEs and Large Enterprises

Segmentation by Service: Comprises Training and consulting, Support and maintenance, Cloud integration and migration and Managed services.

Segmentation by End-User: Comprises BFSI, Consumer goods and retail, Education, Government and public sector, Healthcare and life sciences.

Segmentation by Regions : Comprises Geographical regions – North America, Europe, APAC and Rest of the World.

Access Report Details @ https://www.marketresearchfuture.com/reports/cloud-backup-market-3152

Global Cloud Backup Market Regional Analysis:

The regional analysis of Cloud Backup market is being studied for region such as Asia Pacific, North America, Europe and Rest of the World. Cloud Backup has driven due to its solutions like storage, simple management and monitoring, real-time backup and recovery, simple integration of cloud backup with enterprise’s other applications, data de-duplication, customer support and many others services.

It has been observed that North America region is the leading in Cloud Backup market. The study reveals that Europe region is showing a rapid growth in the Cloud Backup market. Asia-Pacific countries like China, Japan and India is projected to be the fastest growing region in the Cloud Backup market due to the increasing size of high data generation in many countries.

Table of Contents

1 Market Introduction

1.1 Introduction

1.2 Scope of Study

1.2.1 Research Objective

1.2.2 Assumptions

1.2.3 Limitations

1.3 Market Structure:

1.3.1 Global Cloud Backup Market: By Solution

1.3.2 Global Cloud Backup Market: By Services

1.3.3 Global Cloud Backup Market: By Deployment

1.3.4 Global Cloud Backup Market: By Organization Size

1.3.5 Global Cloud Backup Market: By End-User

1.3.6 Global Cloud Backup Market: By Region

Continued…..

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Contact Info:

Name: Akash Anand

Email: akash.anand@marketresearchfuture.com

Organization: Market Research Future

Address: Market Research Future Office No. 524/528,

Phone: +1 646 845 9312

Source URL: http://marketersmedia.com/cloud-backup-market-growth-analysis-segments-key-players-drivers-size-and-trends-by-forecast-to-2023/223391

For more information, please visit https://www.marketresearchfuture.com/reports/cloud-backup-market-3152

Source: MarketersMedia

Release ID: 223391