Latest report on Natural Rubber Industry provides essential information for business growth. It shows the market trends, manufacturing processes, cost structures, import-export, supply, production, revenue growth rate, major manufacturers and more.

Pune, India – August 31, 2016 /MarketersMedia/ —

Since 2011, the global natural rubber market has been in a state of oversupply which reached 220,000 tons in 2011 and about 140,000 tons in 2015. Affected by the growing tapping area of natural rubber in main producing regions, the slowdown in the growth rate of the tire industry and other factors, there will still be a glut of natural rubber worldwide during 2016-2020 and the global glut will be 110,000 tons or so in 2020.

Due to the sluggish global economic growth and the excess supply of natural rubber, the price of natural rubber has been hovering at a low level. As of the end of 2015, China’s natural rubber price had fallen to around USD1,140 / ton which was also the cost price. In 2016, the global average price of natural rubber fluctuates at USD1,200-1,500 / ton.

In 2015, China’s natural rubber output dropped 5.5% year on year to 794,200 tons. Weather factors confine China’s natural rubber planting areas to a limited scope; plus the rubber price lingering on the cost line, more and more farmers have abandoned rubber production. In 2016, China’s output of natural rubber is expected to further decline by 5.3% to 752,100 tons.

As the world’s largest consumer, China consumed 4.682 million tons of natural rubber in 2015, accounting for 38.5% of the global total. Amid the serious imbalance between supply and demand, China mostly imports natural rubber to meet the additional demand. The import volume rose 4.8% year on year to 2.736 million tons, while the average import price fell 24.5% year on year to USD1,431.6 / ton in 2015.

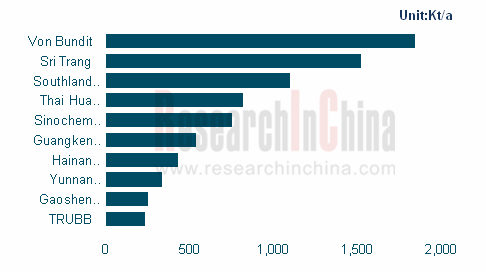

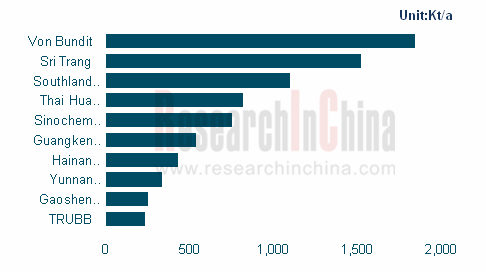

Key Global Players: Sri Trang Agro-Industry Plc, Thai Rubber Latex Corporation (Thailand) Public Co., Ltd. (TRUBB), Thai Hua Rubber Public Co., Ltd, Von Bundit Co., Ltd, Southland Rubber Co., Ltd.

Key Chinese Players: China Hainan Rubber Industry Group Co., Ltd. (601118), Sinochem International Corporation (600500), Yunnan State Farms Group Co., Ltd, Guangdong Guangken Rubber Group Co., Ltd, Yunnan Gaoshen Rubber Co., Ltd.

Complete Report Spread across 121 pages and 141 Charts. Order a Copy of This Report at http://www.rnrmarketresearch.com/contacts/purchase?rname=679671

In the backdrop of the descending rubber price and the downsized rubber plantations, China’s automobile industry has been expanding in ownership and new increment, conducing to the ascending rigid demand of the tire industry and the growing demand for natural rubber. In 2016-2020, the contradiction between natural rubber supply and demand in China will further intensify; by 2020, the gap between supply and demand will hit about 5.142 million tons, an increase of 32.3% over 2015.

Restricted by resource distribution, the natural rubber industry is highly centralized in Thailand, Malaysia and other Southeast Asian nations, represented by the key players such as Sri Trang Agro-Industry, Von Bundit, Southland Rubber, Thai Rubber Latex and Sinochem International.

Given the downturn of the natural rubber market, companies can speed up the development of resources and strategies, increase the planting area in major producing countries as well as enhance processing factory layout to improve production capacity in the next years; on the other hand, they can keep an eye on customization and high-end market applications of natural rubber, such as military rubber tires, to heighten the gross margin and competitiveness of products.

The report focuses on the following aspects:

Supply & demand, regional distribution, prices, competitive landscape and development trends of global natural rubber market.

Supply & demand, import & export, regional structure, competitive landscape, development trends of Chinese natural rubber market.

Tapping area and planting area of natural rubber in China and around the world.

Development of applications of natural rubber in China, such as tyre, rubber belt & hose;

Operation and development in China of 5 global natural rubber companies.

Operation and development strategies of 5 key Chinese natural rubber companies.

View More Reports on Materials & Chemicals at http://www.rnrmarketresearch.com/reports/materials-chemicals

Major Points from Table of Contents

1 Basic Concept of Natural Rubber

2 Development of Global Natural Rubber Market

3 Development of Chinese Natural Rubber Market

4 Development of Global and China Natural Rubber-related Industries

5 Key Global Players

6 Major Chinese Companies

About Us:

RnRMarketResearch.com is your single source for all market research needs. Our database includes 100,000+ market research reports from over 95 leading global publishers & in-depth market research studies of over 5000 micro markets. With comprehensive information about the publishers and the industries for which they publish market research reports, we help you in your purchase decision by mapping your information needs with our huge collection of reports.

Contact Us:

We provide 24/7 online and offline support to our customers. Contact us for your special interest needs and we will get in touch within 24hrs to help you find the market research report you need.

sales@rnrmarketresearch.com

+ 1 888 391 5441

For more information, please visit http://www.rnrmarketresearch.com/global-and-china-natural-rubber-industry-report-2016-2020-market-report.html

Contact Info:

Name: Ritesh Tiwari

Email: sales@rnrmarketresearch.com

Organization: RnR Market Research

Address: UNIT no 802, Tower no. 7, SEZ Magarpatta city, Hadapsar, Pune, Maharashtra 411013, India

Phone: + 1 888 391 5441

Source: http://marketersmedia.com/natural-rubber-industry-2016-trends-and-forecasts-2020-for-global-market/130513

Release ID: 130513