Lynnfield, Massachusetts – Healthcare Retirement Planner, the first IRMAA (Income Related Adjustment Amount) Financial planning software package with patent-pending technology, adds new functionality to assist financial professionals with planning for Medicare’s IRMAA 2024 by incorporating tax planning into its workflow and is now transforming how financial professionals conduct business and increase service value. Leading the […]

Lynnfield, Massachusetts – September 20, 2023 /MarketersMEDIA/ —

Healthcare Retirement Planner, the first IRMAA (Income Related Adjustment Amount) Financial planning software package with patent-pending technology, adds new functionality to assist financial professionals with planning for Medicare’s IRMAA 2024 by incorporating tax planning into its workflow and is now transforming how financial professionals conduct business and increase service value.

Leading the pack with industry-only IRMAA, Social Security, and Taxes planning tools, Healthcare Retirement Planner’s new feature is set to push it to the forefront of advanced retirement planning. The new feature adds to the company’s foundational planning and offers users the ability to view and calculate the amount of taxation on their Social Security benefit(s), the impact of Federal taxes on their entire retirement plan, and the amount of Medicare Surcharges that will be paid out of pocket.

IRMAA is a surcharge that is added to an individual’s monthly Medicare costs based on the amount of income they are receiving in retirement from various sources such as a pension, Social Security, W2 wages, investments, or a combination of these different types.

With IRMAA and its effects having a direct impact on businesses, by leveraging knowledge of asset planning and its impact on Medicare premiums, financial professionals can not only re-evaluate asset allocations in current retirement plans but can also attract new clients that need an expert in the subject matter to assist them and build compliant plans that mitigate Medicare costs.

Healthcare Retirement Planner streamlines this process by uncovering current and future Medicare surcharges, tax ramifications, and the impact of IRMAA on an individual’s Social Security benefit.

This software is aimed at a selection of individuals, namely:

- CPA’s – Identification of tax pitfalls created by IRMAA and how to circumvent these pitfalls

- Financial Advisors and Insurance Professionals – Retirement income effects on Medicare premiums and how to fine-tune asset allocation

- Attorneys – Educating on how IRMAA affects estate planning, tax planning, and wealth distribution

- Long-Term Care Agents – Leveraging IRMAA to create tighter relationships with Financial Advisors and CPAs and boost production

A spokesperson for Healthcare Retirement Planner said, “Healthcare planning in retirement is a vital part of holistic financial planning for both individuals and small businesses and can’t easily be automated. It’s also a lucrative field, where just one sale can pay for the entire software cost many times over. Whether you’re just launching your career or an established professional trying to offer more to your clients, adding Healthcare Retirement Planner to your practice is an intelligent choice.”

Streamlining the Medicare Surcharge Calculation Process

Healthcare Retirement Planner IRMAA software is an efficient way to calculate IRMAA costs and allows financial professionals to save time and focus on other aspects of their clients’ retirement plans. The software’s features include:

- Faster calculations: Healthcare Retirement Planner’s software quickly calculates IRMAA costs based on the client’s income and tax filing status, eliminating manual calculations and potential errors.

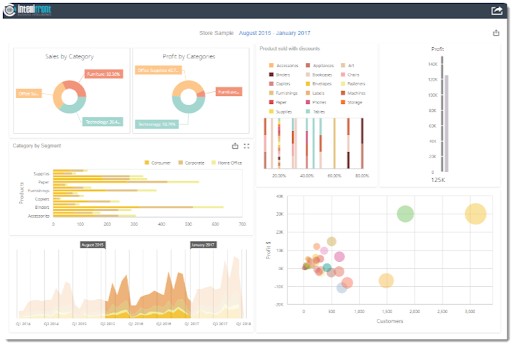

- User-friendly interface: The intuitive design of Healthcare Retirement Planner’s platform makes it easy for financial professionals to input data and generate results with minimal effort.

- Data integration: Seamlessly integrate Healthcare Retirement Planner’s calculator into existing financial planning tools or CRM systems for a more streamlined workflow.

- Easy to Understand Reports: Export reports to easily share with clients.

- Tax and Surcharge Modeling: See how different types of income affect both taxes and surcharges.

In addition to simplifying the calculation process, Healthcare Retirement Planner’s new software features can also help improve communication between financial professionals and their clients. This is done with clear visuals that illustrate how IRMAA costs impact an overall retirement plan and allow financial professionals to effectively convey complex information in an easily digestible format. Clients are then empowered to make informed decisions about their healthcare expenses during retirement while ensuring they are prepared for any potential changes in Medicare premiums due to income fluctuations.

More information

To find out more about Healthcare Retirement Planner and its addition of new functionality to assist financial professionals with planning for Medicare’s IRMAA, please visit the website at https://www.healthcareretirementplanner.com.

About Us: Introducing the only financial planning software that accurately plans for it.

Contact Info:

Organization: Healthcare Retirement Planner

Address: 4 Standish Road

Lynnfield

Massachusetts 01940

United States

Website: https://www.healthcareretirementplanner.com

Release ID: 89108062

In the event of any inaccuracies, problems, or queries arising from the content shared in this press release, we encourage you to notify us immediately at error@releasecontact.com. Our diligent team will be readily available to respond and take swift action within 8 hours to rectify any identified issues or assist with removal requests. Ensuring the provision of high-quality and precise information is paramount to us.