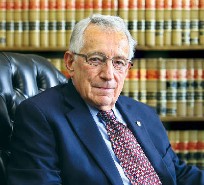

Top Bankruptcy Attorney Tony Thompson, founding partner at Thompson Law in Los Angeles, CA, unveils options currently available to wipe debt clean during COVID-19. For more information please visit https://lawtl.com

Los Angeles, CA, United States – July 28, 2020 /MM-REB/ —

In a recent interview, Bankruptcy Attorney Tony Thompson, founding partner at Thompson Law in Los Angeles, CA, unveiled options currently available to wipe debt clean during COVID-19.

For more information please visit https://lawtl.com

When asked for a comment, Thompson said, “The dip in the economy due to the onset of COVID-19 has brought about financial hardship for millions of Americans. Anyone on the verge of bankruptcy before the pandemic is in an even tougher spot now, leaving many to wonder how they can clear their debt and start over.”

The most important thing for the American public to be aware of, according to Thompson, is that bankruptcy courts will continue to operate during this time.

When asked to elaborate, he said, “While bankruptcy courts are physically closed to the public, they will continue working and taking on new cases remotely. As much of the country is now handling business electronically, the courts have also followed suit in the state of California. So, for instance, California residents can work with their lawyers to submit bankruptcy petitions electronically.”

“Because California bankruptcy courts are trying to conduct as much business as possible over the telephone, you might experience a delay in your case, particularly if you’ve just filed,” he commented.

Thompson added that anyone who filed before COVID-19 should keep a close eye on the progression of their case.

“Make sure you’re up-to-date in case any meetings are postponed. All 341 meetings and confirmations of Chapter 13 bankruptcies will occur via telephone. There are other deadlines in your case that should be on top of, including submitting proof of bankruptcy education, filing fees, and other paperwork. Failing to meet these deadlines could postpone your case even further,” he said.

Many Americans are curious whether or not the CARES Act package, which was passed recently by Congress, will affect their ability to file for bankruptcy.

“Some might be able to receive relief benefits from the CARES Act at this time. Even if you receive payment, then that amount will not be calculated as part of your income, no matter if you’re filing for Chapter 7 or Chapter 13 bankruptcy,” he said.

During COVID-19, Thompson added that automatic stays will continue to function normally after someone files for bankruptcy.

When asked to explain further, Thompson said, “An automatic stay means that creditors can’t hassle you to collect on any unpaid debt. The automatic stay will remain the same, which often provides much-needed relief to anyone who has creditors or collecting agencies chasing after them.”

Source: http://RecommendedExperts.biz

Contact Info:

Name: Tony Thompson

Email: Send Email

Organization: Thompson Law

Address: 1055 W. 7TH STREET 33RD FLOOR LOS ANGELES, CA 90017

Phone: 213-221-4030

Website: https://lawtl.com

Source: MM-REB

Release ID: 88969647